Lazard Investor Presentation Deck

INVESTOR PRESENTATION

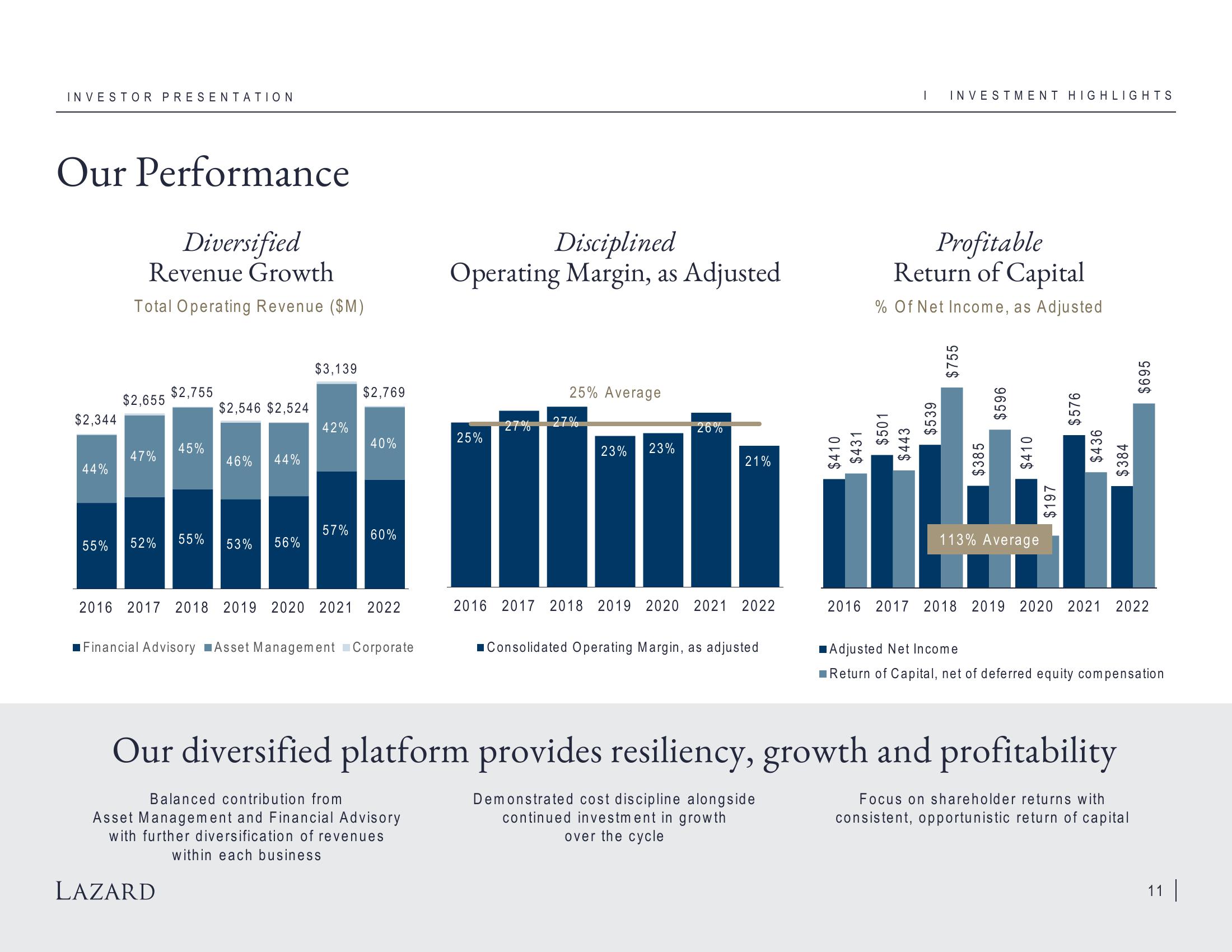

Our Performance

Diversified

Revenue Growth

Total Operating Revenue ($M)

$2,344

44%

55%

$2,655

47%

$2,755

45%

52% 55%

$2,546 $2,524

LAZARD

46% 44%

53% 56%

$3,139

42%

$2,769

40%

57% 60%

2016 2017 2018 2019 2020 2021 2022

Financial Advisory Asset Management Corporate

Disciplined

Operating Margin, as Adjusted

25%

25% Average

27% 27%

23% 23%

26%

21%

2016 2017 2018 2019 2020 2021 2022

■Consolidated Operating Margin, as adjusted

I

INVESTMENT HIGHLIGHTS

Profitable

Return of Capital

% Of Net Income, as Adjusted

$755

113% Average

$695

2016 2017 2018 2019 2020 2021 2022

Our diversified platform provides resiliency, growth and profitability

Balanced contribution from

Asset Management and Financial Advisory

with further diversification of revenues

within each business

Demonstrated cost discipline alongside

continued investment in growth

over the cycle

Focus on shareholder returns with

consistent, opportunistic return of capital

Adjusted Net Income

Return of Capital, net of deferred equity compensation

11 |View entire presentation