Oatly Results Presentation Deck

Production

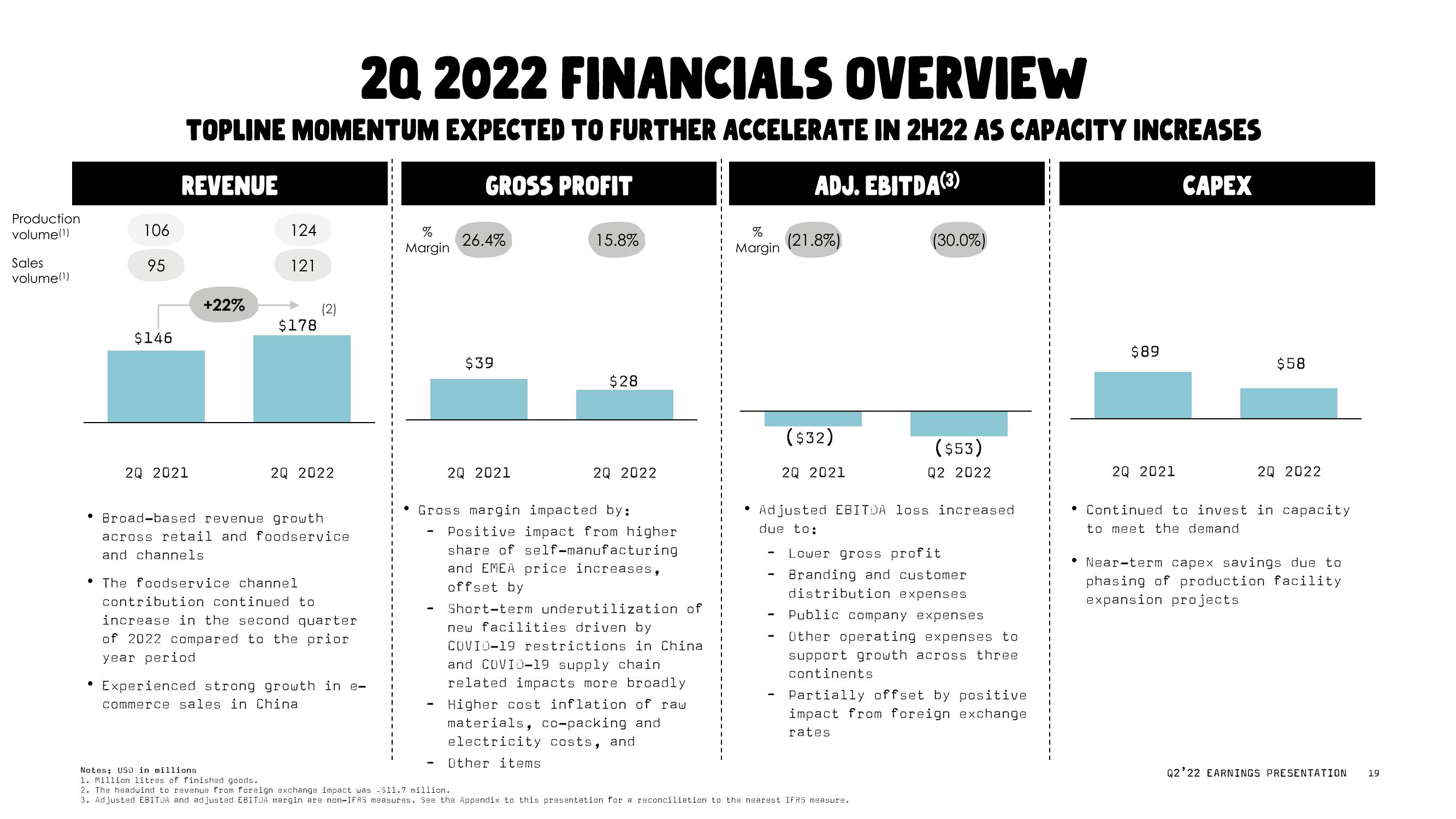

volume(1)

Sales

volume(1)

106

95

$146

20 2022 FINANCIALS OVERVIEW

TOPLINE MOMENTUM EXPECTED TO FURTHER ACCELERATE IN 2H22 AS CAPACITY INCREASES

REVENUE

GROSS PROFIT

ADJ. EBITDA (3)

CAPEX

20 2021

+22%

124

121

$178

2Q 2022

Broad-based revenue growth

across retail and foodservice

and channels

The foodservice channel

contribution continued to

increase in the second quarter

of 2022 compared to the prior

year period

Experienced strong growth in e-

commerce sales in China

%

Margin

26.4%

$39

20 2021

15.8%

$28

Other items

2Q 2022

Gross margin impacted by:

Positive impact from higher

share of self-manufacturing

and EMEA price increases,

offset by

Short-term underutilization of

new facilities driven by

COVID-19 restrictions in China

and COVID-19 supply chain

related impacts more broadly

Higher cost inflation of raw

materials, co-packing and

electricity costs, and

%

Margin

●

(21.8%)

($32)

20 2021

(30.0%)

($53)

Q2 2022

Adjusted EBITDA loss increased

due to:

Notes: USD in millions

1. Million litres of finished goods.

2. The headwind to revenue from foreign exchange impact was $11.7 million.

3. Adjusted EBITDA and adjusted EBITDA margin are non-IFRS measures. See the Appendix to this presentation for a reconciliation to the nearest IFRS measure.

Lower gross profit

Branding and customer

distribution expenses

Public company expenses

Other operating expenses to

support growth across three

continents

Partially offset by positive

impact from foreign exchange

rates

$89

20 2021

$58

2Q 2022

Continued to invest in capacity

to meet the demand

Near-term capex savings due to

phasing of production facility.

expansion projects.

Q2'22 EARNINGS PRESENTATION

19View entire presentation