Crocs Investor Presentation Deck

Q3 FINANCIAL HIGHLIGHTS

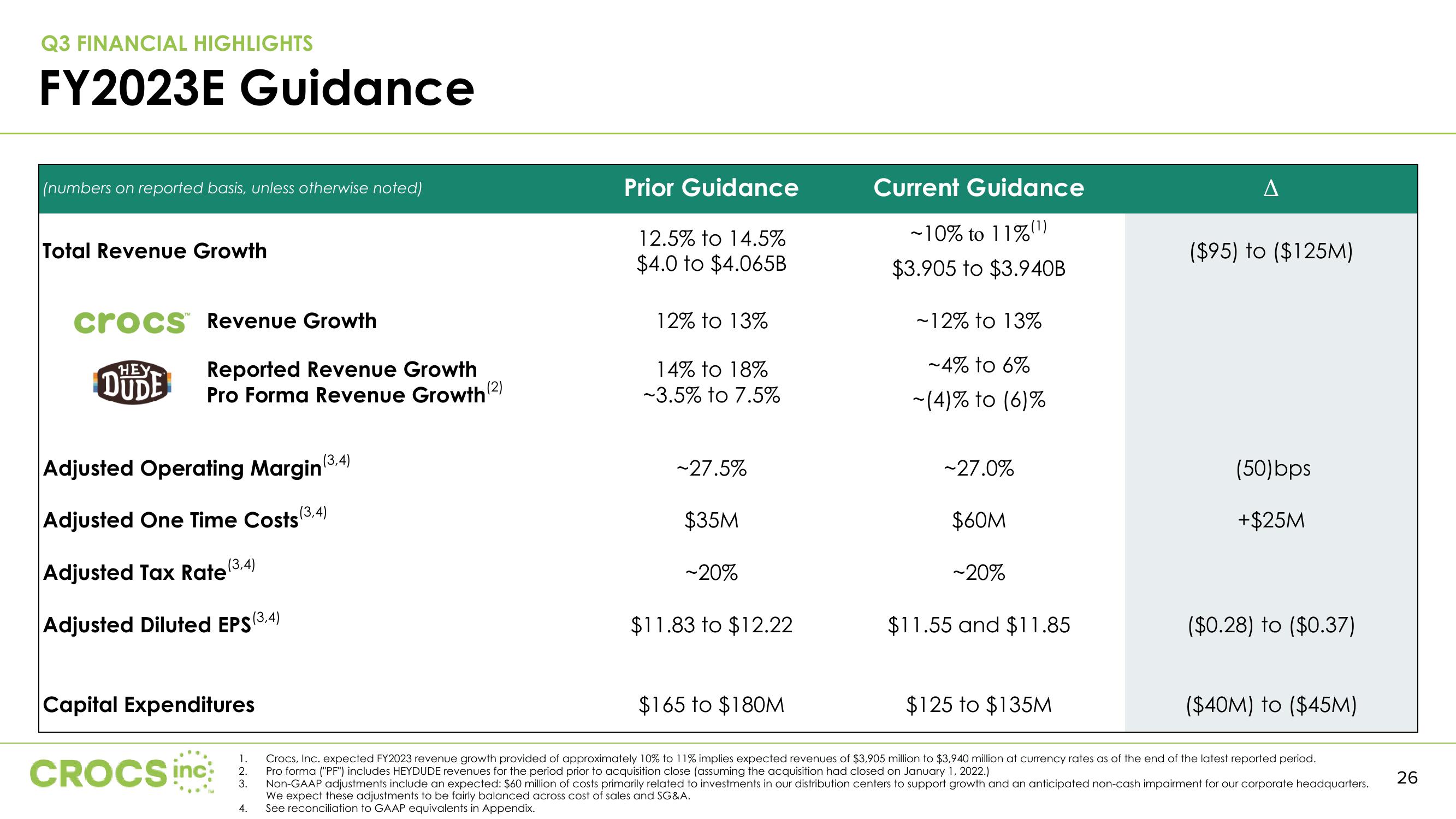

FY2023E Guidance

(numbers on reported basis, unless otherwise noted)

Total Revenue Growth

crocs™ Revenue Growth

HEY

DUDE

Reported Revenue Growth

Pro Forma Revenue Growth (2)

Adjusted Operating Margin(3,4)

Adjusted One Time Costs (3,4)

Adjusted Tax Rate(3,4)

Adjusted Diluted EPS (3,4)

Capital Expenditures

CROCS inc

1.

2.

3.

4.

Prior Guidance

12.5% to 14.5%

$4.0 to $4.065B

12% to 13%

14% to 18%

-3.5% to 7.5%

~27.5%

$35M

~20%

$11.83 to $12.22

Current Guidance

-10% to 11%

$3.905 to $3.940B

$165 to $180M

-12% to 13%

~4% to 6%

~(4)% to (6)%

~27.0%

$60M

~20%

$11.55 and $11.85

($95) to ($125M)

$125 to $135M

(50)bps

+$25M

($40M) to ($45M)

Crocs, Inc. expected FY2023 revenue growth provided of approximately 10% to 11% implies expected revenues of $3,905 million to $3,940 million at currency rates as of the end of the latest reported period.

Pro forma ("PF") includes HEYDUDE revenues for the period prior to acquisition close (assuming the acquisition had closed on January 1, 2022.)

Non-GAAP adjustments include an expected: $60 million of costs primarily related to investments in our distribution centers to support growth and an anticipated non-cash impairment for our corporate headquarters.

We expect these adjustments to be fairly balanced across cost of sales and SG&A.

See reconciliation to GAAP equivalents in Appendix.

($0.28) to ($0.37)

26View entire presentation