WeWork Restructuring Presentation Deck

Transaction Term Sheet (Cont'd)

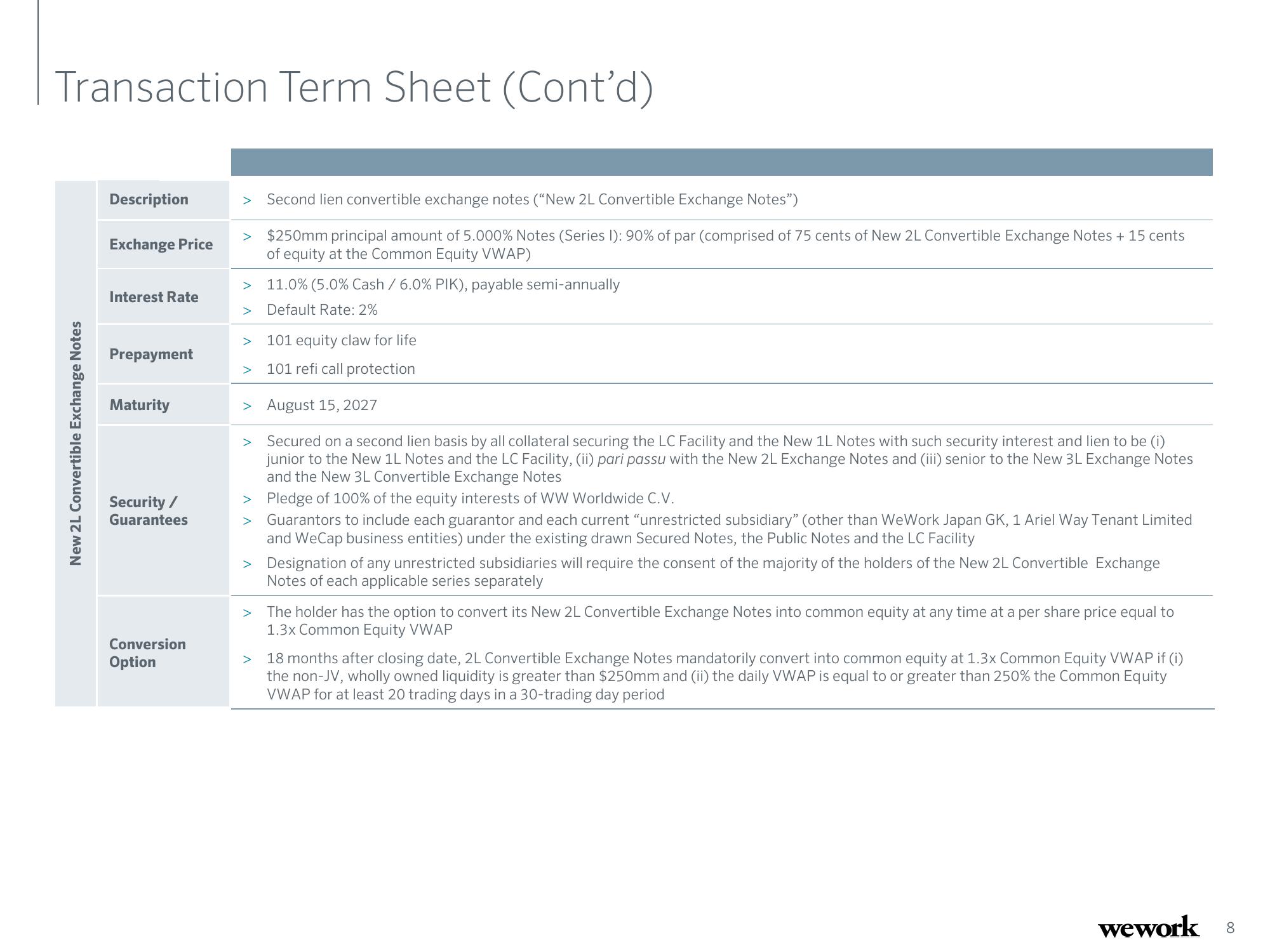

New 2L Convertible Exchange Notes

Description

Exchange Price

Interest Rate

Prepayment

Maturity

Security /

Guarantees

Conversion

Option

> Second lien convertible exchange notes ("New 2L Convertible Exchange Notes")

$250mm principal amount of 5.000% Notes (Series I): 90% of par (comprised of 75 cents of New 2L Convertible Exchange Notes + 15 cents

of equity at the Common Equity VWAP)

>

>

11.0% (5.0% Cash / 6.0% PIK), payable semi-annually

Default Rate: 2%

>

101 equity claw for life

101 refi call protection

> August 15, 2027

Secured on a second lien basis by all collateral securing the LC Facility and the New 1L Notes with such security interest and lien to be (i)

junior to the New 1L Notes and the LC Facility, (ii) pari passu with the New 2L Exchange Notes and (iii) senior to the New 3L Exchange Notes

and the New 3L Convertible Exchange Notes

> Pledge of 100% of the equity interests of WW Worldwide C.V.

>

Guarantors to include each guarantor and each current "unrestricted subsidiary" (other than WeWork Japan GK, 1 Ariel Way Tenant Limited

and WeCap business entities) under the existing drawn Secured Notes, the Public Notes and the LC Facility

> Designation of any unrestricted subsidiaries will require the consent of the majority of the holders of the New 2L Convertible Exchange

Notes of each applicable series separately

The holder has the option to convert its New 2L Convertible Exchange Notes into common equity at any time at a per share price equal to

1.3x Common Equity VWAP

> 18 months after closing date, 2L Convertible Exchange Notes mandatorily convert into common equity at 1.3x Common Equity VWAP if (i)

the non-JV, wholly owned liquidity is greater than $250mm and (ii) the daily VWAP is equal to or greater than 250% the Common Equity

VWAP for at least 20 trading days in a 30-trading day period

wework 8View entire presentation