Lilium SPAC Presentation Deck

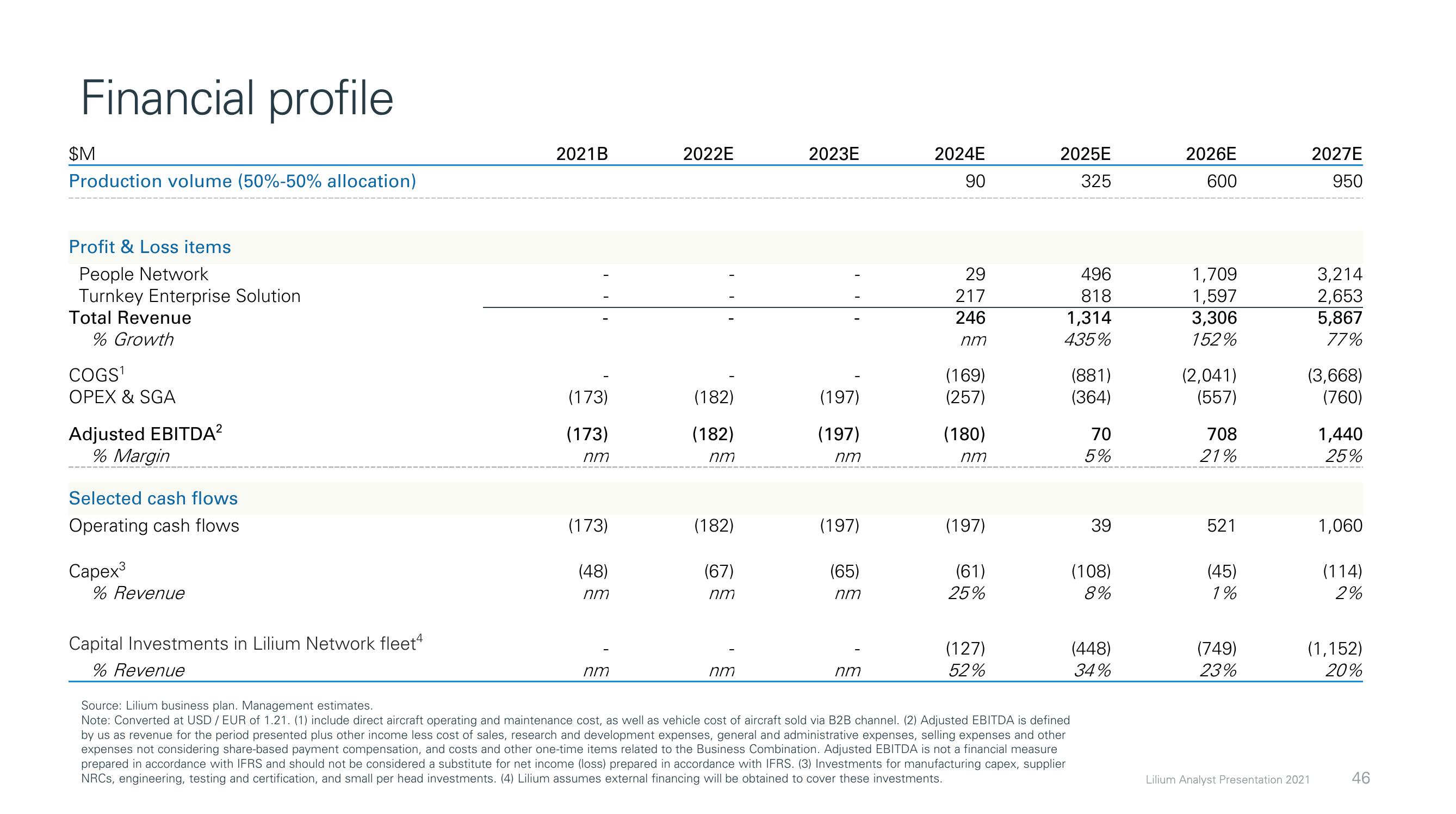

Financial profile

$M

Production volume (50%-50% allocation)

Profit & Loss items

People Network

Turnkey Enterprise Solution

Total Revenue

% Growth

COGS¹

OPEX & SGA

Adjusted EBITDA²

% Margin

Selected cash flows

Operating cash flows

Capex3

% Revenue

Capital Investments in Lilium Network fleet4

% Revenue

2021B

(173)

(173)

nm

(173)

(48)

nm

nm

2022E

(182)

(182)

nm

(182)

(67)

nm

nm

2023E

(197)

(197)

nm

(197)

(65)

nm

nm

2024E

90

29

217

246

nm

(169)

(257)

(180)

nm

(197)

(61)

25%

(127)

52%

2025E

325

496

818

1,314

435%

Source: Lilium business plan. Management estimates.

Note: Converted at USD / EUR of 1.21. (1) include direct aircraft operating and maintenance cost, as well as vehicle cost of aircraft sold via B2B channel. (2) Adjusted EBITDA is defined

by us as revenue for the period presented plus other income less cost of sales, research and development expenses, general and administrative expenses, selling expenses and other

expenses not considering share-based payment compensation, and costs and other one-time items related to the Business Combination. Adjusted EBITDA is not a financial measure

prepared in accordance with IFRS and should not be considered a substitute for net income (loss) prepared in accordance with IFRS. (3) Investments for manufacturing capex, supplier

NRCs, engineering, testing and certification, and small per head investments. (4) Lilium assumes external financing will be obtained to cover these investments.

(881)

(364)

70

5%

39

(108)

8%

(448)

34%

2026E

600

1,709

1,597

3,306

152%

(2,041)

(557)

708

21%

521

(45)

1%

(749)

23%

2027E

950

3,214

2,653

5,867

77%

(3,668)

(760)

Lilium Analyst Presentation 2021

1,440

25%

1,060

(114)

2%

(1,152)

20%

46View entire presentation