Hyzon SPAC Presentation Deck

Pro Forma Equity Ownership

US$ in millions, unless otherwise stated

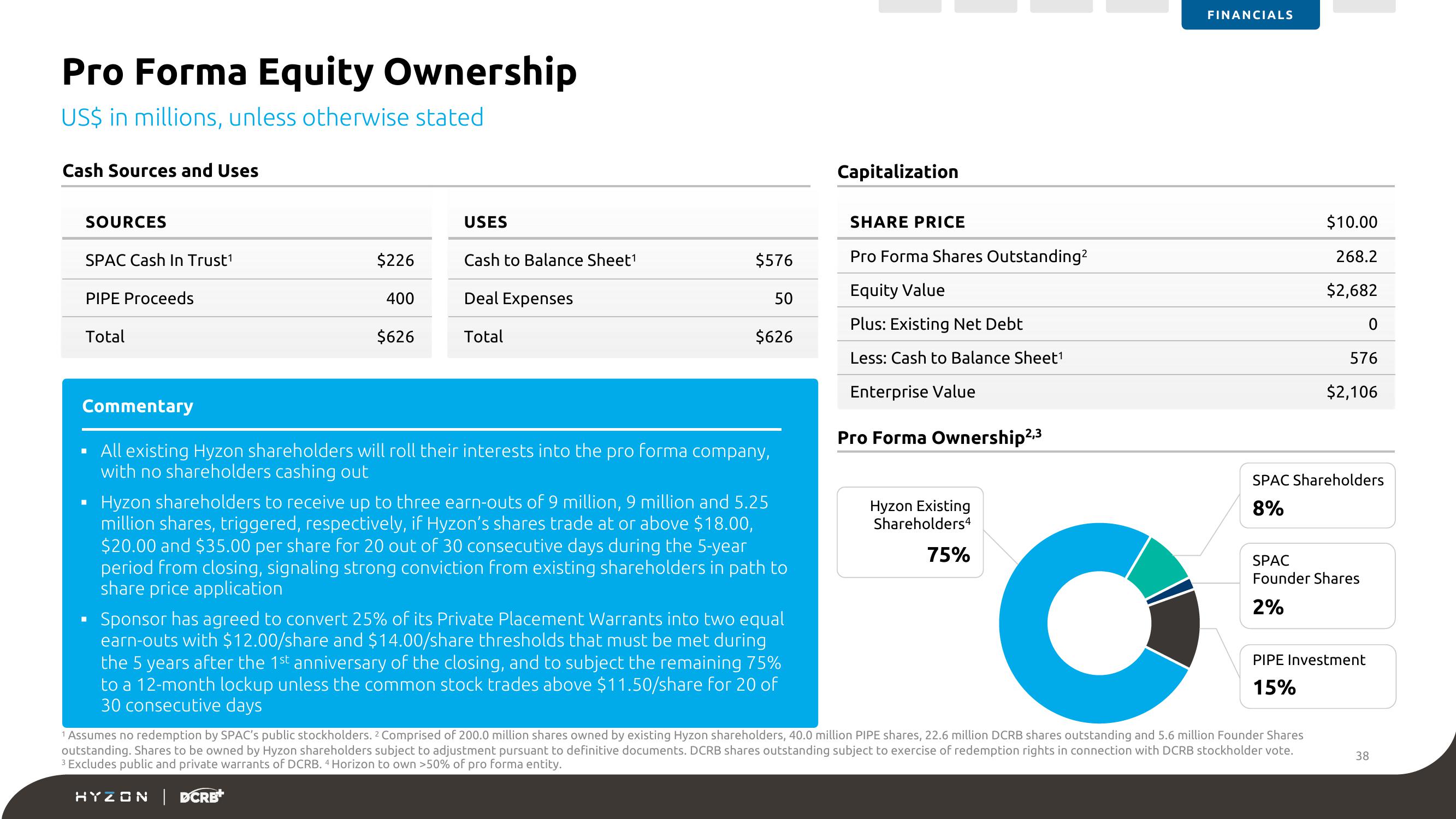

Cash Sources and Uses

SOURCES

SPAC Cash In Trust¹

PIPE Proceeds

Total

■

$226

■

400

$626

USES

Cash to Balance Sheet¹

Deal Expenses

Total

$576

Commentary

All existing Hyzon shareholders will roll their interests into the pro forma company,

with no shareholders cashing out

50

$626

Hyzon shareholders to receive up to three earn-outs of 9 million, 9 million and 5.25

million shares, triggered, respectively, if Hyzon's shares trade at or above $18.00,

$20.00 and $35.00 per share for 20 out of 30 consecutive days during the 5-year

period from closing, signaling strong conviction from existing shareholders in path to

share price application

Sponsor has agreed to convert 25% of its Private Placement Warrants into two equal

earn-outs with $12.00/share and $14.00/share thresholds that must be met during

the 5 years after the 1st anniversary of the closing, and to subject the remaining 75%

to a 12-month lockup unless the common stock trades above $11.50/share for 20 of

30 consecutive days

Capitalization

SHARE PRICE

Pro Forma Shares Outstanding²

Equity Value

Plus: Existing Net Debt

Less: Cash to Balance Sheet¹

Enterprise Value

Pro Forma Ownership²,3

Hyzon Existing

Shareholders4

75%

FINANCIALS

$10.00

268.2

$2,682

0

576

$2,106

SPAC Shareholders

8%

SPAC

Founder Shares

2%

1 Assumes no redemption by SPAC's public stockholders. 2 Comprised of 200.0 million shares owned by existing Hyzon shareholders, 40.0 million PIPE shares, 22.6 million DCRB shares outstanding and 5.6 million Founder Shares

outstanding. Shares to be owned by Hyzon shareholders subject to adjustment pursuant to definitive documents. DCRB shares outstanding subject to exercise of redemption rights in connection with DCRB stockholder vote.

3 Excludes public and private warrants of DCRB. 4 Horizon to own >50% of pro forma entity.

HYZON | DCRB+

PIPE Investment

15%

38View entire presentation