Hostess SPAC Presentation Deck

PAGE

13

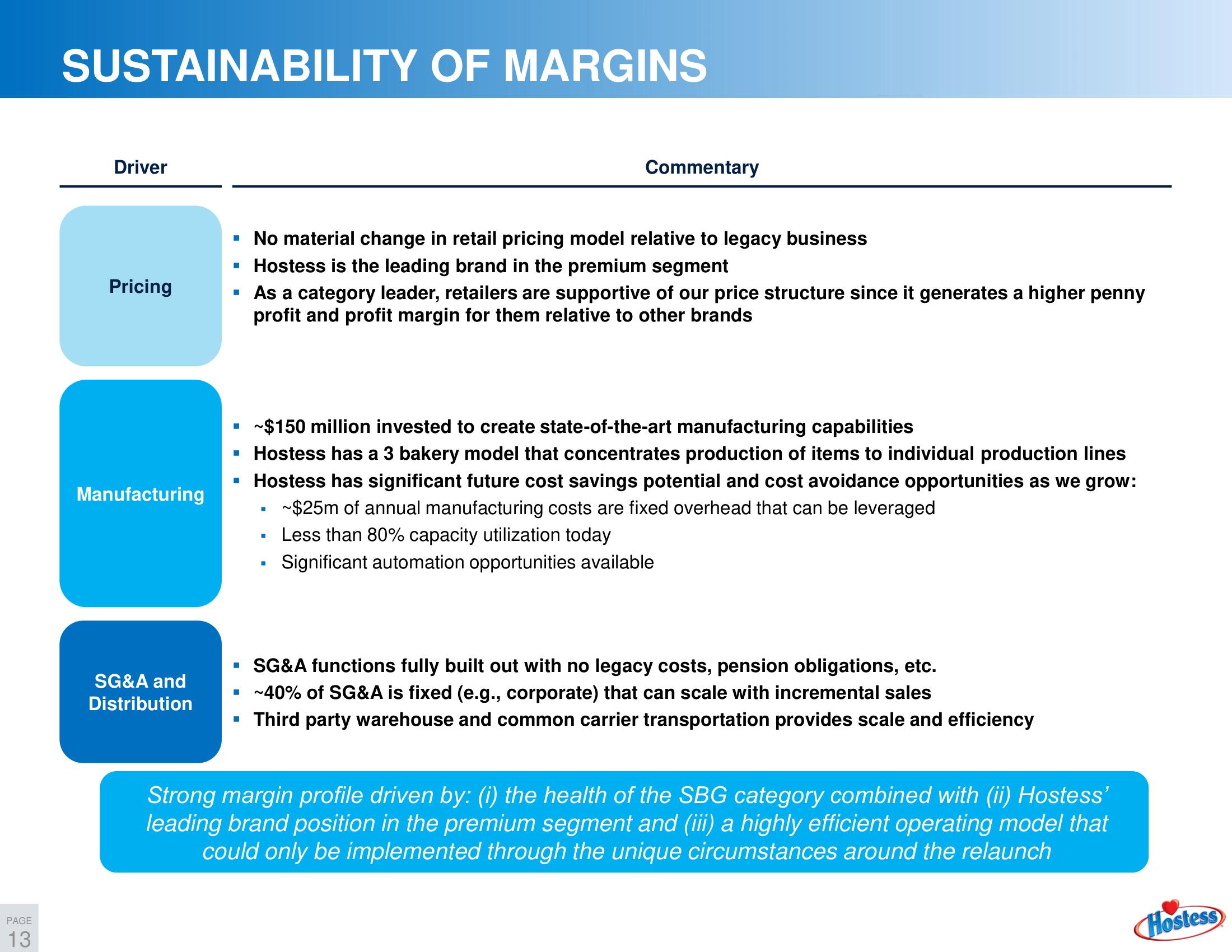

SUSTAINABILITY OF MARGINS

Driver

Pricing

Manufacturing

SG&A and

Distribution

▪ No material change in retail pricing model relative to legacy business

▪ Hostess is the leading brand in the premium segment

▪ As a category leader, retailers are supportive of our price structure since it generates a higher penny

profit and profit margin for them relative to other brands

■

~$150 million invested to create state-of-the-art manufacturing capabilities

▪ Hostess has a 3 bakery model that concentrates production of items to individual production lines

Hostess has significant future cost savings potential and cost avoidance opportunities as we grow:

~$25m of annual manufacturing costs are fixed overhead that can be leveraged

Less than 80% capacity utilization today

Significant automation opportunities available

■

■

■

Commentary

■

■

▪ SG&A functions fully built out with no legacy costs, pension obligations, etc.

▪ ~40% of SG&A is fixed (e.g., corporate) that can scale with incremental sales

Third party warehouse and common carrier transportation provides scale and efficiency

Strong margin profile driven by: (i) the health of the SBG category combined with (ii) Hostess'

leading brand position in the premium segment and (iii) a highly efficient operating model that

could only be implemented through the unique circumstances around the relaunch

HostessView entire presentation