Kin SPAC Presentation Deck

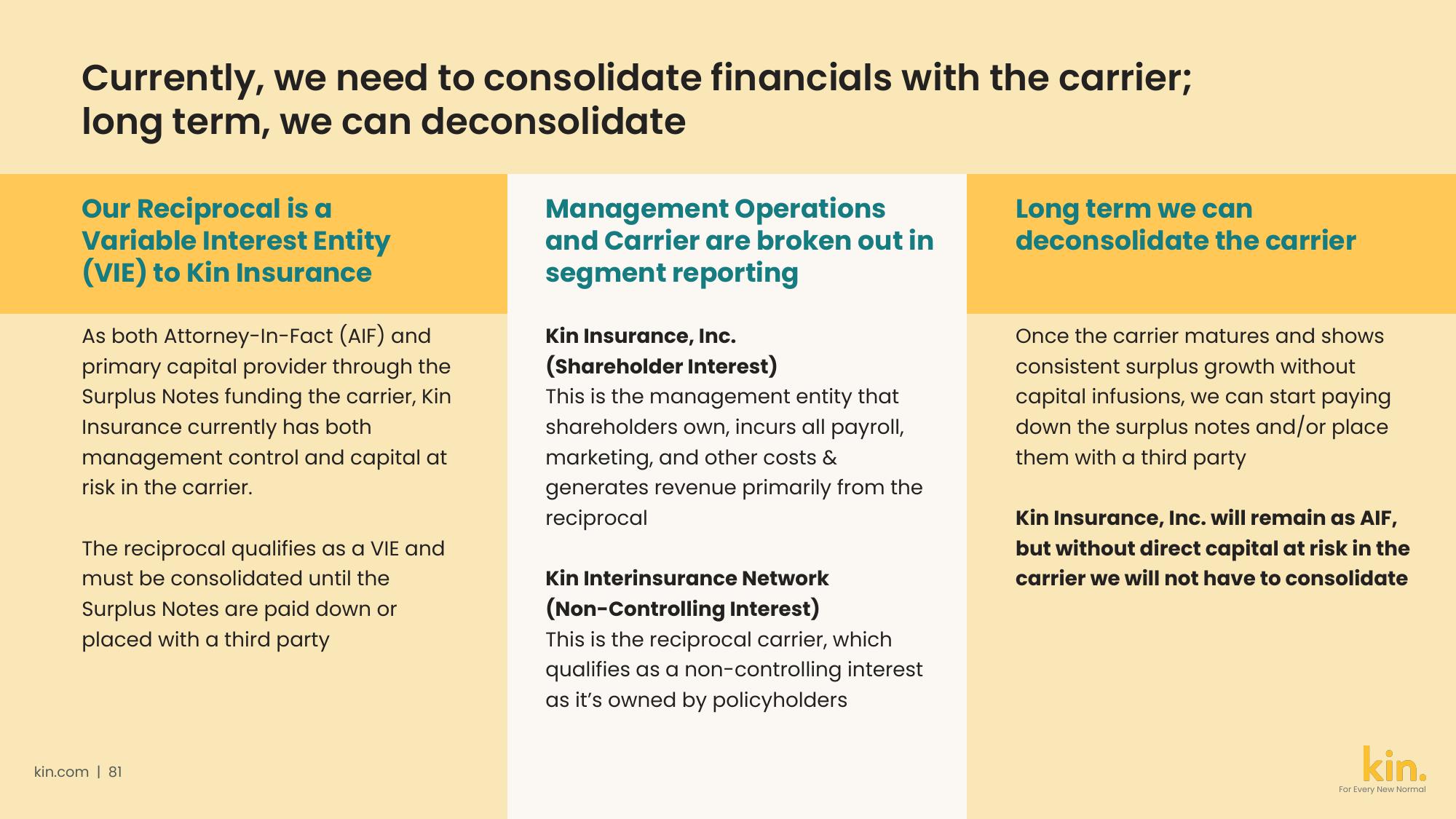

Currently, we need to consolidate financials with the carrier;

long term, we can deconsolidate

Our Reciprocal is a

Variable Interest Entity

(VIE) to Kin Insurance

As both Attorney-In-Fact (AIF) and

primary capital provider through the

Surplus Notes funding the carrier, Kin

Insurance currently has both

management control and capital at

risk in the carrier.

The reciprocal qualifies as a VIE and

must be consolidated until the

Surplus Notes are paid down or

placed with a third party

kin.com | 81

Management Operations

and Carrier are broken out in

segment reporting

Kin Insurance, Inc.

(Shareholder Interest)

This is the management entity that

shareholders own, incurs all payroll,

marketing, and other costs &

generates revenue primarily from the

reciprocal

Kin Interinsurance Network

(Non-Controlling Interest)

This is the reciprocal carrier, which

qualifies as a non-controlling interest

as it's owned by policyholders

Long term we can

deconsolidate the carrier

Once the carrier matures and shows

consistent surplus growth without

capital infusions, we can start paying

down the surplus notes and/or place

them with a third party

Kin Insurance, Inc. will remain as AIF,

but without direct capital at risk in the

carrier we will not have to consolidate

kin.

For Every New NormalView entire presentation