XP Inc Results Presentation Deck

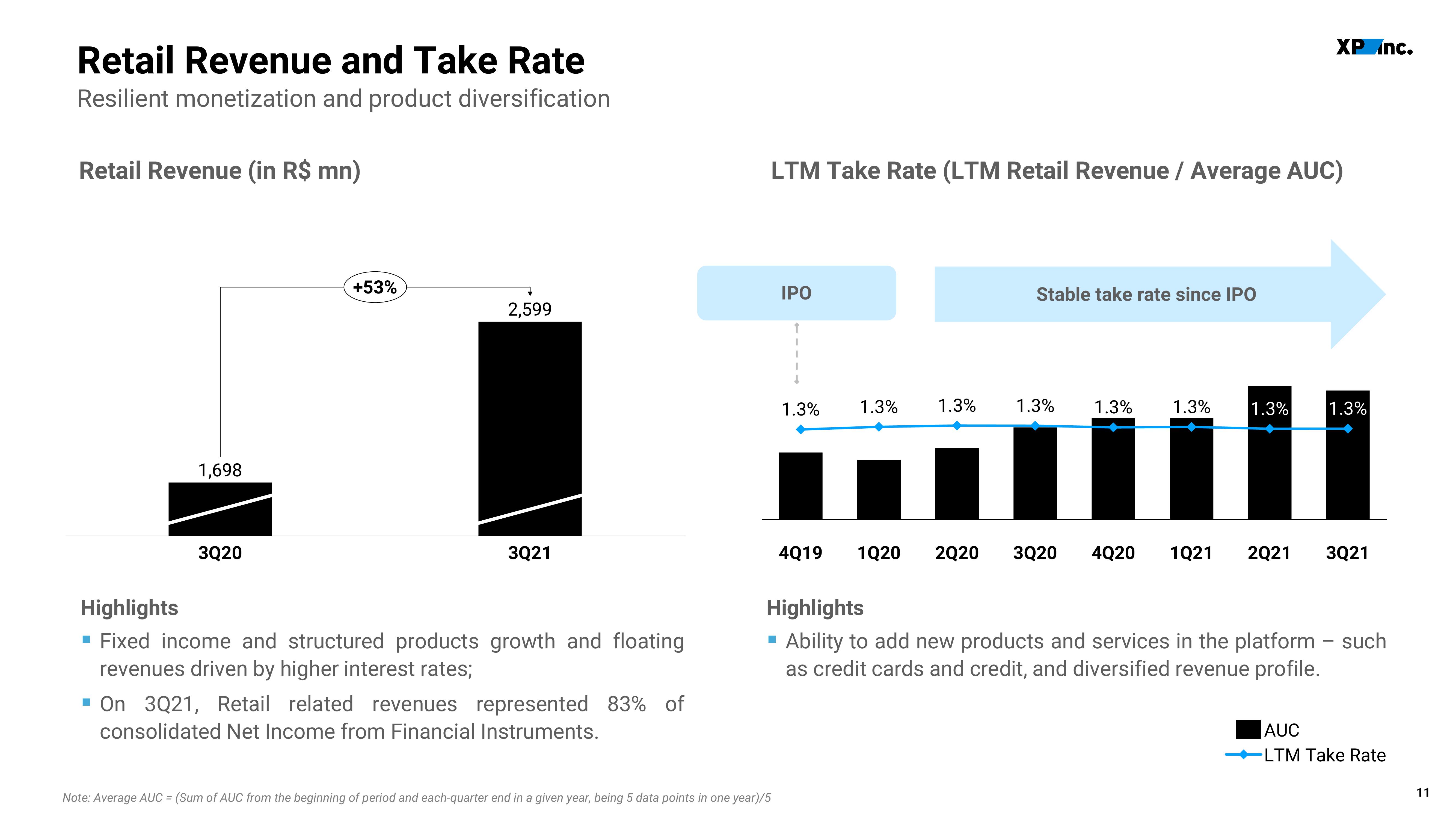

Retail Revenue and Take Rate

Resilient monetization and product diversification

Retail Revenue (in R$ mn)

1,698

3Q20

+53%

2,599

3Q21

Highlights

▪ Fixed income and structured products growth and floating

revenues driven by higher interest rates;

▪ On 3Q21, Retail related revenues represented 83% of

consolidated Net Income from Financial Instruments.

LTM Take Rate (LTM Retail Revenue / Average AUC)

IPO

Note: Average AUC = (Sum of AUC from the beginning of period and each-quarter end in a given year, being 5 data points in one year)/5

↑

1.3%

4Q19

1.3%

1.3%

1Q20 2Q20

Stable take rate since IPO

1.3%

¶

3Q20 4Q20 1Q21 2Q21 3Q21

1.3%

XP Inc.

1.3%

1.3%

1.3%

Highlights

Ability to add new products and services in the platform - such

as credit cards and credit, and diversified revenue profile.

AUC

-LTM Take Rate

11View entire presentation