Consistent Progress Investor Presentation

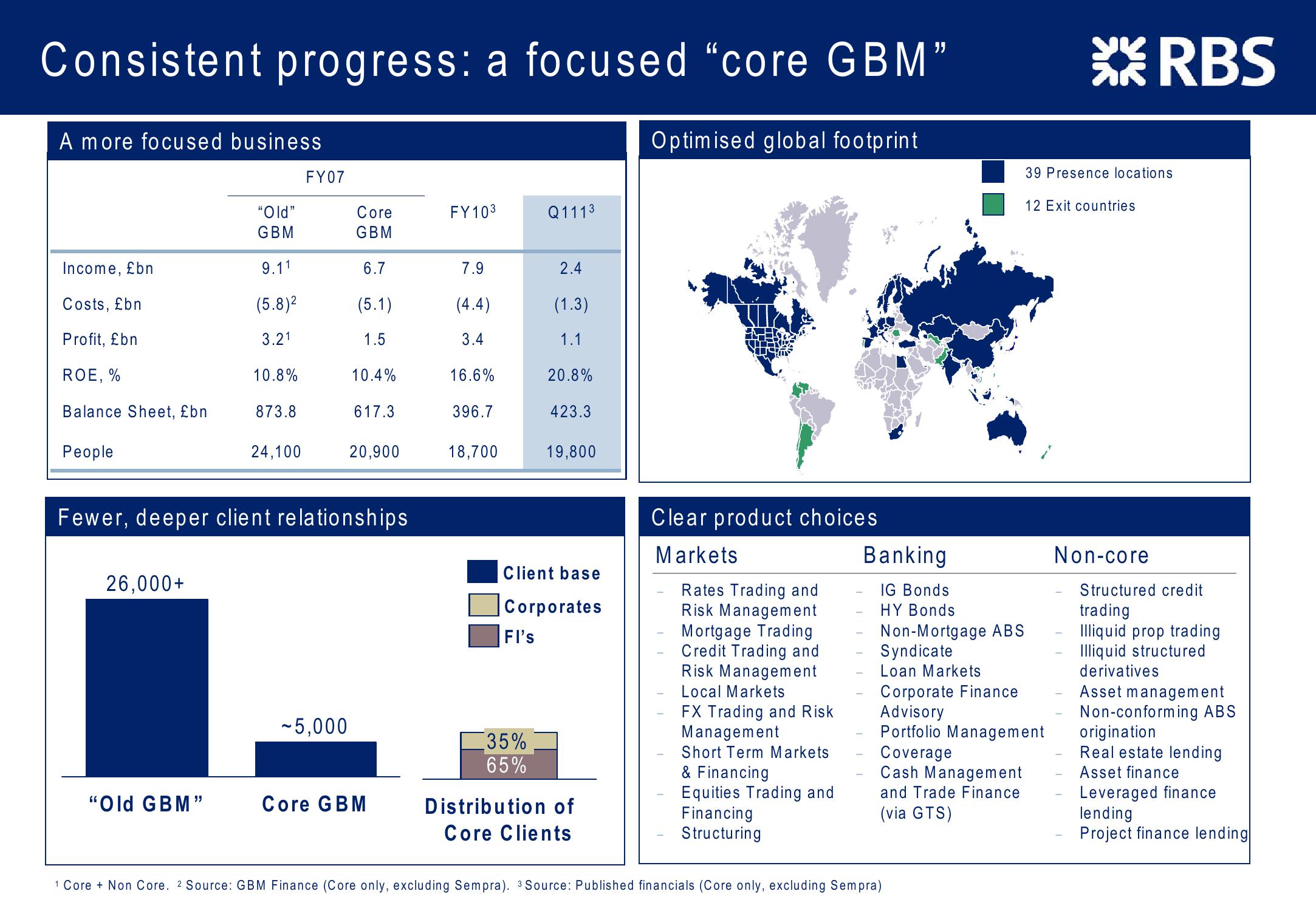

Consistent progress: a focused "core GBM"

A more focused business

FY07

"Old"

Core

FY103

Q1113

GBM

GBM

Income, £bn

9.11

6.7

7.9

2.4

Costs, £bn

(5.8)2

(5.1)

(4.4)

(1.3)

Profit, £bn

3.21

1.5

3.4

1.1

ROE, %

10.8%

10.4%

16.6%

20.8%

Balance Sheet, £bn

873.8

617.3

396.7

423.3

People

24,100

20,900

18,700

19,800

Fewer, deeper client relationships

26,000+

Client base

Corporates

FI's

~5,000

35%

65%

"Old GBM"

Core GBM

Distribution of

Core Clients

Optimised global footprint

RBS

39 Presence locations

12 Exit countries

Clear product choices

Markets

Rates Trading and

Risk Management

Mortgage Trading

Credit Trading and

Risk Management

Local Markets

FX Trading and Risk

Management

Short Term Markets

& Financing

Equities Trading and

Financing

Structuring

Banking

IG Bonds

HY Bonds

Non-Mortgage ABS

Syndicate

Loan Markets

Corporate Finance

Advisory

Portfolio Management

Coverage

Cash Management

and Trade Finance

(via GTS)

Non-core

Structured credit

trading

Illiquid prop trading

Illiquid structured

derivatives

Asset management

Non-conforming ABS

origination

Real estate lending

Asset finance

Leveraged finance

lending

Project finance lending

1 Core + Non Core. 2 Source: GBM Finance (Core only, excluding Sempra). 3 Source: Published financials (Core only, excluding Sempra)View entire presentation