Maersk Investor Presentation Deck

Terminals & Towage - highlights Q3 2020

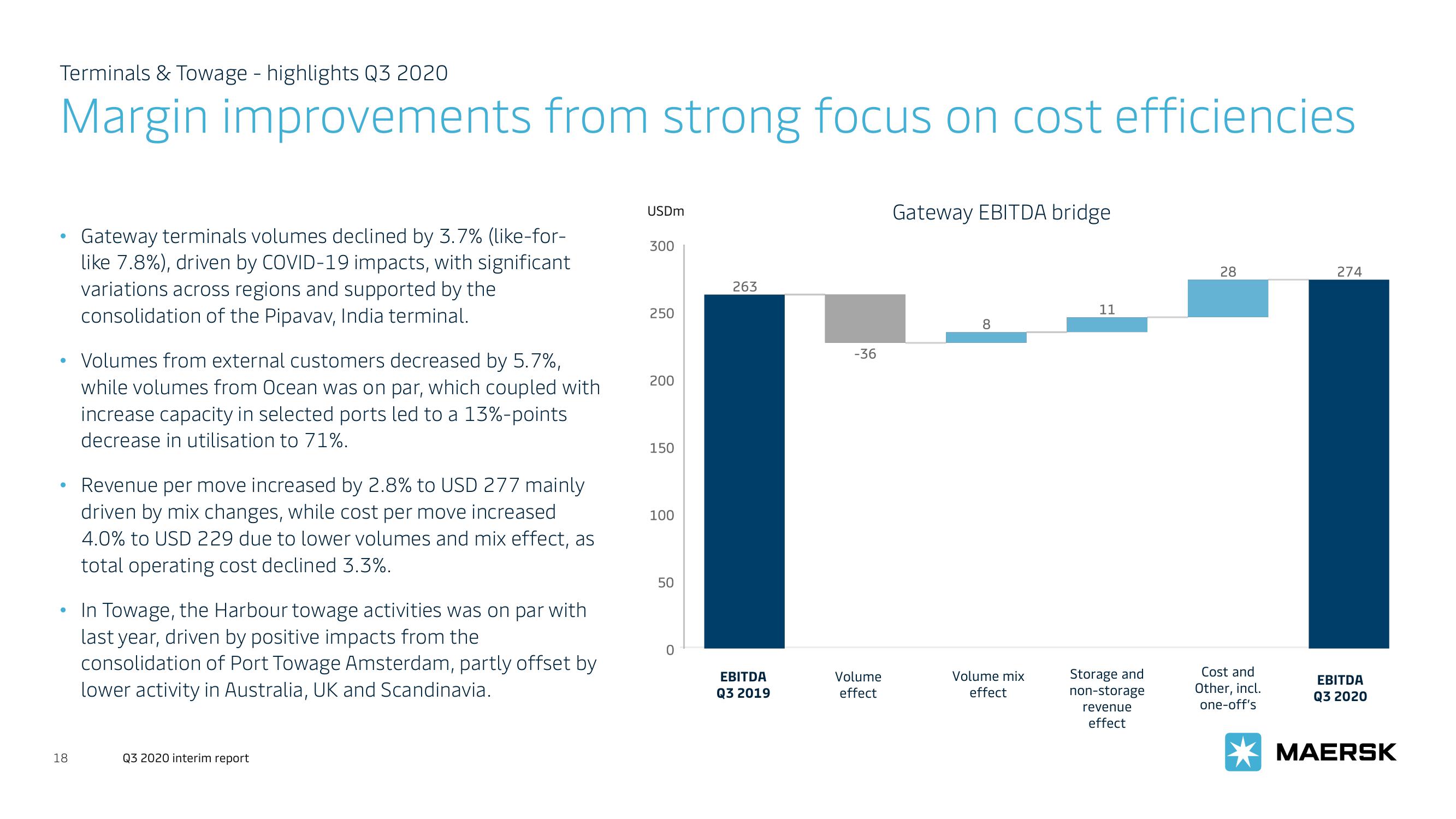

Margin improvements from strong focus on cost efficiencies

●

●

18

Gateway terminals volumes declined by 3.7% (like-for-

like 7.8%), driven by COVID-19 impacts, with significant

variations across regions and supported by the

consolidation of the Pipavav, India terminal.

Volumes from external customers decreased by 5.7%,

while volumes from Ocean was on par, which coupled with

increase capacity in selected ports led to a 13%-points

decrease in utilisation to 71%.

Revenue per move increased by 2.8% to USD 277 mainly

driven by mix changes, while cost per move increased

4.0% to USD 229 due to lower volumes and mix effect, as

total operating cost declined 3.3%.

In Towage, the Harbour towage activities was on par with

last year, driven by positive impacts from the

consolidation of Port Towage Amsterdam, partly offset by

lower activity in Australia, UK and Scandinavia.

Q3 2020 interim report

USDm

300

250

200

150

100

50

0

263

EBITDA

Q3 2019

-36

Volume

effect

Gateway EBITDA bridge

8

Volume mix

effect

11

Storage and

non-storage

revenue

effect

28

Cost and

Other, incl.

one-off's

274

EBITDA

Q3 2020

MAERSKView entire presentation