CorpAcq SPAC Presentation Deck

11

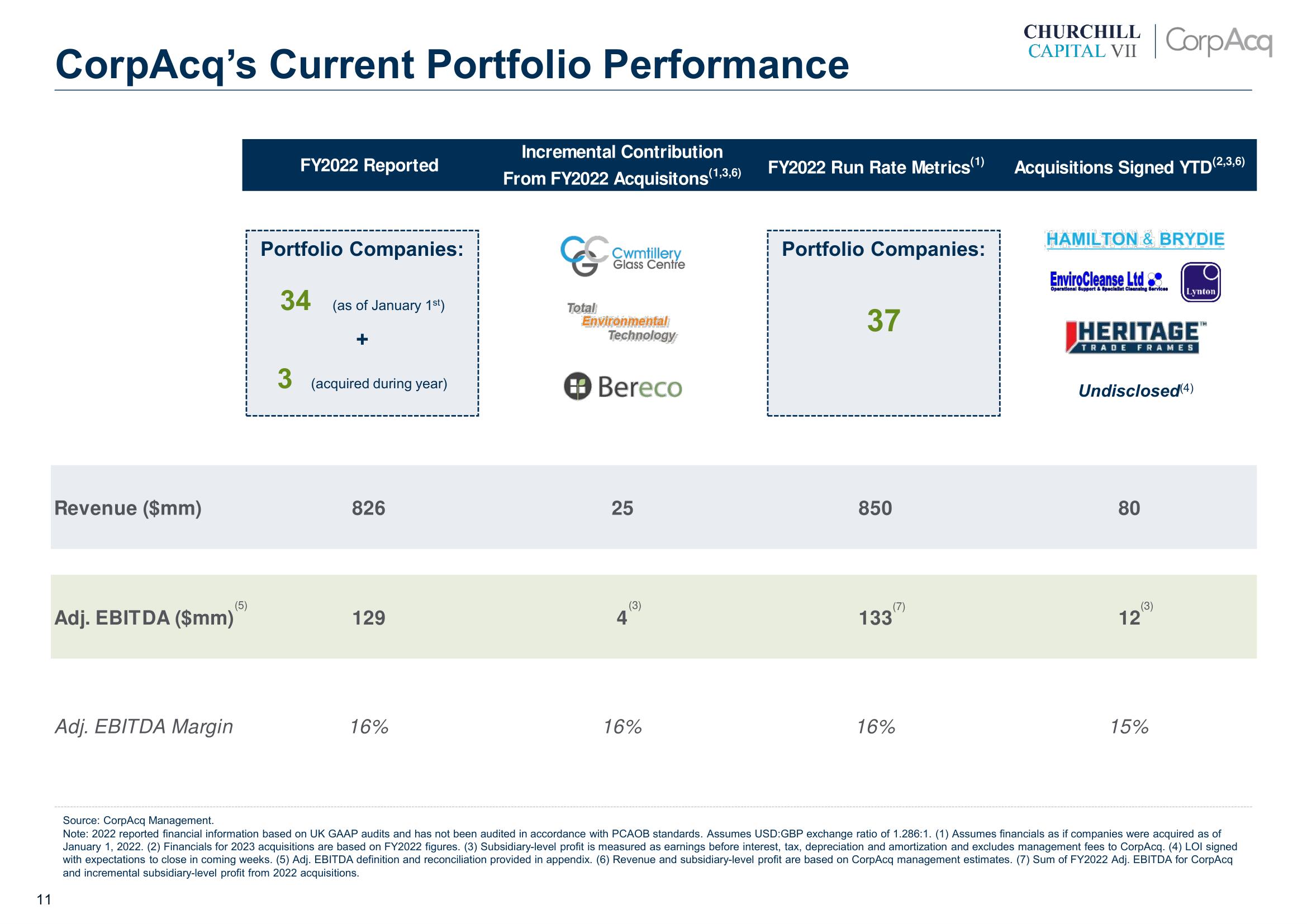

CorpAcq's Current Portfolio Performance

Revenue ($mm)

(5)

Adj. EBITDA ($mm)

Adj. EBITDA Margin

FY2022 Reported

Portfolio Companies:

34 (as of January 1st)

3 (acquired during year)

826

129

16%

Incremental Contribution

From FY2022 Acquisitons

Total

Cwmtillery

Glass Centre

Environmental

Technology

Bereco

25

(3)

4

16%

(1,3,6)

FY2022 Run Rate Metrics (¹)

Portfolio Companies:

37

850

(7)

133

16%

CHURCHILL

CAPITAL VII CorpAcq

Acquisitions Signed YTD (2,3,6)

HAMILTON & BRYDIE

EnviroCleanse Ltd 8

Operational Support & Speciallet Cleansing Services

HERITAGE™

TRADE FRAMES

Undisclosed(4)

80

Lynton

(3)

12

15%

Source: CorpAcq Management.

Note: 2022 reported financial information based on UK GAAP audits and has not been audited in accordance with PCAOB standards. Assumes USD:GBP exchange ratio of 1.286:1. (1) Assumes financials as if companies were acquired as of

January 1, 2022. (2) Financials for 2023 acquisitions are based on FY2022 figures. (3) Subsidiary-level profit is measured as earnings before interest, tax, depreciation and amortization and excludes management fees to CorpAcq. (4) LOI signed

with expectations to close in coming weeks. (5) Adj. EBITDA definition and reconciliation provided in appendix. (6) Revenue and subsidiary-level profit are based on CorpAcq management estimates. (7) Sum of FY2022 Adj. EBITDA for CorpAcq

and incremental subsidiary-level profit from 2022 acquisitions.View entire presentation