XP Inc Results Presentation Deck

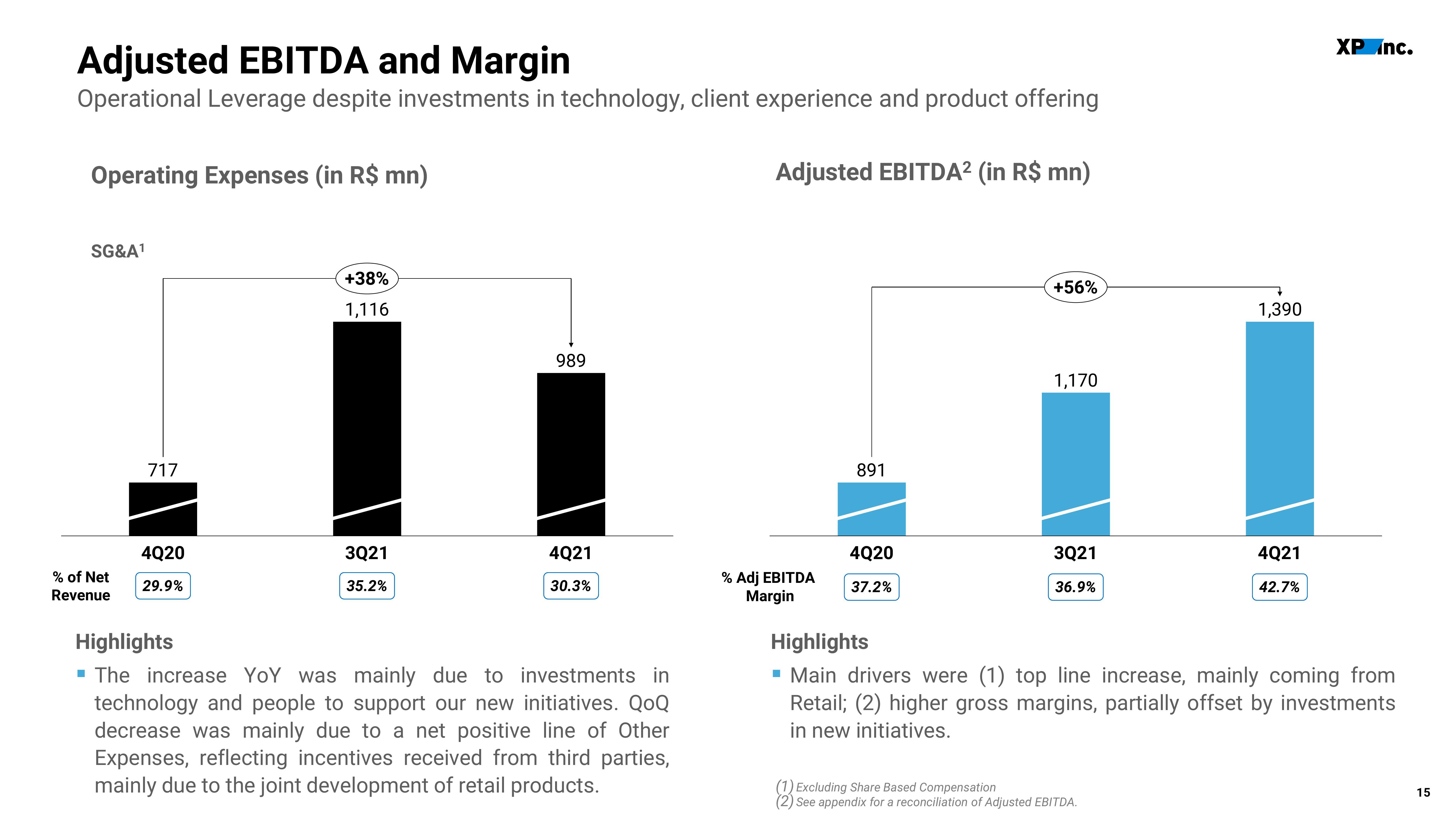

Adjusted EBITDA and Margin

Operational Leverage despite investments in technology, client experience and product offering

Operating Expenses (in R$ mn)

SG&A¹

% of Net

Revenue

717

4Q20

29.9%

+38%

1,116

3Q21

35.2%

989

4Q21

30.3%

Highlights

▪ The increase YoY was mainly due to investments in

technology and people to support our new initiatives. QoQ

decrease was mainly due to a net positive line of Other

Expenses, reflecting incentives received from third parties,

mainly due to the joint development of retail products.

Adjusted EBITDA² (in R$ mn)

% Adj EBITDA

Margin

891

4Q20

37.2%

+56%

1,170

3Q21

36.9%

1,390

Excluding Share Based Compensation

85

See appendix for a reconciliation of Adjusted EBITDA.

4Q21

42.7%

XP Inc.

Highlights

▪ Main drivers were (1) top line increase, mainly coming from

Retail; (2) higher gross margins, partially offset by investments

in new initiatives.

15View entire presentation