Ares US Real Estate Opportunity Fund III

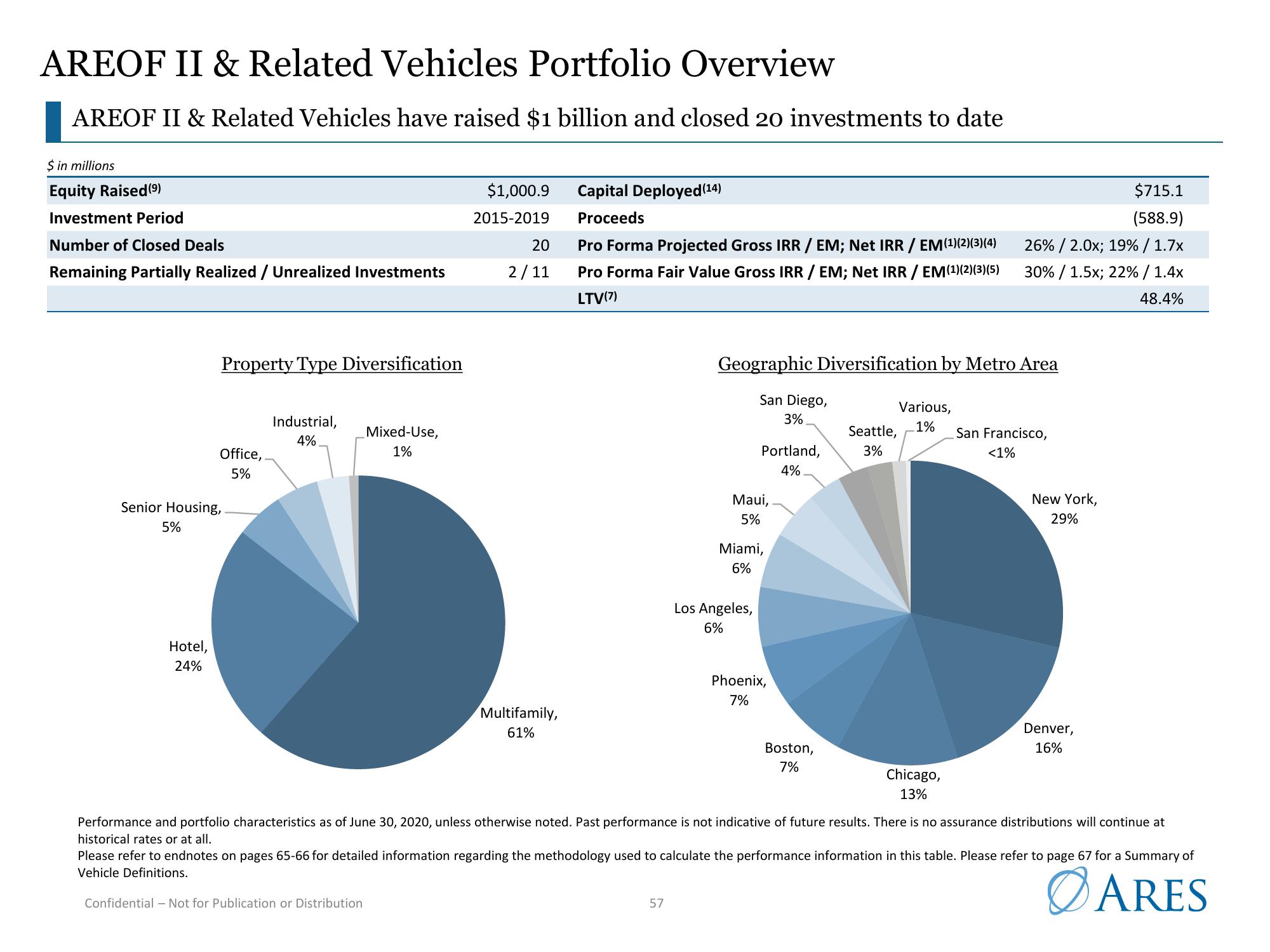

AREOF II & Related Vehicles Portfolio Overview

AREOF II & Related Vehicles have raised $1 billion and closed 20 investments to date

$ in millions

Equity Raised (⁹)

Investment Period

Number of Closed Deals

Remaining Partially Realized / Unrealized Investments

5%

Property Type Diversification

Senior Housing,

Hotel,

24%

Office,

5%

Industrial,

4%

Mixed-Use,

1%

$1,000.9

2015-2019

Confidential - Not for Publication or Distribution

20

2/11

Multifamily,

61%

Capital Deployed (14)

Proceeds

Pro Forma Projected Gross IRR / EM; Net IRR / EM (1)(2)(3)(4)

Pro Forma Fair Value Gross IRR / EM; Net IRR / EM (1)(2)(3)(5)

LTV(7)

Geographic Diversification by Metro Area

San Diego,

3%

57

Portland,

4%

Maui,

5%

Miami,

6%

Los Angeles,

6%

Phoenix,

7%

Boston,

7%

$715.1

(588.9)

26% / 2.0x; 19% / 1.7x

30% / 1.5x; 22% / 1.4x

48.4%

Various,

Seattle, 1% San Francisco,

3%

<1%

Chicago,

13%

New York,

29%

Performance and portfolio characteristics as of June 30, 2020, unless otherwise noted. Past performance is not indicative of future results. There is no assurance distributions will continue at

historical rates or at all.

Denver,

16%

Please refer to endnotes on pages 65-66 for detailed information regarding the methodology used to calculate the performance information in this table. Please refer to page 67 for a Summary of

Vehicle Definitions.

ARESView entire presentation