Ford Investor Conference

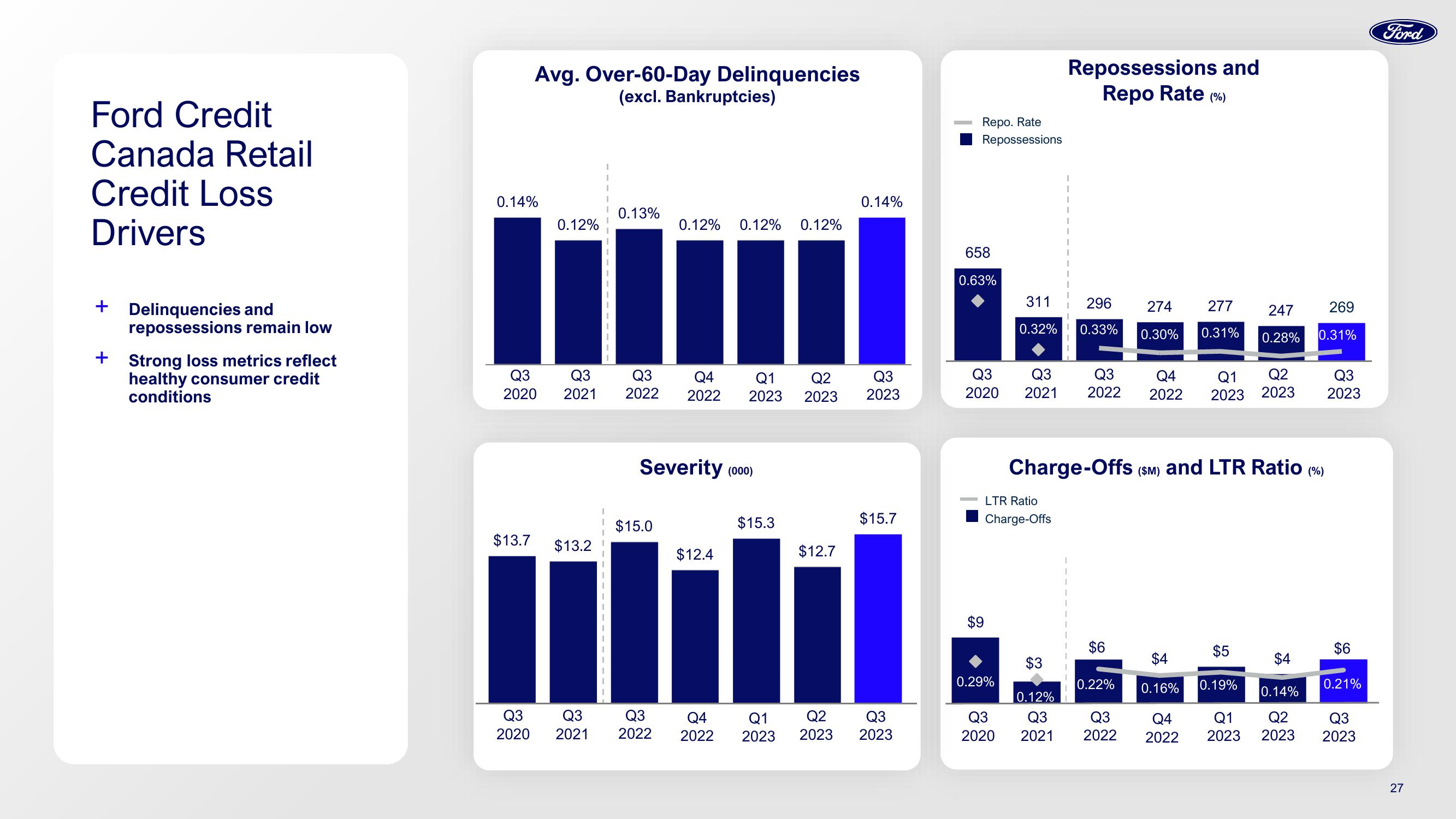

Ford Credit

Canada Retail

Credit Loss

Drivers

+

Delinquencies and

repossessions remain low

+ Strong loss metrics reflect

healthy consumer credit

conditions

Avg. Over-60-Day Delinquencies

(excl. Bankruptcies)

0.14%

Q3

2020

Q3

2020

0.12%

Q3

2021

I

1

0.13%

Q3

2022

0.12% 0.12% 0.12%

Q4 Q1 Q2

2022 2023 2023

Severity (000)

$15.3

Q4

Q3 Q3

2021 2022 2022

$15.0

$13.7 $13.2

$12.4

mili

0.14%

$12.7

Q3

2023

$15.7

Q1

Q2 Q3

2023 2023 2023

Repo. Rate

Repossessions

658

0.63%

Q3

2020

$9

0.29%

311

0.32%

LTR Ratio

Charge-Offs

Q3

2020

Q3

2021

Repossessions and

Repo Rate (%)

T

1

T

1

296

0.33%

$6

274

0.30%

Q3 Q4 Q1 Q2

2022 2022 2023 2023

Charge-Offs (SM) and LTR Ratio

$3

0.12%

Q3 Q3

2021 2022

277

0.31%

0.22%

247

0.28%

$5

$4

$4

0.16% 0.19%

0.14%

Q4 Q1 Q2

2022 2023 2023

269

0.31%

(%)

Q3

2023

$6

0.21%

Q3

2023

Ford

27View entire presentation