Acquisition of ReedTMS Logistics

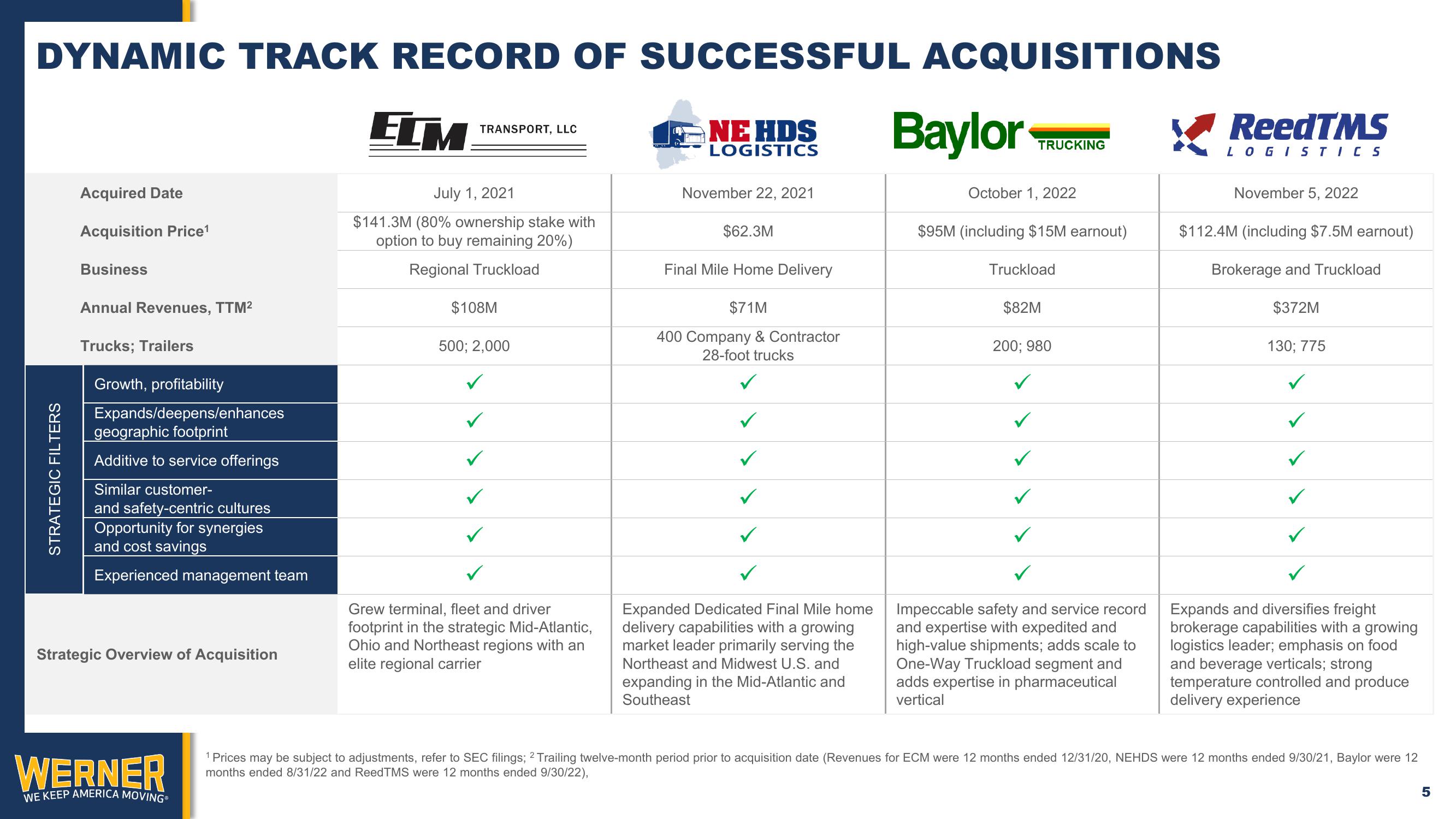

DYNAMIC TRACK RECORD OF SUCCESSFUL ACQUISITIONS

STRATEGIC FILTERS

Acquired Date

Acquisition Price¹

Business

Annual Revenues, TTM²

Trucks; Trailers

Growth, profitability

Expands/deepens/enhances

geographic footprint

Additive to service offerings

Similar customer-

and safety-centric cultures

Opportunity for synergies

and cost savings

Experienced management team

Strategic Overview of Acquisition

WERNER

WE KEEP AMERICA MOVINGⓇ

ELM

TRANSPORT, LLC

July 1, 2021

$141.3M (80% ownership stake with

option to buy remaining 20%)

Regional Truckload

$108M

500; 2,000

✓

✓

Grew terminal, fleet and driver

footprint in the strategic Mid-Atlantic,

Ohio and Northeast regions with an

elite regional carrier

NE HDS

LOGISTICS

November 22, 2021

$62.3M

Final Mile Home Delivery

$71M

400 Company & Contractor

28-foot trucks

Expanded Dedicated Final Mile home

delivery capabilities with a growing

market leader primarily serving the

Northeast and Midwest U.S. and

expanding in the Mid-Atlantic and

Southeast

Baylor

TRUCKING

October 1, 2022

$95M (including $15M earnout)

Truckload

$82M

200; 980

Impeccable safety and service record

and expertise with expedited and

high-value shipments; adds scale to

One-Way Truckload segment and

adds expertise in pharmaceutical

vertical

ReedTMS

LOGISTICS

November 5, 2022

$112.4M (including $7.5M earnout)

Brokerage and Truckload

$372M

130; 775

✓

✓

Expands and diversifies freight

brokerage capabilities with a growing

logistics leader; emphasis on food

and beverage verticals; strong

temperature controlled and produce

delivery experience

¹ Prices may be subject to adjustments, refer to SEC filings; 2 Trailing twelve-month period prior to acquisition date (Revenues for ECM were 12 months ended 12/31/20, NEHDS were 12 months ended 9/30/21, Baylor were 12

months ended 8/31/22 and ReedTMS were 12 months ended 9/30/22),

5View entire presentation