Evercore Investment Banking Pitch Book

Preliminary Valuation of SIRE Common Units

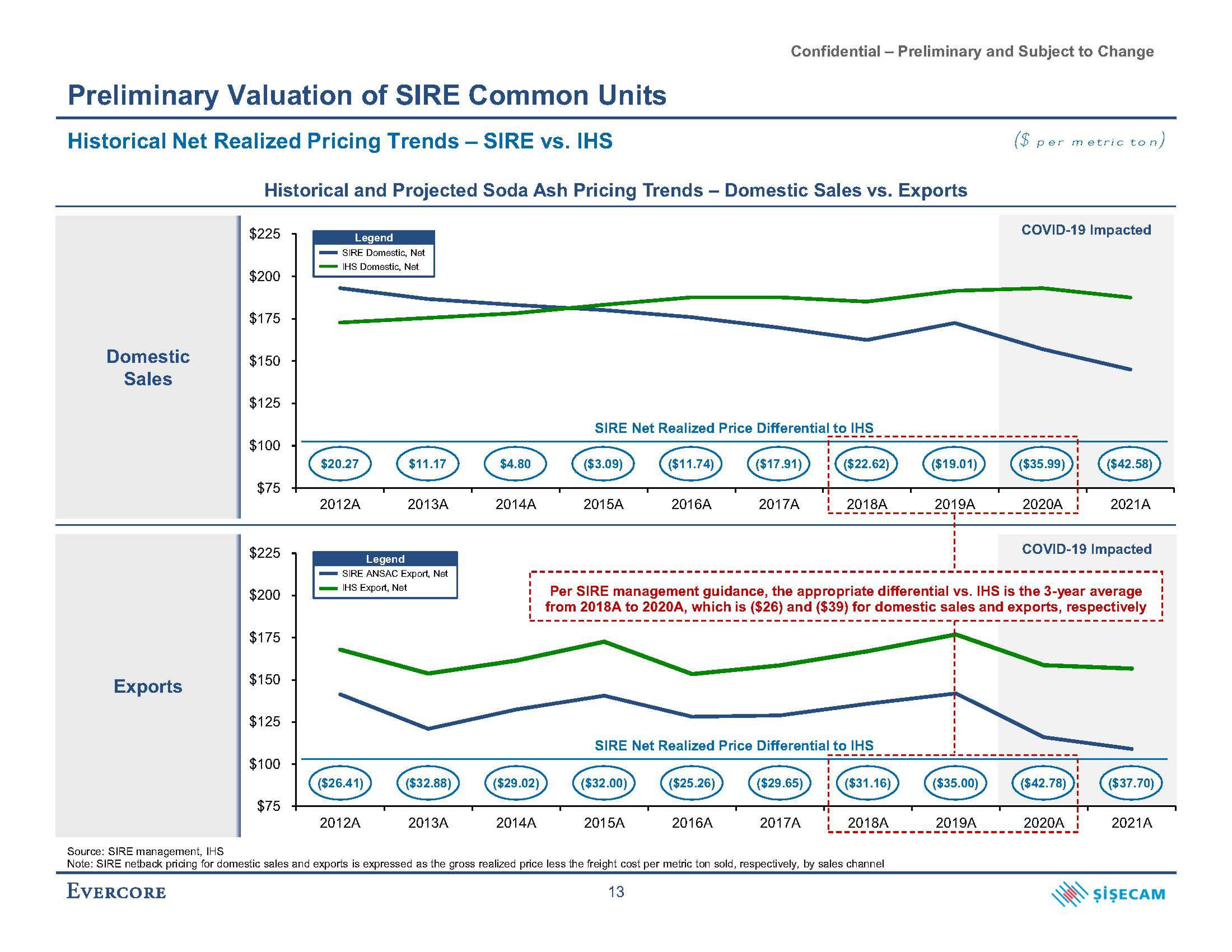

Historical Net Realized Pricing Trends - SIRE vs. IHS

Domestic

Sales

Exports

Historical and Projected Soda Ash Pricing Trends - Domestic Sales vs. Exports

$225

$200

$175

$150

$125

$100

$75

$225

$200

$175

$150

$125

$100

$75

Legend

SIRE Domestic, Net

IHS Domestic, Net

$20.27

2012A

($26.41)

$11.17

Legend

SIRE ANSAC Export, Net

IHS Export, Net

2012A

2013A

($32.88)

2013A

$4.80

2014A

($29.02)

2014A

SIRE Net Realized Price Differential to IHS

($3.09)

2015A

($11.74)

($32.00)

2016A

2015A

Confidential - Preliminary and Subject to Change

($25.26)

($17.91)

2016A

2017A

SIRE Net Realized Price Differential to IHS

($22.62)

($29.65)

2018A

2017A

($31.16)

Per SIRE management guidance, the appropriate differential vs. IHS is the 3-year average

from 2018A to 2020A, which is ($26) and ($39) for domestic sales and exports, respectively

2018A

($19.01)

Source: SIRE management, IHS

Note: SIRE netback pricing for domestic sales and exports is expressed as the gross realized price less the freight cost per metric ton sold, respectively, by sales channel

EVERCORE

13

2019A

($35.00)

per metric ton)

2019A

COVID-19 Impacted

($35.99)

2020A

($42.58)

COVID-19 Impacted

($42.78)

2021A

2020A

($37.70)

2021A

ŞİŞECAMView entire presentation