J.P.Morgan Results Presentation Deck

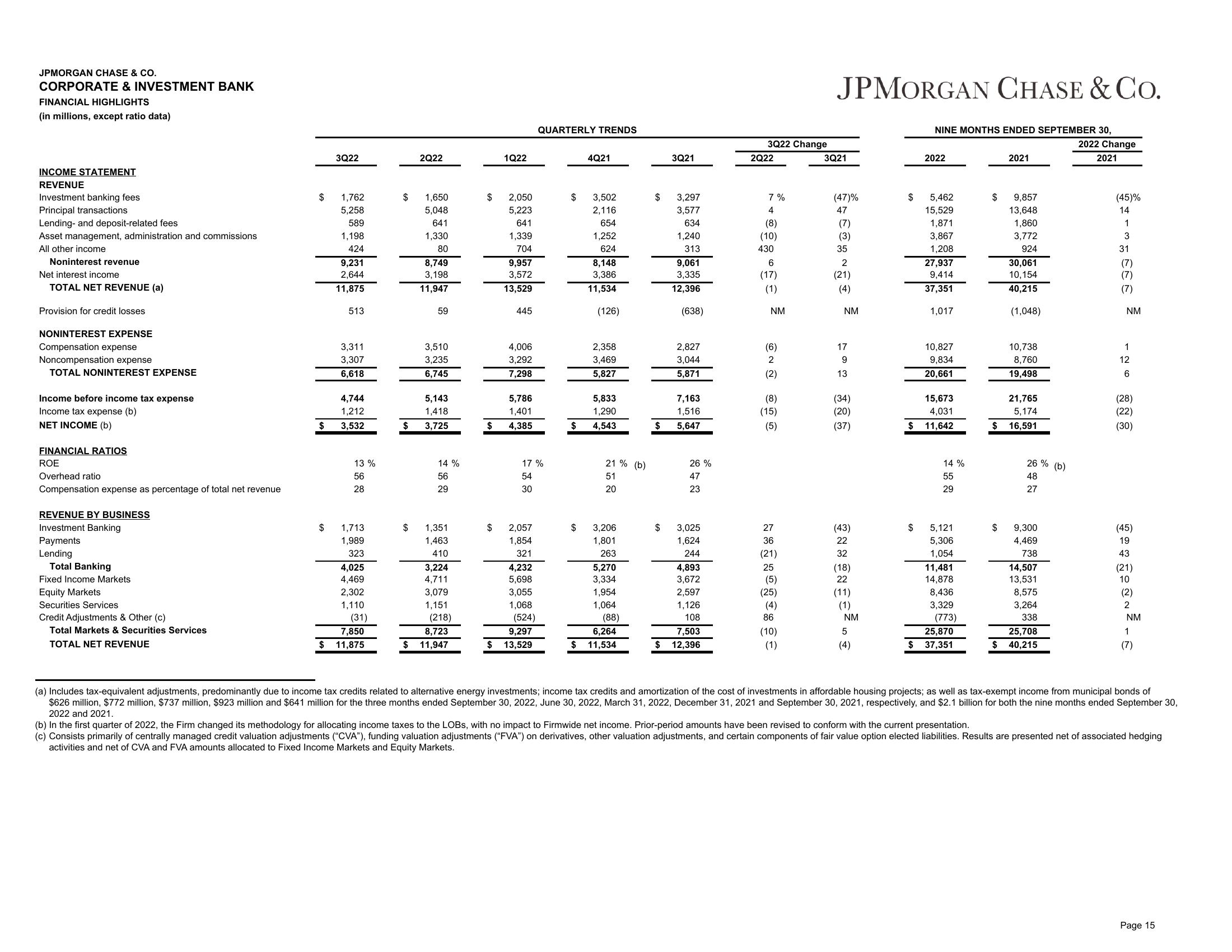

JPMORGAN CHASE & CO.

CORPORATE & INVESTMENT BANK

FINANCIAL HIGHLIGHTS

(in millions, except ratio data)

INCOME STATEMENT

REVENUE

Investment banking fees

Principal transactions

Lending- and deposit-related fees

Asset management, administration and commissions

All other income

Noninterest revenue

Net interest income

TOTAL NET REVENUE (a)

Provision for credit losses

NONINTEREST EXPENSE

Compensation expense

Noncompensation expense

TOTAL NONINTEREST EXPENSE

Income before income tax expense

Income tax expense (b)

NET INCOME (b)

FINANCIAL RATIOS

ROE

Overhead ratio

Compensation expense

REVENUE BY BUSINESS

Investment Banking

Payments

Lending

Total Banking

Fixed Income Markets

Equity Markets

Securities Services

percentage of total net revenue

Credit Adjustments & Other (c)

Total Markets & Securities Services

TOTAL NET REVENUE

$

$

$

3Q22

1,762

5,258

589

1,198

424

9,231

2,644

11,875

513

3,311

3,307

6,618

4,744

1,212

3,532

13%

56

28

1,713

1,989

323

4,025

4,469

2,302

1,110

(31)

7,850

11,875

$

2Q22

$

1,650

5,048

641

1,330

80

8,749

3,198

11,947

59

3,510

3,235

6,745

5,143

1,418

$ 3,725

14 %

56

29

1,351

1,463

410

3,224

4,711

3,079

1,151

(218)

8,723

$ 11,947

$

1Q22

2,050

5,223

641

1,339

704

9,957

3,572

13,529

445

4,006

3,292

7,298

5,786

1,401

$ 4,385

17%

54

30

2,057

1,854

321

4,232

5,698

3,055

1,068

(524)

QUARTERLY TRENDS

9,297

$ 13,529

$

$

$

4Q21

3,502

2,116

654

1,252

624

8,148

3,386

11,534

(126)

2,358

3,469

5,827

5,833

1,290

4,543

21% (b)

51

20

3,206

1,801

263

5,270

3,334

1,954

1,064

(88)

6,264

$ 11,534

$

3Q21

3,297

3,577

634

1,240

313

9,061

3,335

12,396

(638)

2,827

3,044

5,871

7,163

1,516

$ 5,647

26 %

47

23

$ 3,025

1,624

244

4,893

3,672

2,597

1,126

108

7,503

$ 12,396

3Q22 Change

2Q22

7%

4

(8)

(10)

430

6

(17)

(1)

NM

(6)

2

(2)

(8)

(15)

(5)

27

36

(21)

25

(5)

(25)

(4)

86

(10)

(1)

JPMORGAN CHASE & CO.

3Q21

(47)%

47

(7)

(3)

35

2

(21)

(4)

NM

17

9

13

(34)

(20)

(37)

(43)

22

32

(18)

22

(11)

(1)

NM

5

(4)

$

NINE MONTHS ENDED SEPTEMBER 30,

$

2022

5,462

15,529

1,871

3,867

1,208

27,937

9,414

37,351

1,017

10,827

9,834

20,661

15,673

4,031

$ 11,642

14 %

55

29

5,121

5,306

1,054

11,481

14,878

8,436

3,329

(773)

25,870

$ 37,351

$

$

$

2021

9,857

13,648

1,860

3,772

924

30,061

10,154

40,215

(1,048)

10,738

8,760

19,498

21,765

5,174

16,591

26% (b)

48

27

9,300

4,469

738

14,507

13,531

8,575

3,264

338

25,708

$ 40,215

2022 Change

2021

(45)%

14

1

3

31

(7)

(7)

(7)

NM

1

12

6

(28)

(22)

(30)

(45)

19

43

SNN

(21)

10

(2)

2

NM

1

(7)

(a) Includes tax-equivalent adjustments, predominantly due to income tax credits related to alternative energy investments; income tax credits and amortization of the cost of investments in affordable housing projects; as well as tax-exempt income from municipal bonds of

$626 million, $772 million, $737 million, $923 million and $641 million for the three months ended September 30, 2022, June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, respectively, and $2.1 billion for both the nine months ended September 30,

2022 and 2021.

(b) In the first quarter of 2022, the Firm changed its methodology for allocating income taxes to the LOBS, with no impact to Firmwide net income. Prior-period amounts have been revised to conform with the current presentation.

(c) Consists primarily of centrally managed credit valuation adjustments ("CVA"), funding valuation adjustments ("FVA") on derivatives, other valuation adjustments, and certain components of fair value option elected liabilities. Results are presented net of associated hedging

activities and net of CVA and FVA amounts allocated to Fixed Income Markets and Equity Markets.

Page 15View entire presentation