KKR Real Estate Finance Trust Investor Presentation Deck

Liquidity Overview

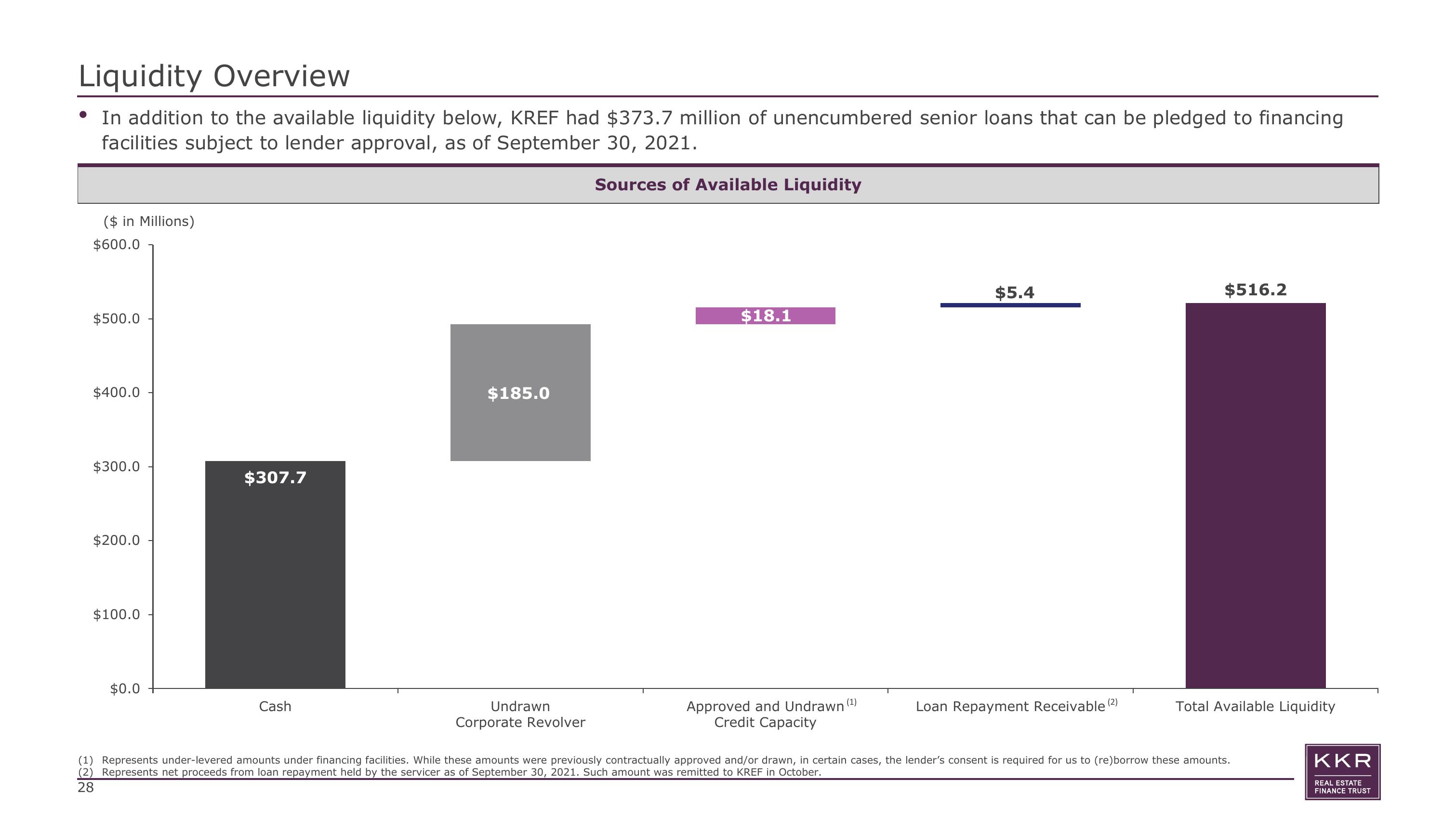

• In addition to the available liquidity below, KREF had $373.7 million of unencumbered senior loans that can be pledged to financing

facilities subject to lender approval, as of September 30, 2021.

Sources of Available Liquidity

($ in Millions)

$600.0

$500.0

$400.0

$300.0

$200.0

$100.0

$0.0

$307.7

Cash

$185.0

Undrawn

Corporate Revolver

$18.1

Approved and Undrawn (¹)

Credit Capacity

$5.4

Loan Repayment Receivable (2)

$516.2

Total Available Liquidity

(1) Represents under-levered amounts under financing facilities. While these amounts were previously contractually approved and/or drawn, in certain cases, the lender's consent is required for us to (re)borrow these amounts.

(2) Represents net proceeds from loan repayment held by the servicer as of September 30, 2021. Such amount was remitted to KREF in October.

28

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation