Bakkt Results Presentation Deck

OUTLOOK / GUIDANCE

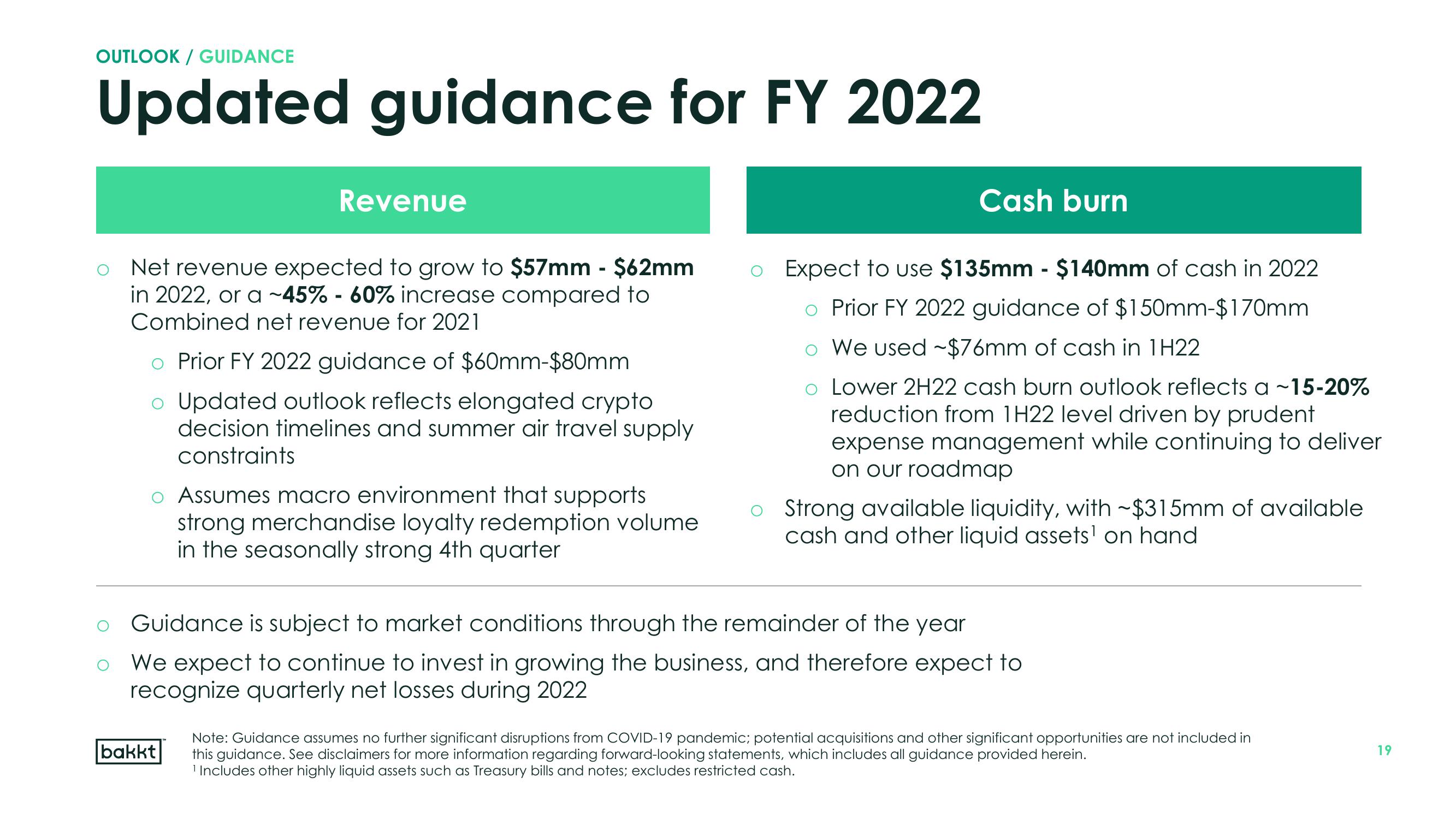

Updated guidance for FY 2022

Revenue

o Net revenue expected to grow to $57mm - $62mm o Expect to use $135mm - $140mm of cash in 2022

in 2022, or a -45% - 60% increase compared to

Combined net revenue for 2021

o Prior FY 2022 guidance of $150mm-$170mm

o We used ~$76mm of cash in 1H22

Prior FY 2022 guidance of $60mm-$80mm

o Lower 2H22 cash burn outlook reflects a ~15-20%

reduction from 1H22 level driven by prudent

Updated outlook reflects elongated crypto

decision timelines and summer air travel supply

constraints

expense management while continuing to deliver

on our roadmap

o Assumes macro environment that supports

strong merchandise loyalty redemption volume

in the seasonally strong 4th quarter

Cash burn

bakkt

Strong available liquidity, with ~$315mm of available

cash and other liquid assets¹ on hand

Guidance is subject to market conditions through the remainder of the year

We expect to continue to invest in growing the business, and therefore expect to

recognize quarterly net losses during 2022

Note: Guidance assumes no further significant disruptions from COVID-19 pandemic; potential acquisitions and other significant opportunities are not included in

this guidance. See disclaimers for more information regarding forward-looking statements, which includes all guidance provided herein.

¹ Includes other highly liquid assets such as Treasury bills and notes; excludes restricted cash.

19View entire presentation