WeWork Results Presentation Deck

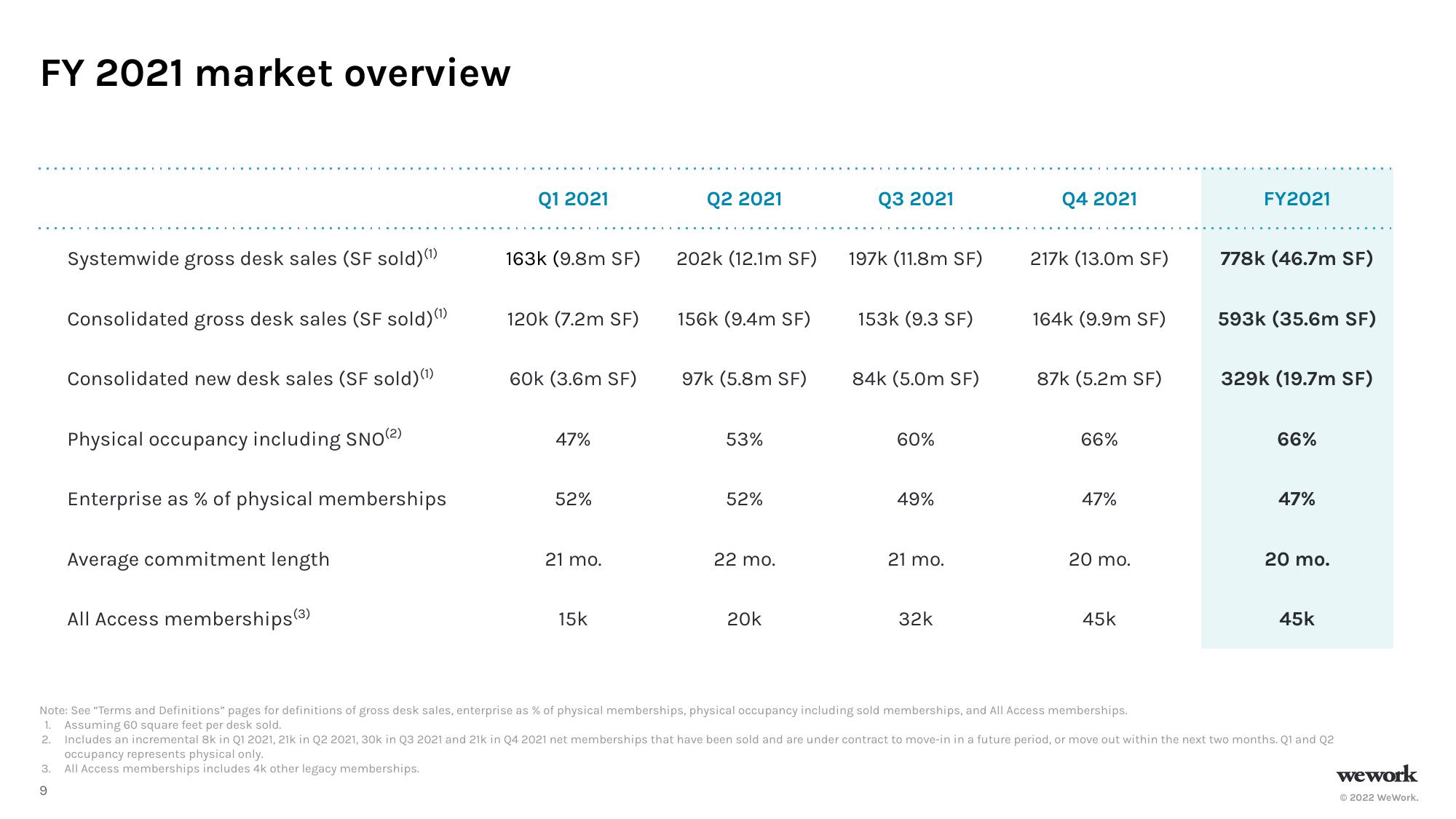

FY 2021 market overview

3.

Systemwide gross desk sales (SF sold)(¹)

9

Consolidated gross desk sales (SF sold)(¹)

Consolidated new desk sales (SF sold)(¹)

Physical occupancy including SNO (2)

Enterprise as % of physical memberships

Average commitment length

All Access memberships (³)

Q1 2021

163k (9.8m SF)

120k (7.2m SF)

60k (3.6m SF)

47%

52%

21 mo.

15k

Q2 2021

202k (12.1m SF)

156k (9.4m SF)

97k (5.8m SF)

53%

52%

22 mo.

20k

Q3 2021

197k (11.8m SF)

153k (9.3 SF)

84k (5.0m SF)

60%

49%

21 mo.

32k

Q4 2021

217k (13.0m SF)

164k (9.9m SF)

87k (5.2m SF)

66%

47%

20 mo.

45k

FY2021

778k (46.7m SF)

593k (35.6m SF)

329k (19.7m SF)

66%

47%

20 mo.

Note: See "Terms and Definitions" pages for definitions of gross desk sales, enterprise as % of physical memberships, physical occupancy including sold memberships, and All Access memberships.

1. Assuming 60 square feet per desk sold.

2.

Includes an incremental 8k in Q1 2021, 21k in Q2 2021, 30k in Q3 2021 and 21k in Q4 2021 net memberships that have been sold and are under contract to move-in in a future period, or move out within the next two months. Q1 and Q2

occupancy represents physical only.

All Access memberships includes 4k other legacy memberships.

45k

wework

Ⓒ2022 WeWork.View entire presentation