J.P.Morgan Software Investment Banking

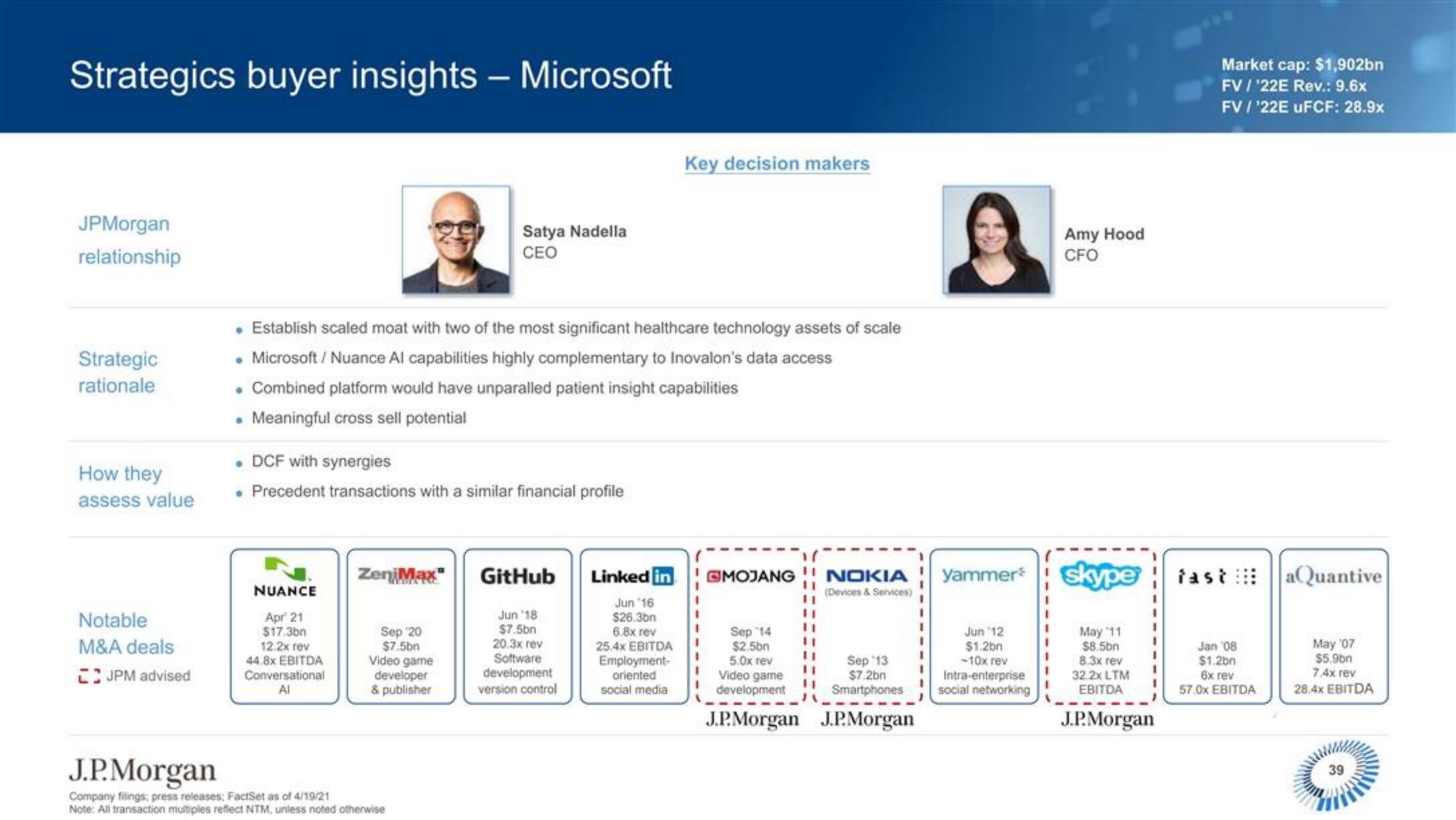

Strategics buyer insights - Microsoft

JPMorgan

relationship

Strategic

rationale

How they

assess value

Notable

M&A deals

JPM advised

Establish scaled moat with two of the most significant healthcare technology assets of scale

• Microsoft / Nuance Al capabilities highly complementary to Inovalon's data access

. Combined platform would have unparalled patient insight capabilities

• Meaningful cross sell potential

DCF with synergies

• Precedent transactions with a similar financial profile

NUANCE

Apr 21

$17.3bn

12.2x rev

44.8x EBITDA

Conversational

Al

ZeniMax

Satya Nadella

CEO

Sep 20

$7.5bn

Video game

developer

& publisher

J.P.Morgan

Company filings: press releases; FactSet as of 4/19/21

Note: All transaction multiples reflect NTM, unless noted otherwise

GitHub

Jun '18

$7.5bn

20.3x rev

Software

development

version control

Key decision makers

Linked in

Jun '16

$26.3bn

6.8x rev

25.4x EBITDA

Employment-

oriented

social media

GMOJANG NOKIA

(Devices & Services)

11

Sep 14

$2.5bn

5.0x rev

Video game

development

Sep 13

$7.2bn

Smartphones

J.P.Morgan J.P.Morgan

yammer*

Jun '12

$1.2bn

-10x rev

Intra-enterprise

social networking

Amy Hood

CFO

skype

May '11

$8.5bn

8.3x rev

32.2x LTM

EBITDA

J.P.Morgan

1

Market cap: $1,902bn

FV / 22E Rev.: 9.6x

FV/'22E UFCF: 28.9x

fast aQuantive

Jan '08

$1.2bn

6x rev

57.0x EBITDA

May '07

$5.9bn

7.4x rev

28.4x EBITDA

39View entire presentation