Main Street Capital Investor Day Presentation Deck

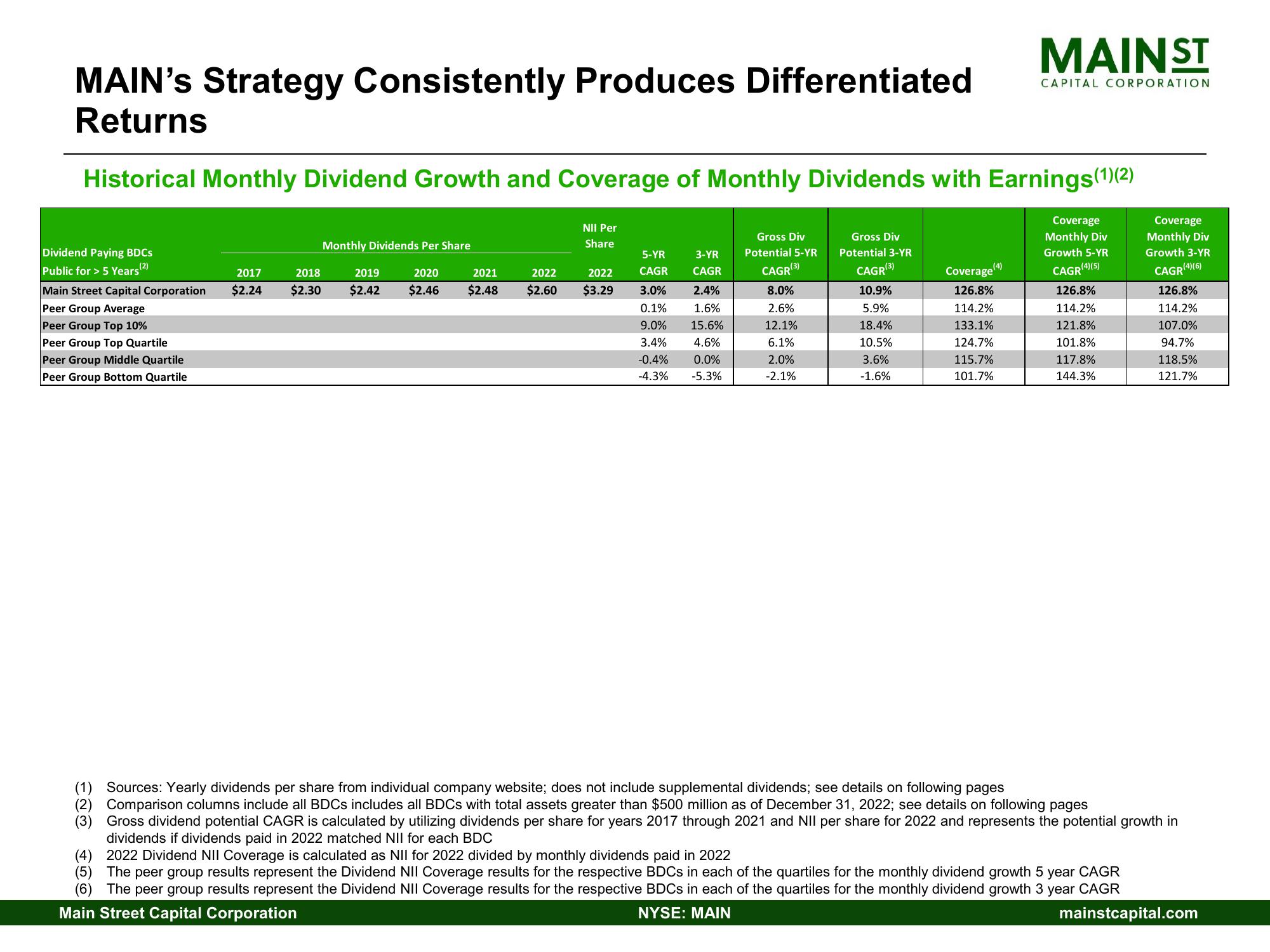

MAIN's Strategy Consistently Produces Differentiated

Returns

Historical Monthly Dividend Growth and Coverage of Monthly Dividends with Earnings (1)(2)

Dividend Paying BDCs

Public for > 5 Years (2)

Main Street Capital Corporation

Peer Group Average

Peer Group Top 10%

Peer Group Top Quartile

Peer Group Middle Quartile

Peer Group Bottom Quartile

NE

2017

$2.24

(3)

Monthly Dividends Per Share

2018

2019

2020

$2.30 $2.42 $2.46

2021

$2.48

2022

$2.60

NII Per

Share

5-YR 3-YR

CAGR CAGR

2022

$3.29 3.0%

2.4%

1.6%

0.1%

9.0% 15.6%

3.4%

4.6%

-0.4%

0.0%

-5.3%

-4.3%

Gross Div

Potential 5-YR

CAGR (3)

8.0%

2.6%

12.1%

6.1%

2.0%

-2.1%

Gross Div

Potential 3-YR

CAGR (3)

10.9%

5.9%

18.4%

10.5%

3.6%

-1.6%

(4)

MAINST

Coverage

126.8%

114.2%

133.1%

124.7%

115.7%

101.7%

CAPITAL CORPORATION

Coverage

Monthly Div

Growth 5-YR

(4)(5)

CAGR

126.8%

114.2%

121.8%

101.8%

117.8%

144.3%

(1) Sources: Yearly dividends per share from individual company website; does not include supplemental dividends; see details on following pages

Comparison columns include all BDCs includes all BDCs with total assets greater than $500 million as of December 31, 2022; see details on following pages

Gross dividend potential CAGR is calculated by utilizing dividends per share for years 2017 through 2021 and NII per share for 2022 and represents the potential growth in

dividends if dividends paid in 2022 matched NII for each BDC

(4) 2022 Dividend NII Coverage calculated as NII for 2022 divided by monthly dividends paid in 2022

(5) The peer group results represent the Dividend NII Coverage results for the respective BDCs in each of the quartiles for the monthly dividend growth 5 year CAGR

(6) The peer group results represent the Dividend NII Coverage results for the respective BDCs in each of the quartiles for the monthly dividend growth 3 year CAGR

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.com

Coverage

Monthly Div

Growth 3-YR

CAGR (4)(6)

126.8%

114.2%

107.0%

94.7%

118.5%

121.7%View entire presentation