Blackwells Capital Activist Presentation Deck

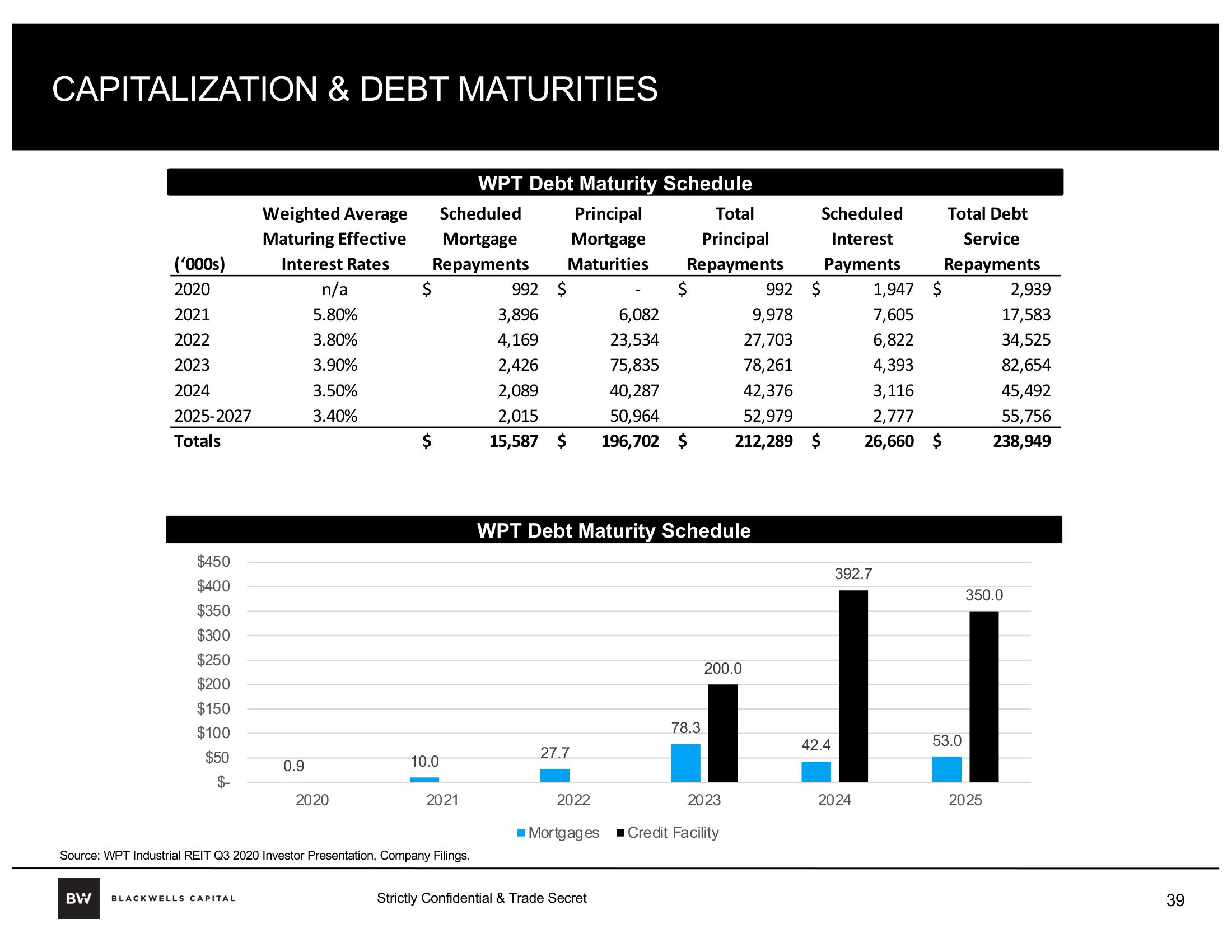

CAPITALIZATION & DEBT MATURITIES

('000s)

2020

2021

2022

2023

2024

2025-2027

Totals

$450

$400

$350

$300

$250

$200

$150

$100

$50

Weighted Average

Maturing Effective

Interest Rates

BW BLACKWELLS CAPITAL

0.9

n/a

5.80%

3.80%

3.90%

3.50%

3.40%

2020

WPT Debt Maturity Schedule

Scheduled

Principal

Mortgage

Mortgage

Repayments Maturities

$

10.0

2021

Source: WPT Industrial REIT Q3 2020 Investor Presentation, Company Filings.

992 $

3,896

6,082

4,169

23,534

2,426

75,835

2,089

40,287

2,015

50,964

15,587 $ 196,702 $

27.7

2022

WPT Debt Maturity Schedule

■ Mortgages

Total

Principal

Repayments

$

Strictly Confidential & Trade Secret

78.3

200.0

2023

1,947

992

9,978

7,605

27,703

6,822

78,261

4,393

42,376

3,116

52,979

2,777

212,289 $ 26,660 $

■Credit Facility

Scheduled

Interest

Payments

$

42.4

392.7

$

2024

Total Debt

Service

Repayments

53.0

2,939

17,583

34,525

82,654

45,492

55,756

238,949

350.0

2025

39View entire presentation