MoneyLion Investor Day Presentation Deck

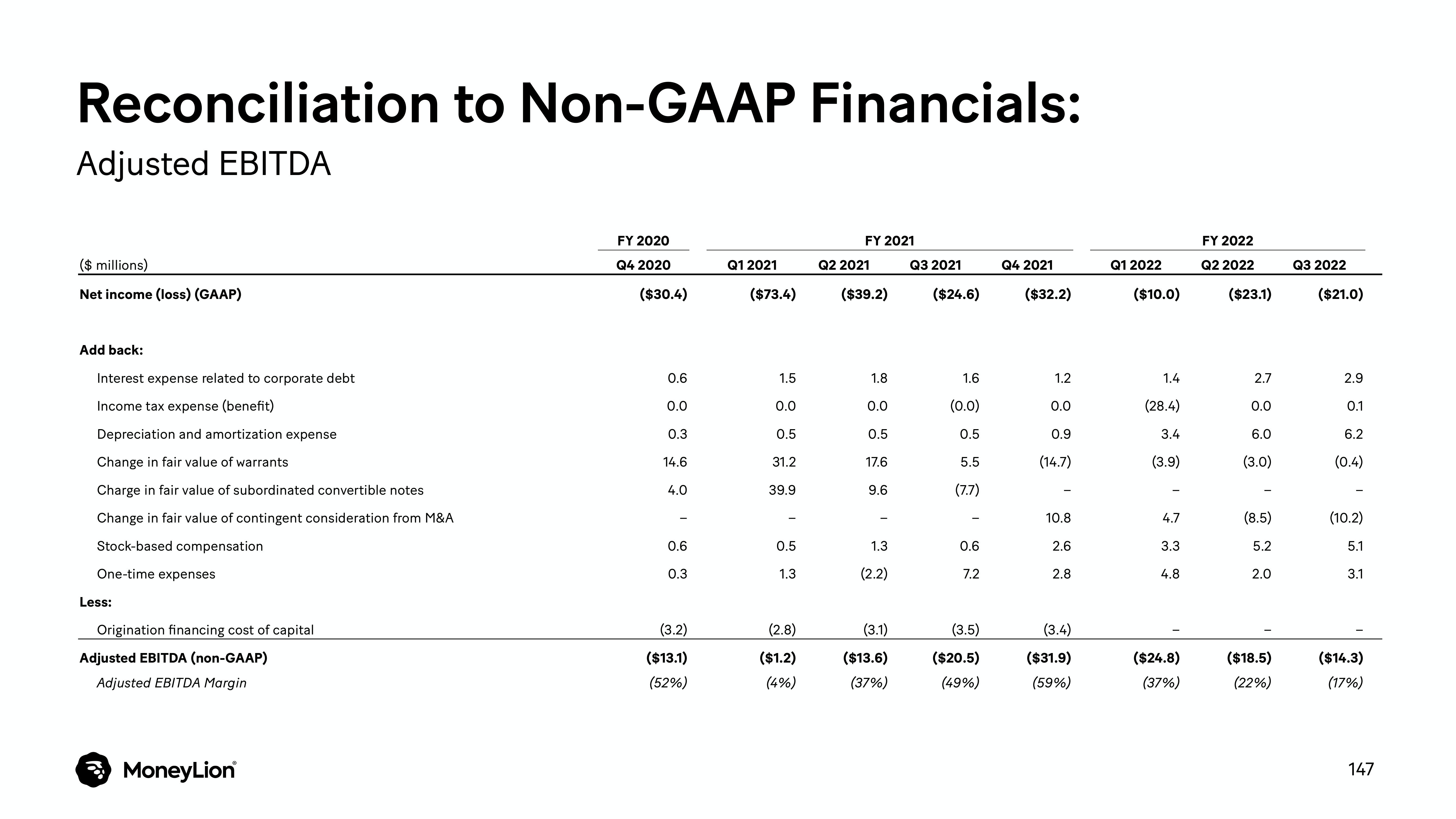

Reconciliation to Non-GAAP Financials:

Adjusted EBITDA

($ millions)

Net income (loss) (GAAP)

Add back:

Interest expense related to corporate debt

Income tax expense (benefit)

Depreciation and amortization expense

Change in fair value of warrants

Charge in fair value of subordinated convertible notes

Change in fair value of contingent consideration from M&A

Stock-based compensation

One-time expenses

Less:

Origination financing cost of capital

Adjusted EBITDA (non-GAAP)

Adjusted EBITDA Margin

MoneyLion

FY 2020

Q4 2020

($30.4)

0.6

0.0

0.3

14.6

4.0

0.6

0.3

(3.2)

($13.1)

(52%)

Q1 2021

($73.4)

1.5

0.0

0.5

31.2

39.9

0.5

1.3

(2.8)

($1.2)

(4%)

FY 2021

Q2 2021

($39.2)

1.8

0.0

0.5

17.6

9.6

1.3

(2.2)

(3.1)

($13.6)

(37%)

Q3 2021

($24.6)

1.6

(0.0)

0.5

5.5

(7.7)

0.6

7.2

(3.5)

($20.5)

(49%)

Q4 2021

($32.2)

1.2

0.0

0.9

(14.7)

10.8

2.6

2.8

(3.4)

($31.9)

(59%)

Q1 2022

($10.0)

1.4

(28.4)

3.4

(3.9)

4.7

3.3

4.8

($24.8)

(37%)

FY 2022

Q2 2022

($23.1)

2.7

0.0

6.0

(3.0)

(8.5)

5.2

2.0

($18.5)

(22%)

Q3 2022

($21.0)

2.9

0.1

6.2

(0.4)

(10.2)

5.1

3.1

($14.3)

(17%)

147View entire presentation