Third Quarter 2022 Earnings Conference Call

3Q22 performance highlights

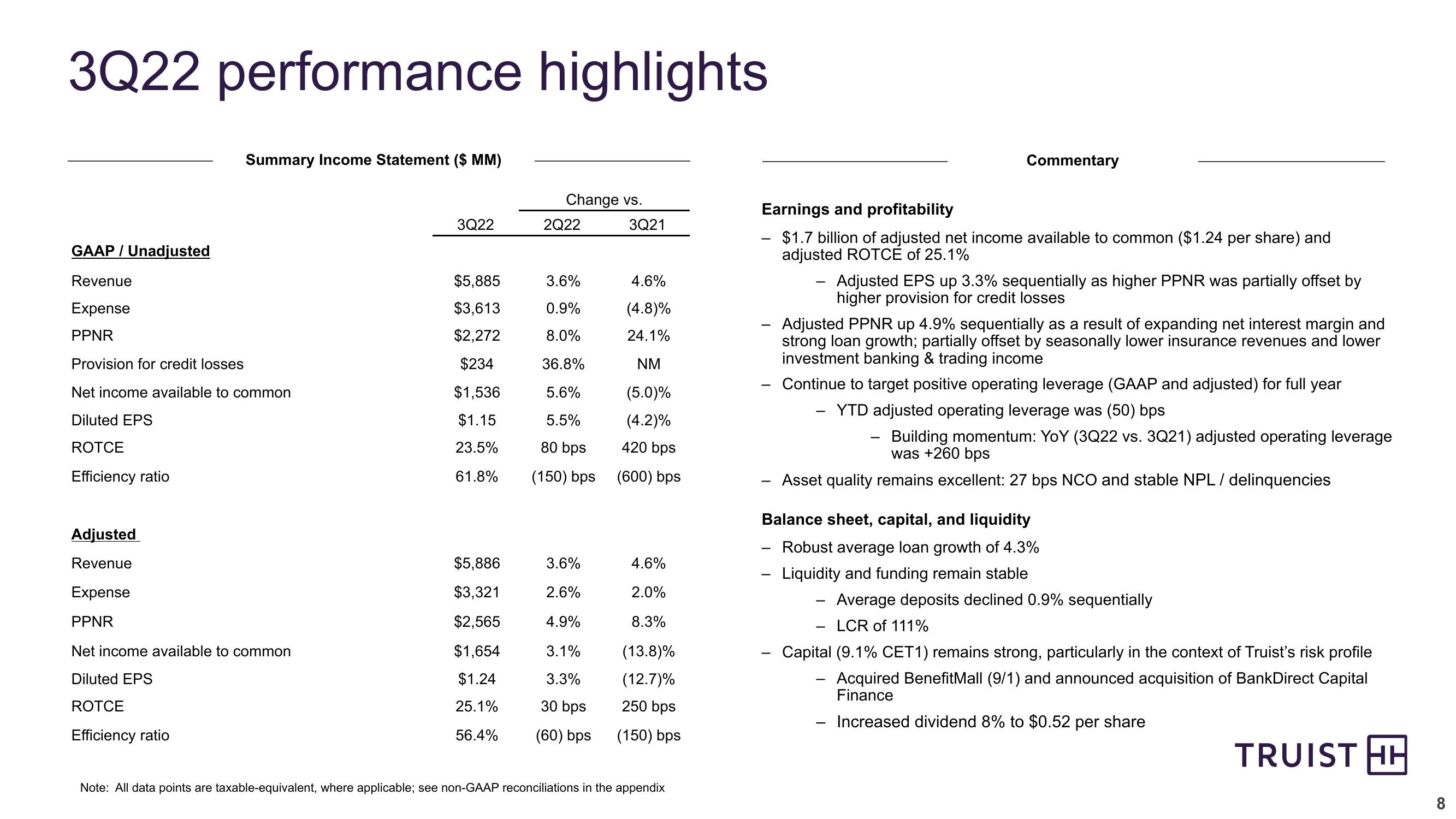

GAAP / Unadjusted

Summary Income Statement ($ MM)

Change vs.

3Q22

2Q22

3Q21

Revenue

Expense

$5,885

3.6%

4.6%

$3,613

0.9%

(4.8)%

PPNR

$2,272

8.0%

Provision for credit losses

$234

36.8%

Net income available to common

$1,536

5.6%

24.1%

NM

(5.0)%

Diluted EPS

$1.15

5.5%

(4.2)%

ROTCE

23.5%

80 bps

420 bps

Efficiency ratio

61.8%

(150) bps

(600) bps

Adjusted

Revenue

$5,886

3.6%

4.6%

Expense

$3,321

2.6%

2.0%

PPNR

$2,565

4.9%

8.3%

Net income available to common

$1,654

3.1%

(13.8)%

Diluted EPS

$1.24

3.3%

ROTCE

25.1%

30 bps

(12.7)%

250 bps

Efficiency ratio

56.4%

(60) bps

(150) bps

Note: All data points are taxable-equivalent, where applicable; see non-GAAP reconciliations in the appendix

Earnings and profitability

Commentary

-

$1.7 billion of adjusted net income available to common ($1.24 per share) and

adjusted ROTCE of 25.1%

-

Adjusted EPS up 3.3% sequentially as higher PPNR was partially offset by

higher provision for credit losses

Adjusted PPNR up 4.9% sequentially as a result of expanding net interest margin and

strong loan growth; partially offset by seasonally lower insurance revenues and lower

investment banking & trading income

Continue to target positive operating leverage (GAAP and adjusted) for full year

-

YTD adjusted operating leverage was (50) bps

Building momentum: YoY (3Q22 vs. 3Q21) adjusted operating leverage

was +260 bps

Asset quality remains excellent: 27 bps NCO and stable NPL / delinquencies

Balance sheet, capital, and liquidity

-

Robust average loan growth of 4.3%

Liquidity and funding remain stable

-

- Average deposits declined 0.9% sequentially

-

LCR of 111%

Capital (9.1% CET1) remains strong, particularly in the context of Truist's risk profile

-

Acquired BenefitMall (9/1) and announced acquisition of BankDirect Capital

Finance

-

Increased dividend 8% to $0.52 per share

TRUIST HH

8View entire presentation