Grove SPAC Presentation Deck

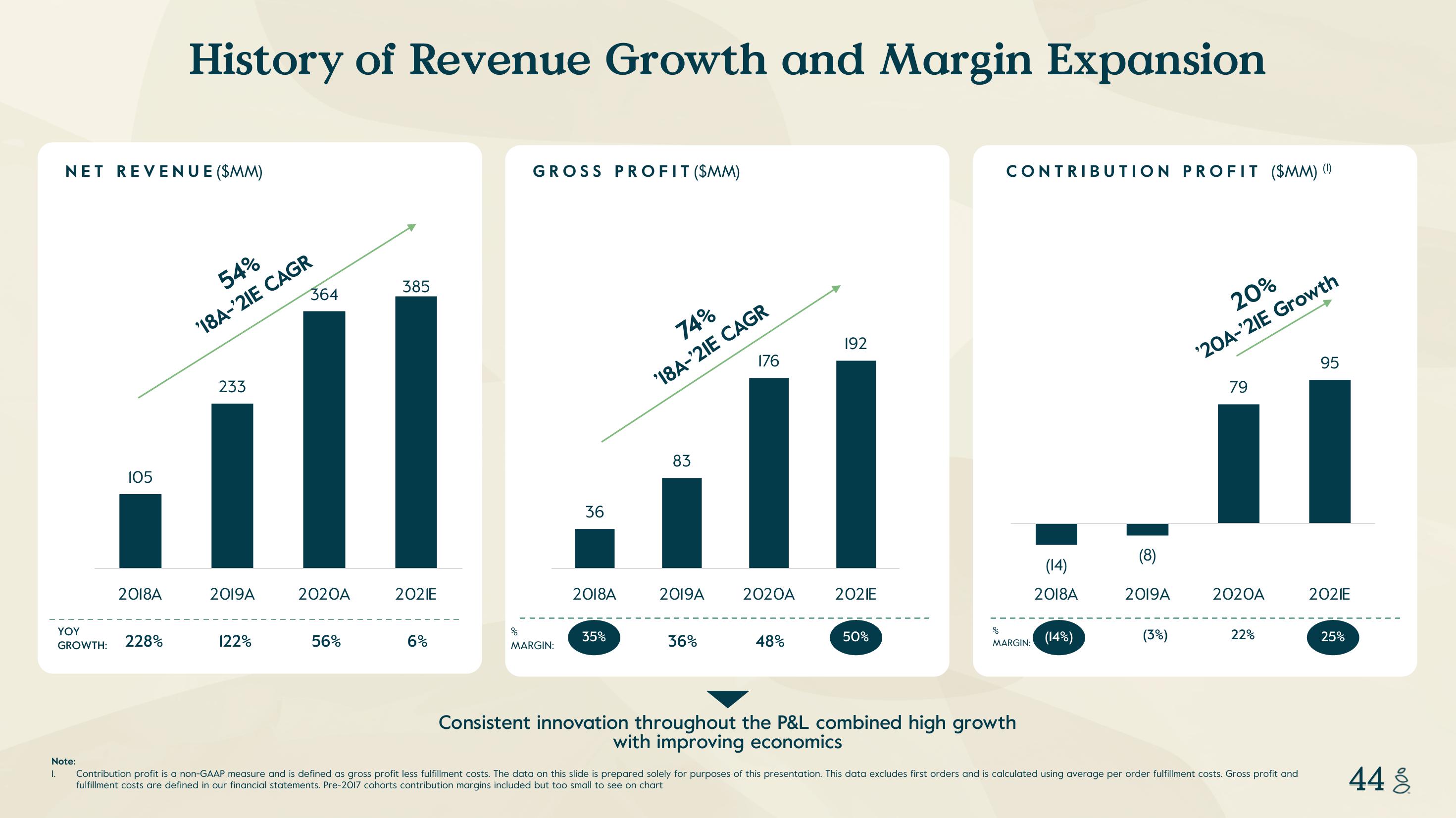

NET REVENUE ($MM)

YOY

GROWTH:

Note:

1.

105

2018A

History of Revenue Growth and Margin Expansion

228%

54%

'18A-'21E CAGR

233

2019A

122%

364

2020A

56%

385

2021E

6%

%

GROSS PROFIT ($MM)

MARGIN:

36

2018A

35%

74%

'18A-'21E CAGR

83

2019A

36%

176

2020A

48%

192

2021E

50%

%

CONTRIBUTION PROFIT ($MM)

MARGIN:

Consistent innovation throughout the P&L combined high growth

with improving economics

(14)

2018A

(14%)

(8)

2019A

(3%)

20%

'20A-'21E Growth

79

2020A

22%

Contribution profit is a non-GAAP measure and is defined as gross profit less fulfillment costs. The data on this slide is prepared solely for purposes of this presentation. This data excludes first orders and is calculated using average per order fulfillment costs. Gross profit and

fulfillment costs are defined in our financial statements. Pre-2017 cohorts contribution margins included but too small to see on chart

95

2021E

25%

44 %View entire presentation