Building a Leading P&C Insurer

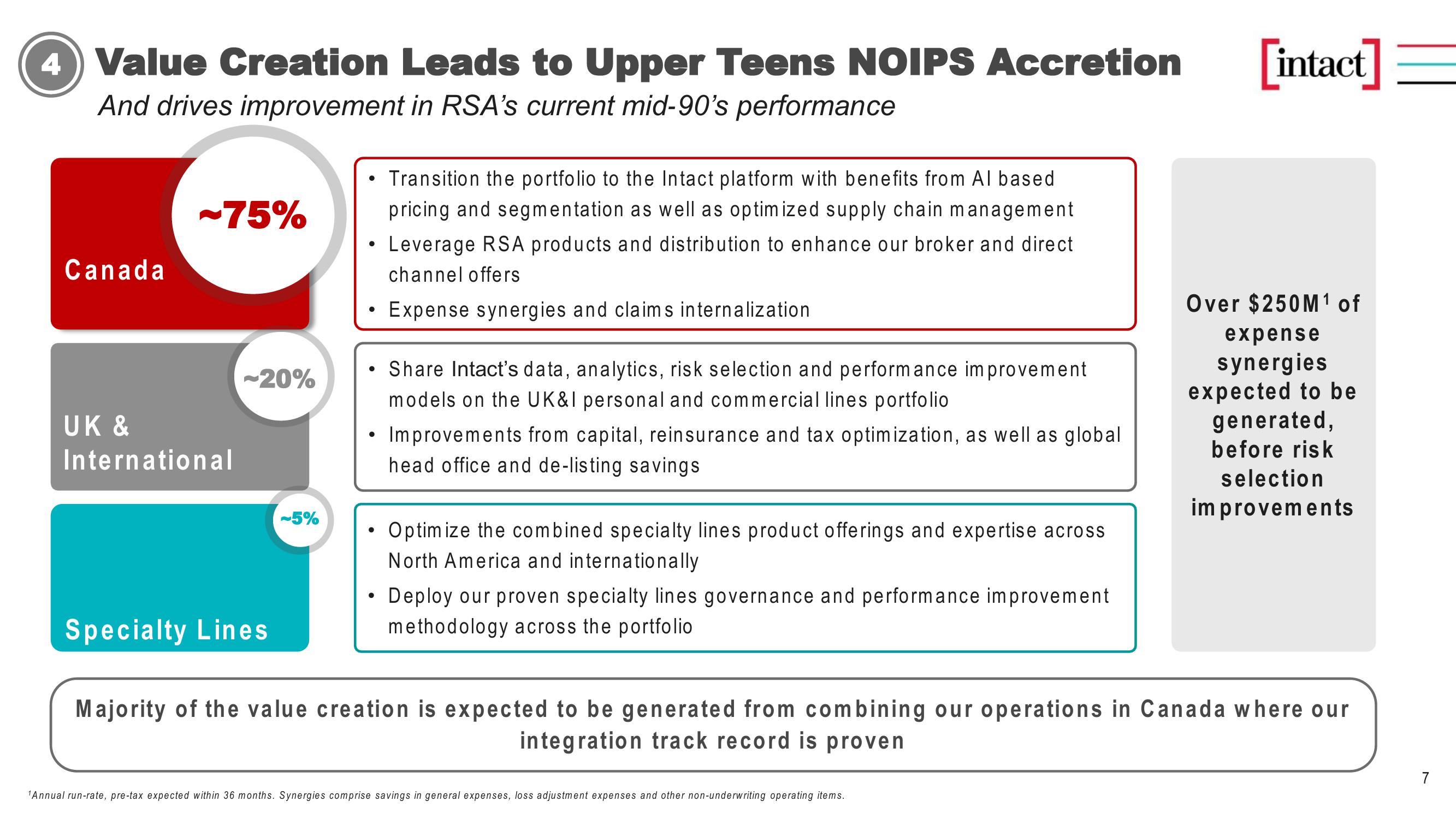

4) Value Creation Leads to Upper Teens NOIPS Accretion

And drives improvement in RSA's current mid-90's performance

Canada

-75%

UK &

International

~20%

Specialty Lines

~5%

●

• Leverage RSA products and distribution to enhance our broker and direct.

channel offers

Expense synergies and claims internalization

●

●

• Share Intact's data, analytics, risk selection and performance improvement.

models on the UK&I personal and commercial lines portfolio

●

Transition the portfolio to the Intact platform with benefits from Al based

pricing and segmentation as well as optimized supply chain management

●

●

Improvements from capital, reinsurance and tax optimization, as well as global

head office and de-listing savings

Optimize the combined specialty lines product offerings and expertise across

North America and internationally

Deploy our proven specialty lines governance and performance improvement

methodology across the portfolio

[intact]

¹Annual run-rate, pre-tax expected within 36 months. Synergies comprise savings in general expenses, loss adjustment expenses and other non-underwriting operating items.

Over $250M¹ of

expense

synergies

expected to be

generated,

before risk

selection

improvements

Majority of the value creation is expected to be generated from combining our operations in Canada where our

integration track record is proven

7View entire presentation