Worthington Industries Mergers and Acquisitions Presentation Deck

WORTHINGTON STEEL IS A BEST-IN-CLASS, VALUE-ADDED

STEEL PROCESSOR IN GROWING END-MARKETS

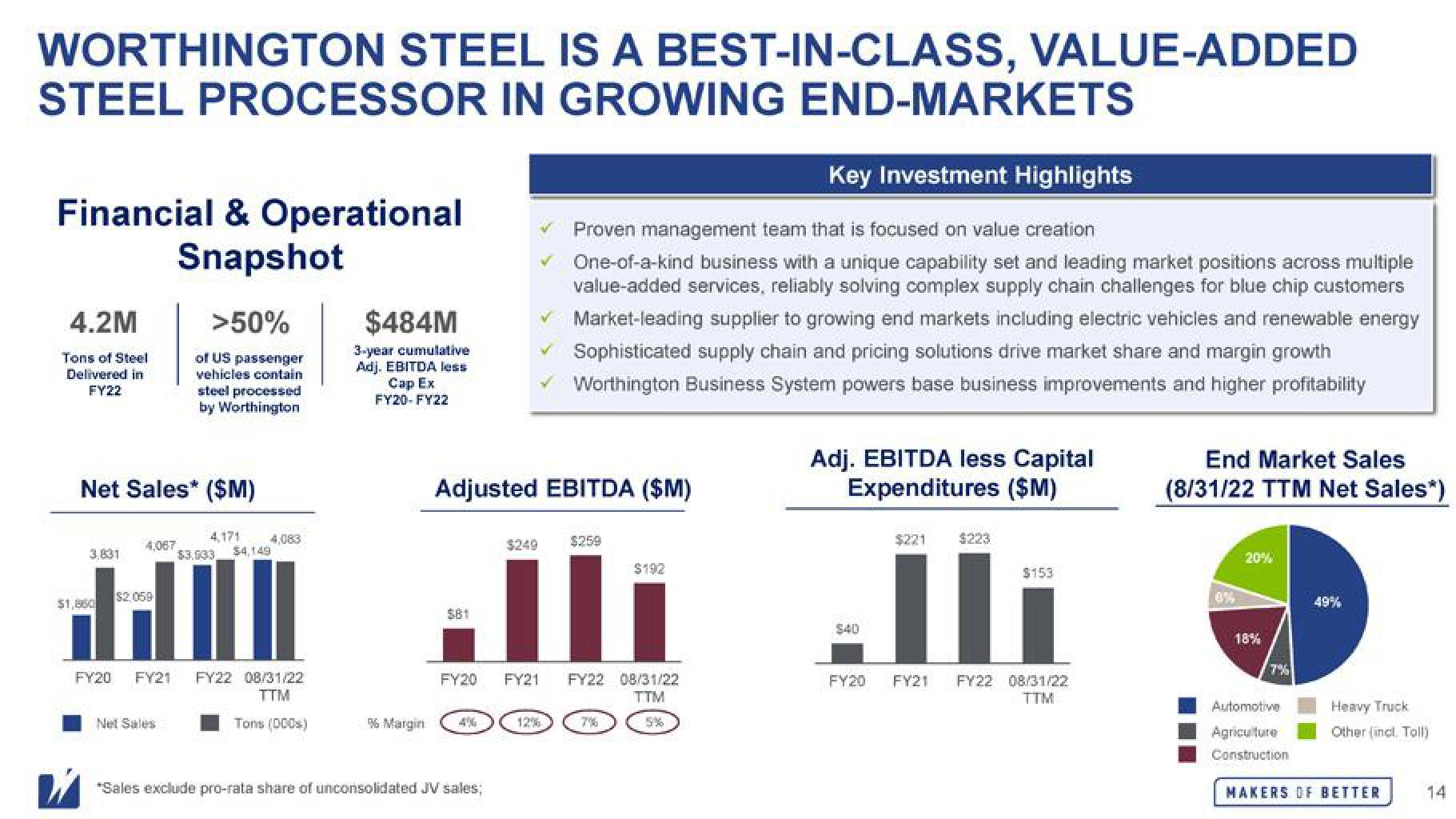

Financial & Operational

Snapshot

4.2M

Tons of Steel

Delivered in

FY22

Net Sales* ($M)

3,831

$1,860

4,067

>50%

of US passenger

vehicles contain

steel processed

by Worthington

Net Sales

4,171

$3,933

4,083

$4,149

FY20 FY21 FY22 08/31/22

TTM

Tons (000s)

$484M

3-year cumulative

Adj. EBITDA less

Cap Ex

FY20-FY22

% Margin

$81

Adjusted EBITDA ($M)

FY20

*Sales exclude pro-rata share of unconsolidated JV sales;

✓

$249

Key Investment Highlights

Proven management team that is focused on value creation

One-of-a-kind business with a unique capability set and leading market positions across multiple

value-added services, reliably solving complex supply chain challenges for blue chip customers

Market-leading supplier to growing end markets including electric vehicles and renewable energy

Sophisticated supply chain and pricing solutions drive market share and margin growth

Worthington Business System powers base business improvements and higher profitability

$259

$192

FY21 FY22 08/31/22

TTM

Adj. EBITDA less Capital

Expenditures ($M)

$40

$221

$153

FY20 FY21 FY22 08/31/22

TTM

End Market Sales

(8/31/22 TTM Net Sales*)

20%

18%

7%

Automotive

Agriculture

Construction

49%

Heavy Truck

Other (incl. Toll)

MAKERS OF BETTER

14View entire presentation