Affirm Investor Event Presentation Deck

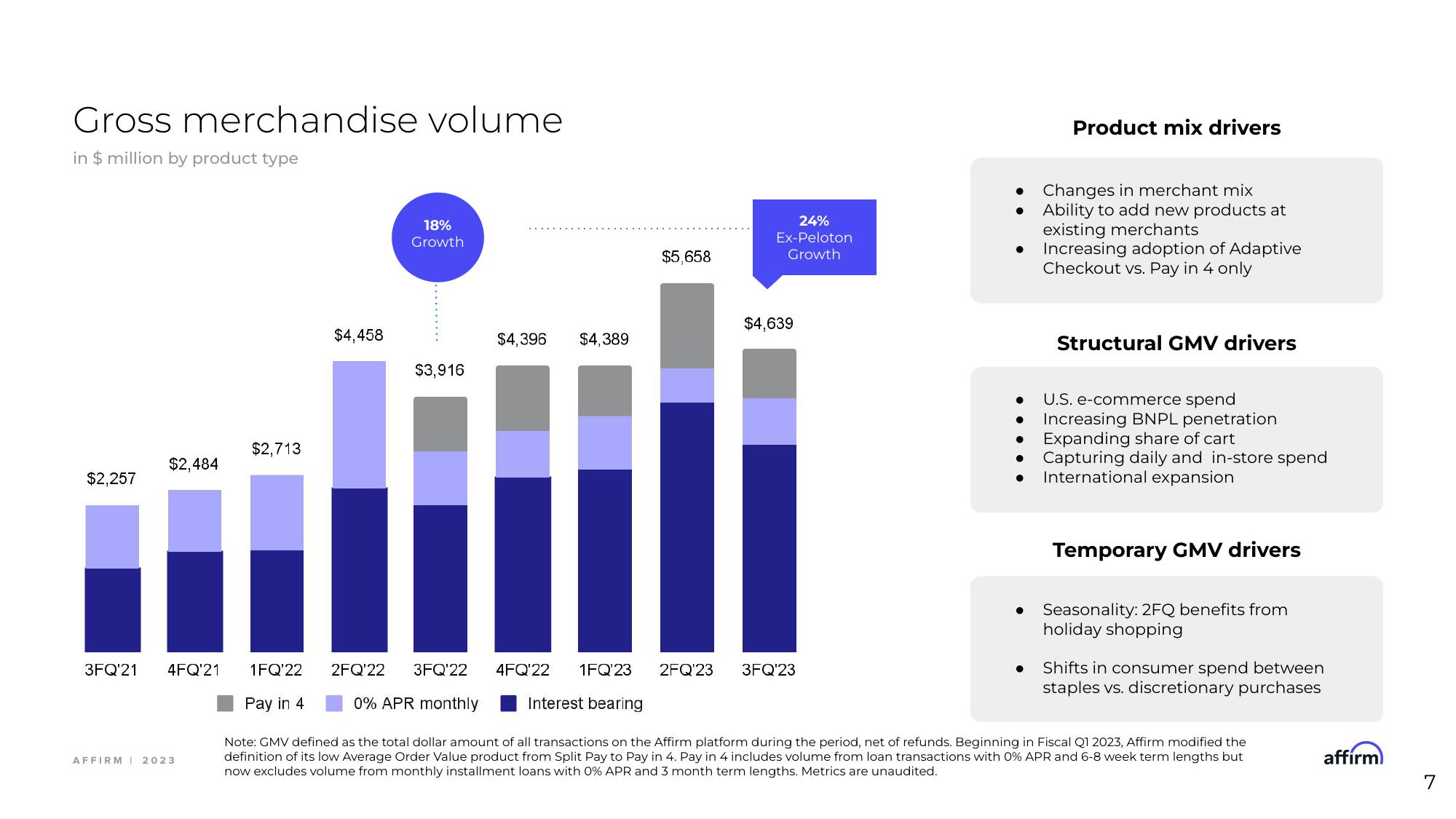

Gross merchandise volume

in $ million by product type

$2,257

3FQ'21

$2,484

4FQ'21

AFFIRMI 2023

$2,713

$4,458

1FQ'22

Pay in 4

18%

Growth

$3,916

$4,396 $4,389

2FQ'22 3FQ'22

0% APR monthly

$5,658

24%

Ex-Peloton

Growth

$4,639

3FQ'23

Product mix drivers

Changes in merchant mix

● Ability to add new products at

existing merchants

Increasing adoption of Adaptive

Checkout vs. Pay in 4 only

●

Structural GMV drivers

● U.S. e-commerce spend

● Increasing BNPL penetration

● Expanding share of cart

●

Capturing daily and in-store spend

International expansion

4FQ'22 1FQ'23 2FQ'23

Interest bearing

Note: GMV defined as the total dollar amount of all transactions on the Affirm platform during the period, net of refunds. Beginning in Fiscal Q1 2023, Affirm modified the

definition of its low Average Order Value product from Split Pay to Pay in 4. Pay in 4 includes volume from loan transactions with 0% APR and 6-8 week term lengths but

now excludes volume from monthly installment loans with 0% APR and 3 month term lengths. Metrics are unaudited.

Temporary GMV drivers

● Seasonality: 2FQ benefits from

holiday shopping

● Shifts in consumer spend between

staples vs. discretionary purchases

affirm

7View entire presentation