Baird Investment Banking Pitch Book

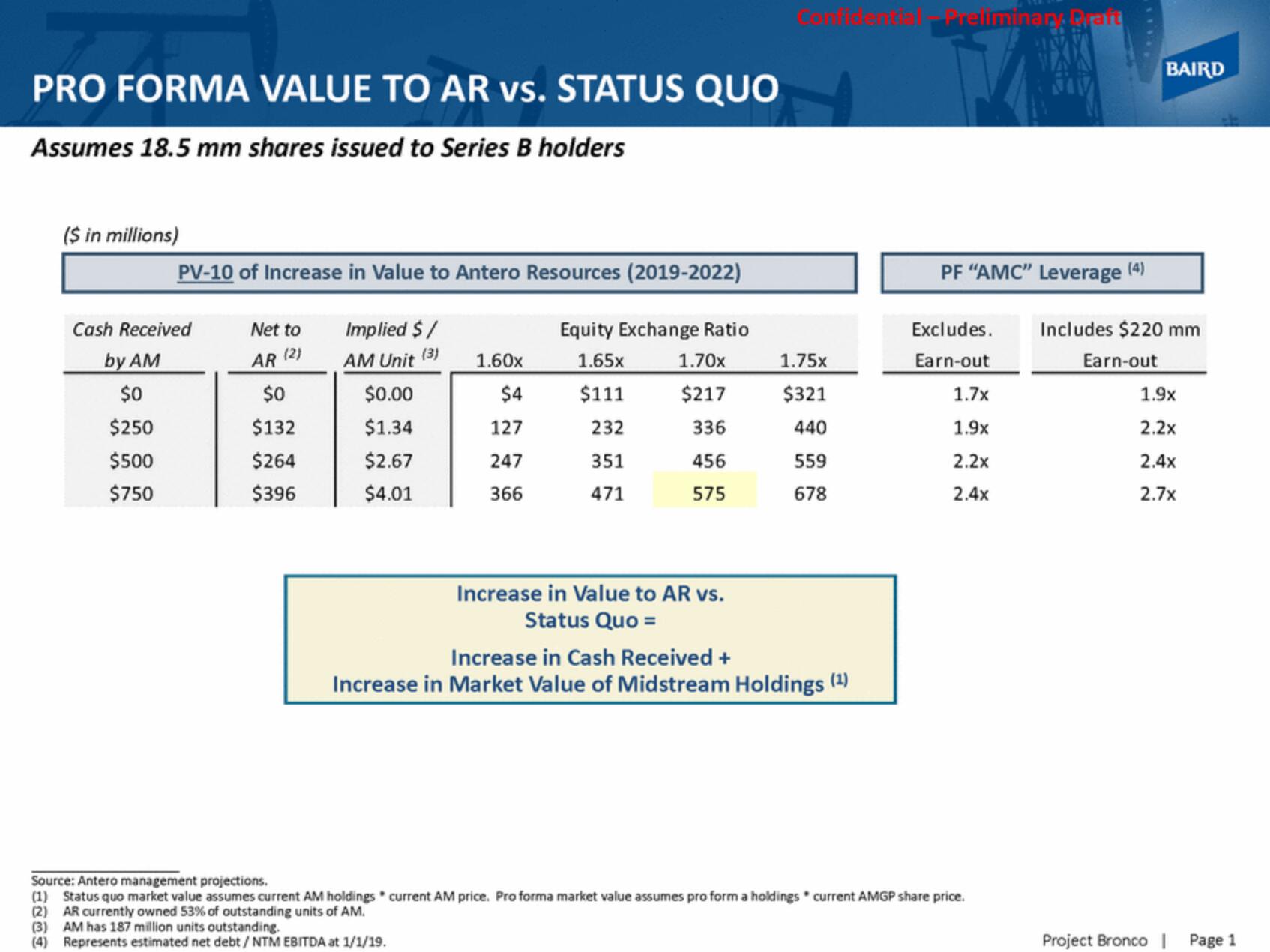

PRO FORMA VALUE TO AR vs. STATUS QUO

Assumes 18.5 mm shares issued to Series B holders

($ in millions)

PV-10 of Increase in Value to Antero Resources (2019-2022)

Implied $ /

(3)

AM Unit

$0.00

$1.34

$2.67

$4.01

Cash Received

by AM

$0

$250

$500

$750

Net to

AR

(2)

$0

$132

$264

$396

1.60x

$4

127

247

366

Equity Exchange Ratio

1.65x

$111

232

351

471

(3) AM has 187 million units outstanding.

(4) Represents estimated net debt / NTM EBITDA at 1/1/19.

1.70x

$217

336

456

575

Increase in Value to AR vs.

Status Quo =

1.75x

$321

440

559

678

Increase in Cash Received +

Increase in Market Value of Midstream Holdings (¹)

Treliminary Draft

PF "AMC" Leverage (4)

Excludes.

Earn-out

1.7x

1.9x

2.2x

2.4x

Source: Antero management projections.

(1) Status quo market value assumes current AM holdings current AM price. Pro forma market value assumes pro form a holdings current AMGP share price.

(2) AR currently owned 53% of outstanding units of AM.

BAIRD

Includes $220 mm

Earn-out

1.9x

2.2x

2.4x

2.7x

Project Bronco |

Page 1View entire presentation