Tudor, Pickering, Holt & Co Investment Banking

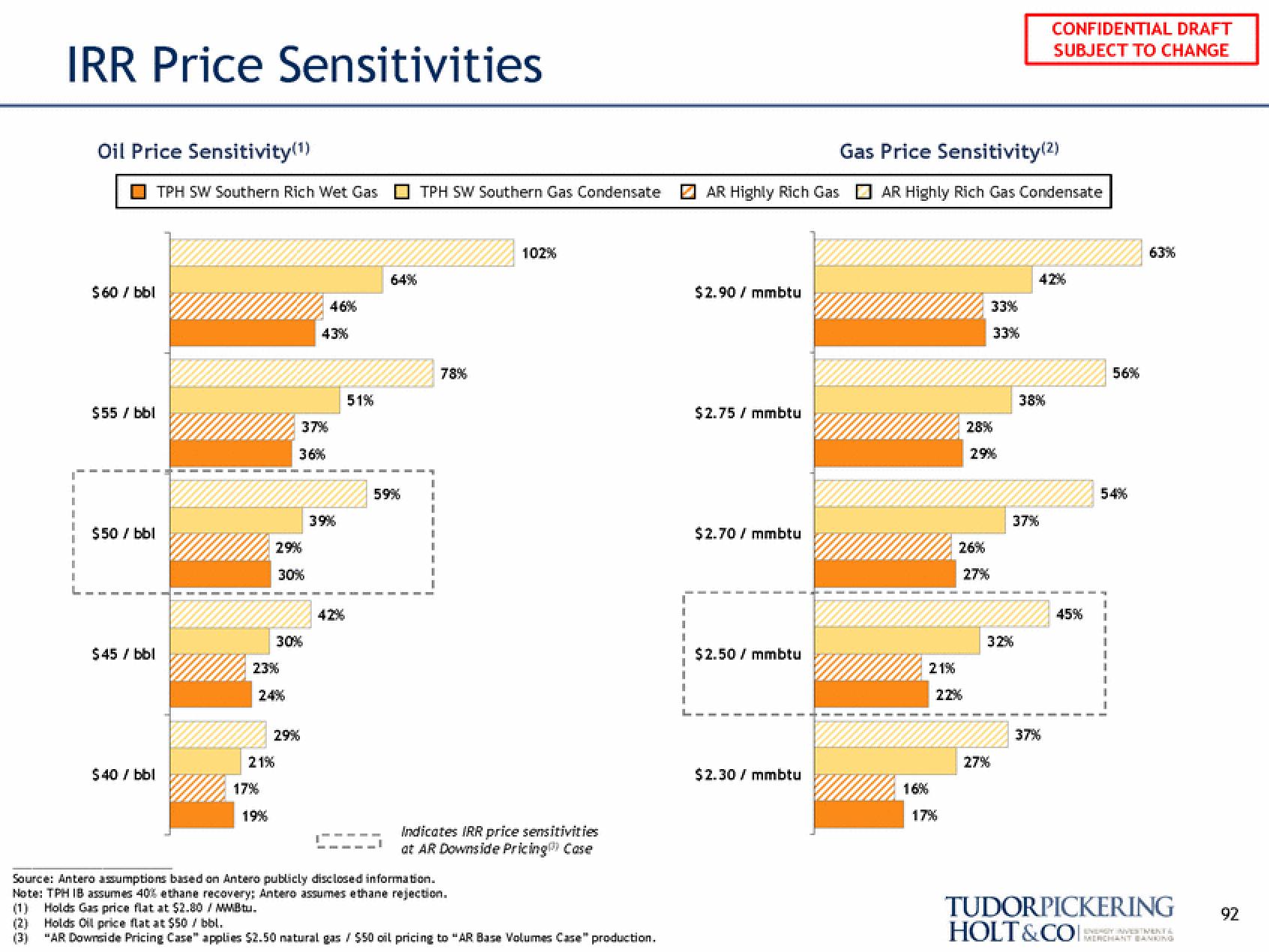

IRR Price Sensitivities

Oil Price Sensitivity (1)

$60 / bbl

$55 / bbl

$50 / bbl

$45 / bbl

$40 / bbl

TPH SW Southern Rich Wet Gas

23%

17%

21%

24%

19%

29%

30%

30%

37%

36%

29%

43%

46%

39%

42%

51%

59%

TPH SW Southern Gas Condensate

78%

102%

Indicates IRR price sensitivities

at AR Downside Pricing Case

Source: Antero assumptions based on Antero publicly disclosed information.

Note: TPH IB assumes 40% ethane recovery; Antero assumes ethane rejection.

Holds Gas price flat at $2.80 / MMBtu.

(2) Holds Oil price flat at $50 / bbl.

(3)

"AR Downside Pricing Case" applies $2.50 natural gas / $50 oil pricing to "AR Base Volumes Case" production.

Gas Price Sensitivity(2)

AR Highly Rich Gas AR Highly Rich Gas Condensate

$2.90 / mmbtu

$2.75 / mmbtu

$2.70 / mmbtu

$2.50 / mmbtu

$2.30 / mmbtu

16%

21%

22%

17%

26%

28%

29%

27%

33%

33%

27%

32%

38%

37%

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

37%

45%

56%

54%

63%

TUDORPICKERING

HOLT&COI:

ENERGY INVESTMENTS

MERCHANT BANKING

92View entire presentation