AMC Other Presentation Deck

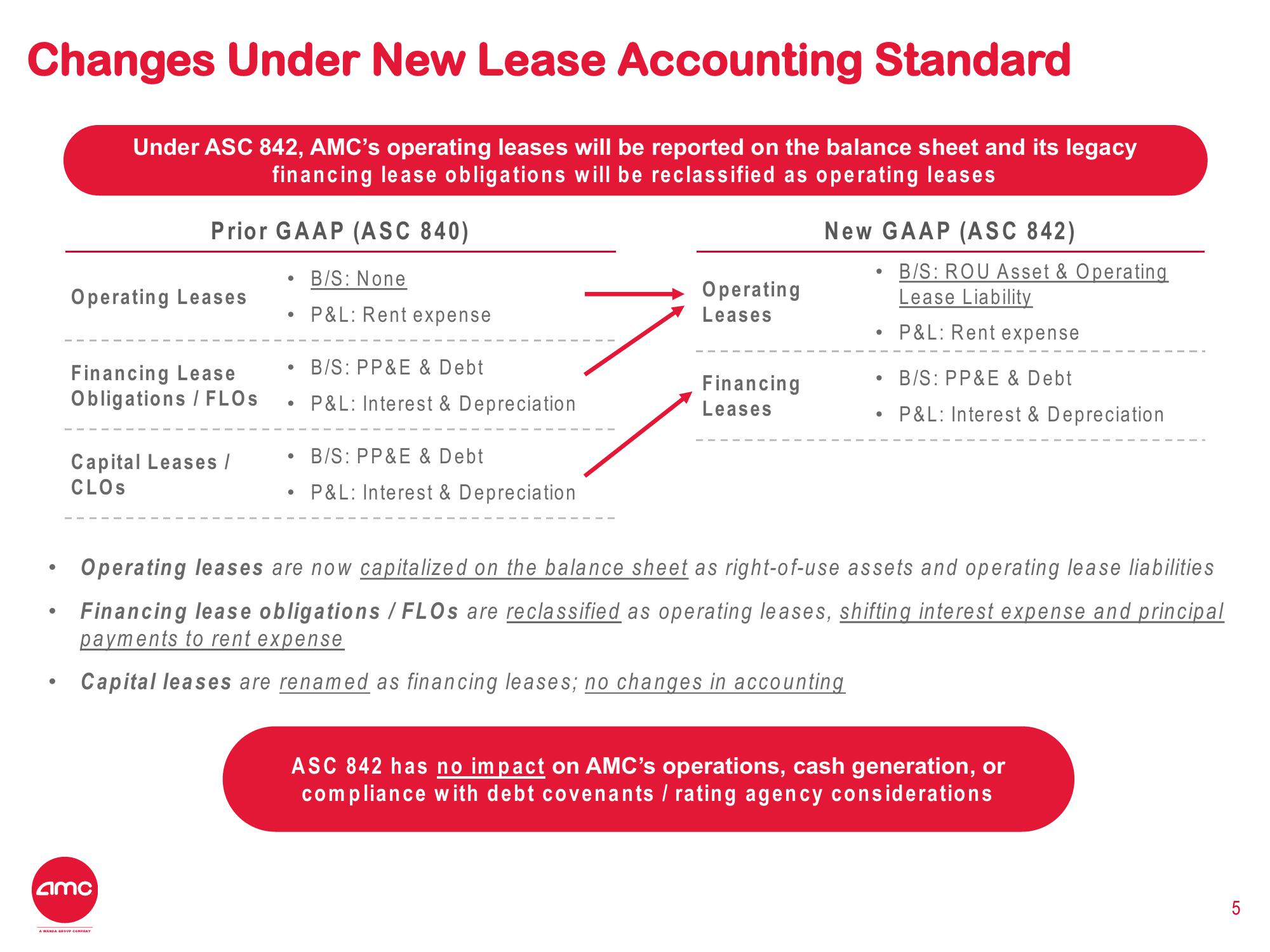

Changes Under New Lease Accounting Standard

Under ASC 842, AMC's operating leases will be reported on the balance sheet and its legacy

financing lease obligations will be reclassified as operating leases

●

●

Operating Leases

Prior GAAP (ASC 840)

B/S: None

P&L: Rent expense

Financing Lease

Obligations / FLOS

Capital Leases /

CLOS

amc

A WANDA GROUP COMPANY

●

●

●

●

●

B/S: PP&E & Debt

P&L: Interest & Depreciation

B/S: PP&E & Debt

P&L: Interest & Depreciation

Operating

Leases

Financing

Leases

New GAAP (ASC 842)

●

B/S: ROU Asset & Operating

Lease Liability

P&L: Rent expense

Operating leases are now capitalized on the balance sheet as right-of-use assets and operating lease liabilities

Financing lease obligations / FLOs are reclassified as operating leases, shifting interest expense and principal

payments to rent expense

Capital leases are renamed as financing leases; no changes in accounting

B/S: PP&E & Debt

P&L: Interest & Depreciation

ASC 842 has no impact on AMC's operations, cash generation, or

compliance with debt covenants / rating agency considerations

LO

5View entire presentation