Summit Hotel Properties Investor Presentation Deck

23

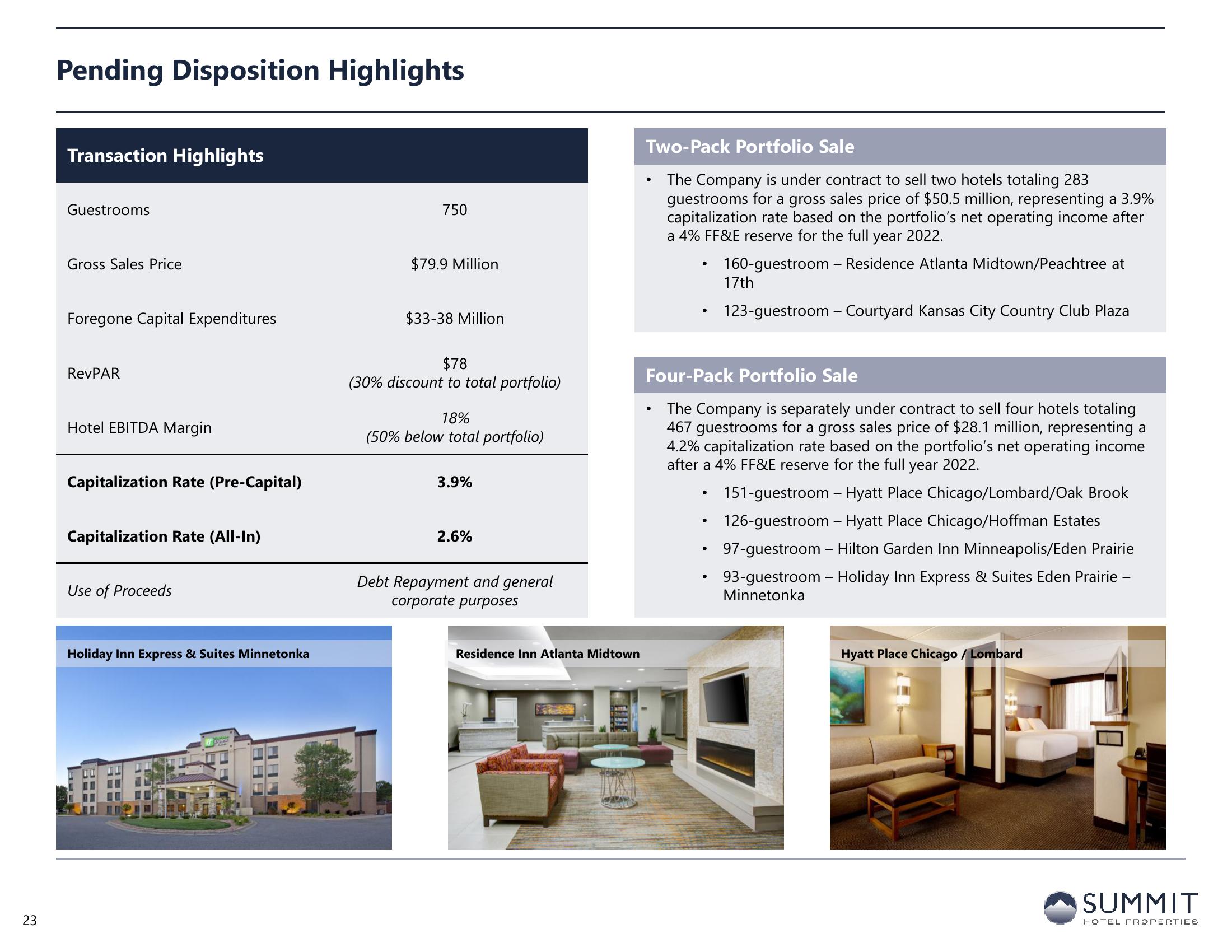

Pending Disposition Highlights

Transaction Highlights

Guestrooms

Gross Sales Price

Foregone Capital Expenditures

RevPAR

Hotel EBITDA Margin

Capitalization Rate (Pre-Capital)

Capitalization Rate (All-In)

Use of Proceeds

Holiday Inn Express & Suites Minnetonka

750

$79.9 Million

$33-38 Million

$78

(30% discount to total portfolio)

18%

(50% below total portfolio)

3.9%

2.6%

Debt Repayment and general

corporate purposes

Residence Inn Atlanta Midtown

Two-Pack Portfolio Sale

The Company is under contract to sell two hotels totaling 283

guestrooms for a gross sales price of $50.5 million, representing a 3.9%

capitalization rate based on the portfolio's net operating income after

a 4% FF&E reserve for the full year 2022.

160-guestroom - Residence Atlanta Midtown/Peachtree at

●

●

●

Four-Pack Portfolio Sale

The Company is separately under contract to sell four hotels totaling

467 guestrooms for a gross sales price of $28.1 million, representing a

4.2% capitalization rate based on the portfolio's net operating income

after a 4% FF&E reserve for the full year 2022.

151-guestroom - Hyatt Place Chicago/Lombard/Oak Brook

126-guestroom - Hyatt Place Chicago/Hoffman Estates

97-guestroom - Hilton Garden Inn Minneapolis/Eden Prairie

93-guestroom - Holiday Inn Express & Suites Eden Prairie -

Minnetonka

●

17th

●

123-guestroom - Courtyard Kansas City Country Club Plaza

Hyatt Place Chicago / Lombard

SUMMIT

HOTEL PROPERTIESView entire presentation