Evercore Investment Banking Pitch Book

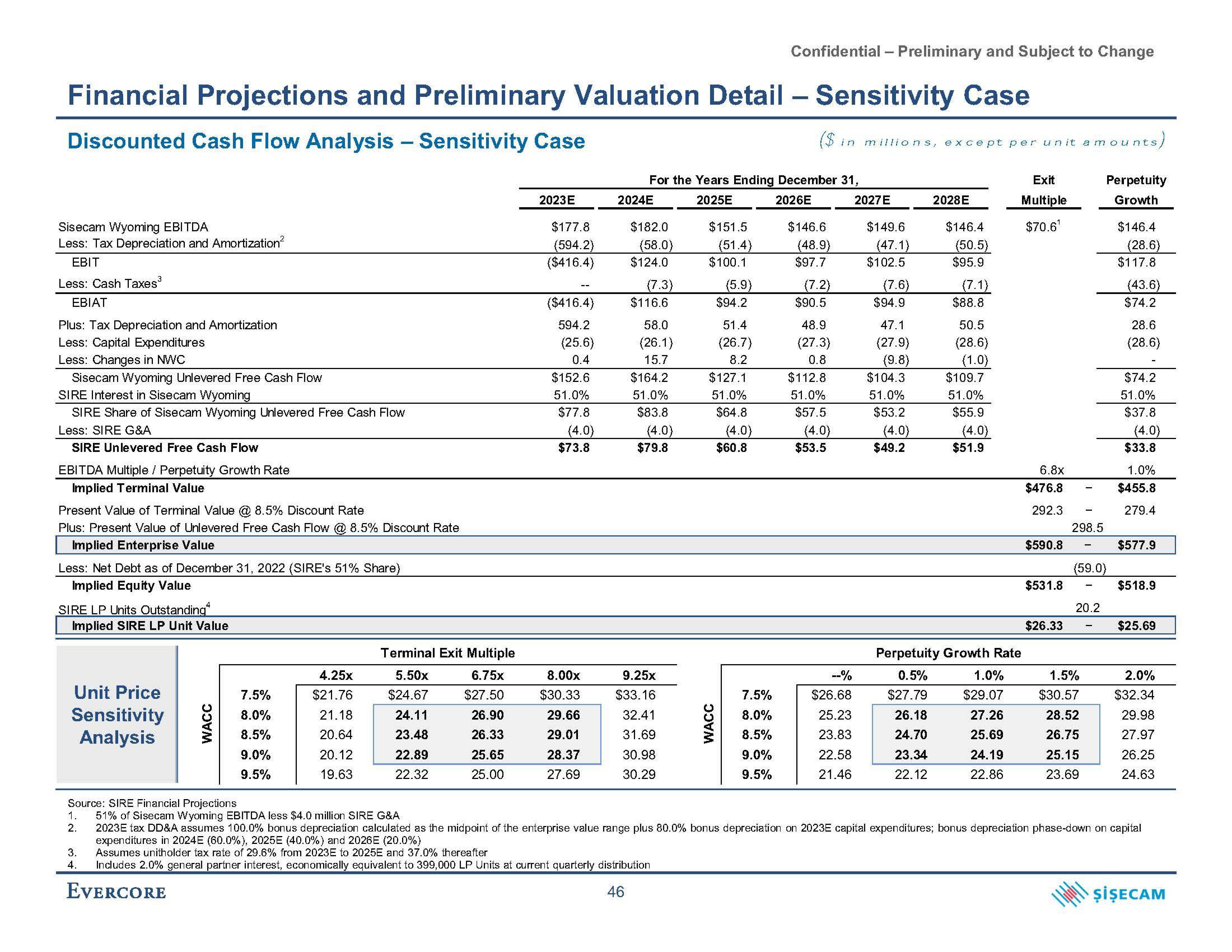

Financial Projections and Preliminary Valuation Detail - Sensitivity Case

Discounted Cash Flow Analysis - Sensitivity Case

Sisecam Wyoming EBITDA

Less: Tax Depreciation and Amortization²

EBIT

Less: Cash Taxes³

EBIAT

Plus: Tax Depreciation and Amortization

Less: Capital Expenditures

Less: Changes in NWC

Sisecam Wyoming Unlevered Free Cash Flow

SIRE Interest in Sisecam Wyoming

SIRE Share of Sisecam Wyoming Unlevered Free Cash Flow

Less: SIRE G&A

SIRE Unlevered Free Cash Flow

EBITDA Multiple / Perpetuity Growth Rate

Implied Terminal Value

Present Value of Terminal Value @ 8.5% Discount Rate

Plus: Present Value of Unlevered Free Cash Flow @ 8.5% Discount Rate

Implied Enterprise Value

Less: Net Debt as of December 31, 2022 (SIRE's 51% Share)

Implied Equity Value

SIRE LP Units Outstanding

Implied SIRE LP Unit Value

Unit Price

Sensitivity

Analysis

WACC

7.5%

8.0%

8.5%

9.0%

9.5%

4.25x

$21.76

21.18

20.64

20.12

19.63

Terminal Exit Multiple

5.50x

6.75x

$24.67

$27.50

24.11

23.48

22.89

22.32

26.90

26.33

25.65

25.00

2023 E

$177.8

(594.2)

($416.4)

($416.4)

594.2

(25.6)

0.4

$152.6

51.0%

$77.8

(4.0)

$73.8

8.00x

$30.33

29.66

29.01

28.37

27.69

2024E

For the Years Ending December 31,

2025E

2026E

$182.0

(58.0)

$124.0

(7.3)

$116.6

58.0

(26.1)

15.7

$164.2

51.0%

$83.8

(4.0)

$79.8

9.25x

$33.16

32.41

31.69

30.98

30.29

$151.5

(51.4)

$100.1

WACC

(5.9)

$94.2

51.4

(26.7)

8.2

$127.1

51.0%

$64.8

(4.0)

Confidential - Preliminary and Subject to Change

$60.8

7.5%

8.0%

8.5%

9.0%

9.5%

($ in millions, except per unit amounts

ts)

$146.6

(48.9)

$97.7

(7.2)

$90.5

48.9

(27.3)

0.8

$112.8

51.0%

$57.5

(4.0)

$53.5

--%

$26.68

25.23

23.83

22.58

21.46

2027 E

$149.6

(47.1)

$102.5

(7.6)

$94.9

47.1

(27.9)

(9.8)

$104.3

51.0%

$53.2

(4.0)

$49.2

2028E

26.18

24.70

23.34

22.12

$146.4

(50.5)

$95.9

(7.1)

$88.8

50.5

(28.6)

(1.0)

$109.7

51.0%

$55.9

(4.0)

$51.9

Perpetuity Growth Rate

0.5%

$27.79

1.0%

$29.07

27.26

25.69

24.19

22.86

Exit

Multiple

$70.6¹

6.8x

$476.8

292.3

$590.8

$531.8

$26.33

298.5

(59.0)

20.2

1.5%

$30.57

Perpetuity

Growth

28.52

26.75

25.15

23.69

$146.4

(28.6)

$117.8

(43.6)

$74.2

28.6

(28.6)

$74.2

51.0%

$37.8

(4.0)

$33.8

1.0%

$455.8

279.4

$577.9

$518.9

$25.69

2.0%

$32.34

29.98

27.97

26.25

24.63

Source: SIRE Financial Projections

1. 51% of Sisecam Wyoming EBITDA less $4.0 million SIRE G&A

2. 2023E tax DD&A assumes 100.0% bonus depreciation calculated as the midpoint of the enterprise value range plus 80.0% bonus depreciation on 2023E capital expenditures; bonus depreciation phase-down on capital

expenditures in 2024E (60.0%), 2025E (40.0%) and 2026E (20.0%)

3. Assumes unitholder tax rate of 29.6% from 2023E to 2025E and 37.0% thereafter

4.

Includes 2.0% general partner interest, economically equivalent to 399,000 LP Units at current quarterly distribution

EVERCORE

46

ŞİŞECAMView entire presentation