WeWork SPAC Presentation Deck

All Access

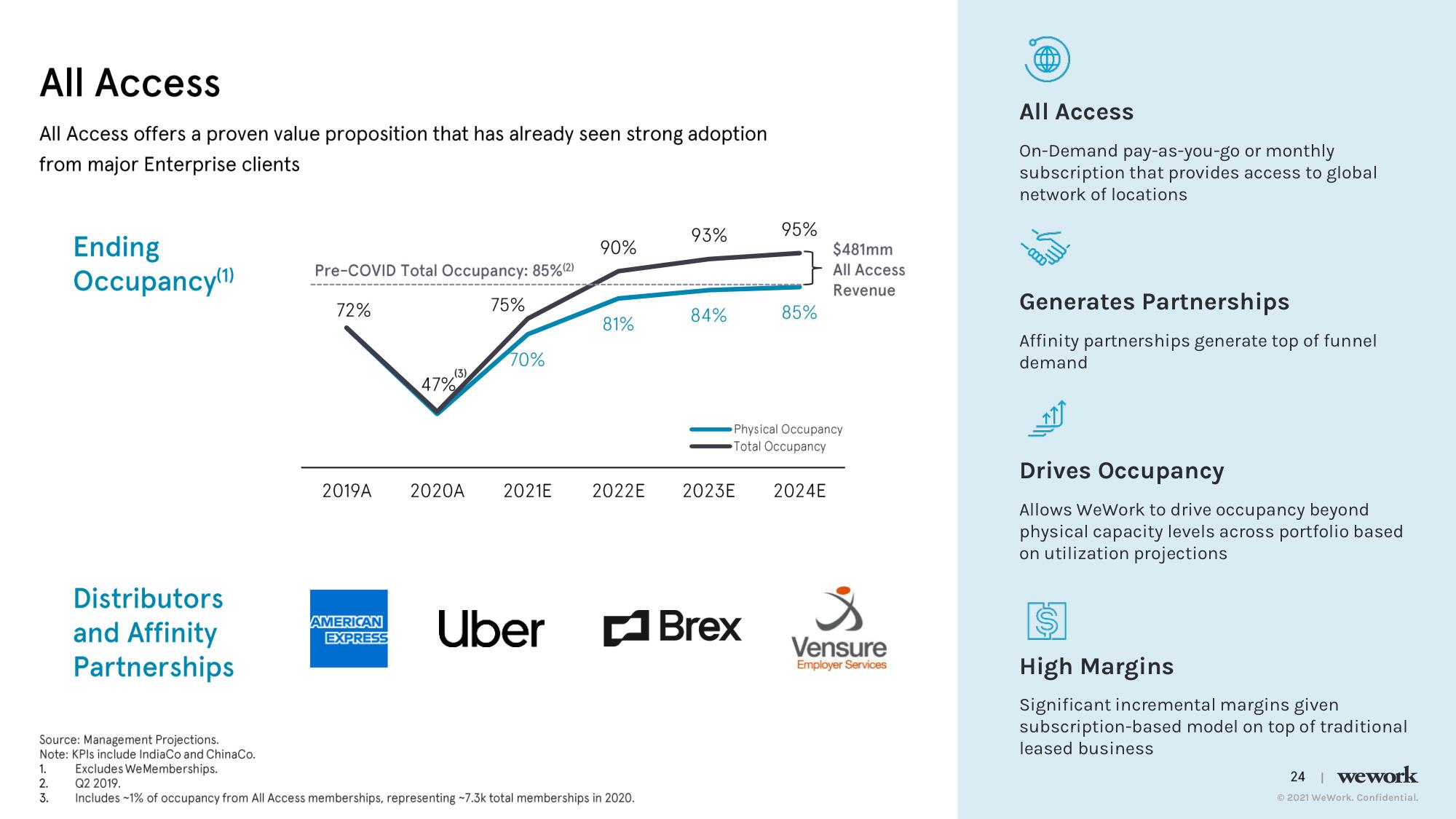

All Access offers a proven value proposition that has already seen strong adoption

from major Enterprise clients

Ending

Occupancy(1)

1.

2.

3.

Distributors

and Affinity

Partnerships

Source: Management Projections.

Note: KPIs include IndiaCo and ChinaCo.

Pre-COVID Total Occupancy: 85%(2)

72%

2019A

AMERICAN

EXPRESS

(3)

47%

75%

70%

90%

Uber

81%

93%

Excludes We Memberships.

Q2 2019.

Includes -1% of occupancy from All Access memberships, representing -7.3k total memberships in 2020.

84%

95%

2020A 2021E 2022E 2023E 2024E

85%

Brex

Physical Occupancy

Total Occupancy

$481mm

All Access

Revenue

Vensure

Employer Services

A

(

All Access

On-Demand pay-as-you-go or monthly

subscription that provides access to global

network of locations

Generates Partnerships

Affinity partnerships generate top of funnel

demand

Drives Occupancy

Allows WeWork to drive occupancy beyond

physical capacity levels across portfolio based

on utilization projections

High Margins

Significant incremental margins given

subscription-based model on top of traditional

leased business

24 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation