TPG Results Presentation Deck

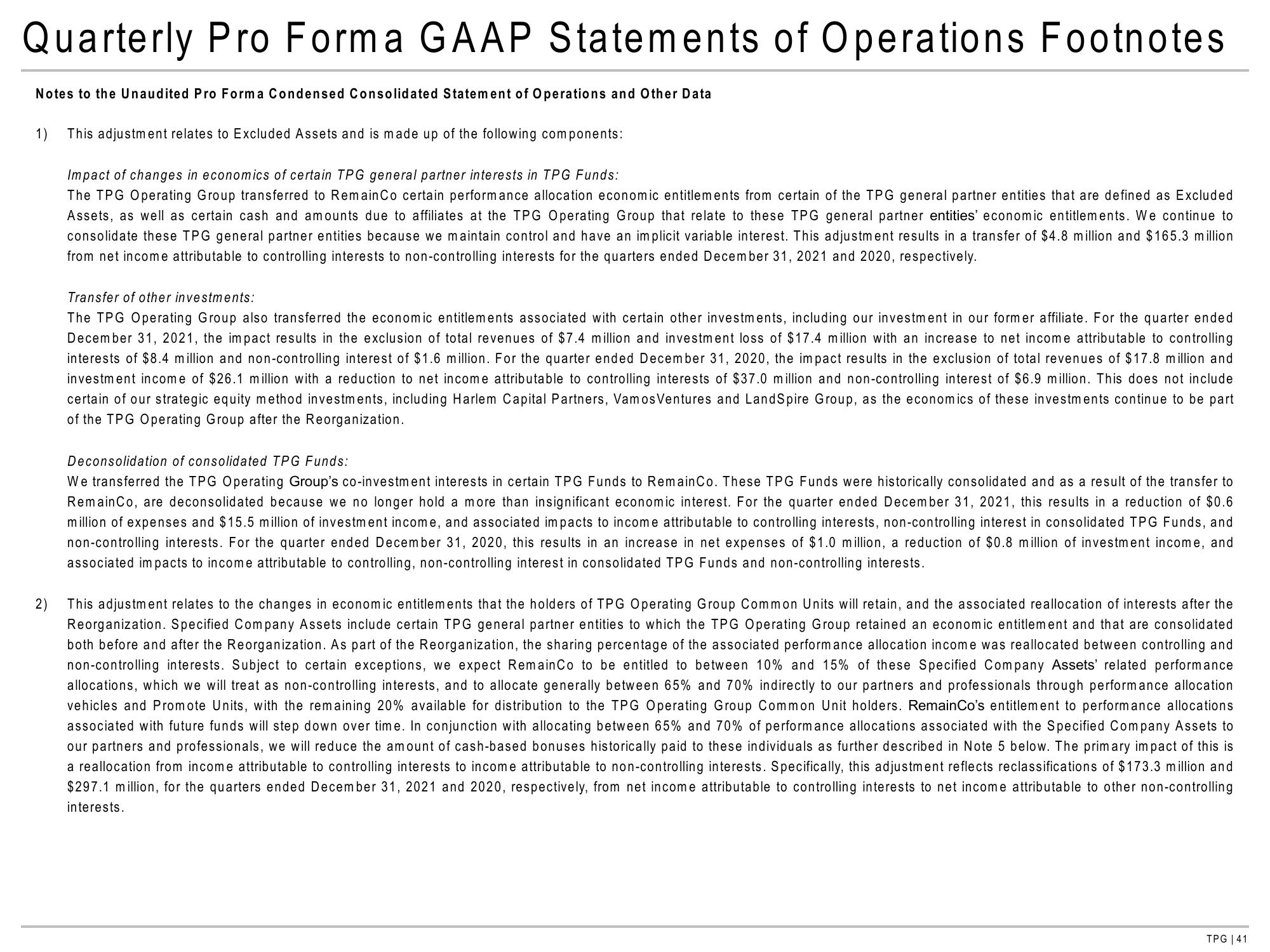

Quarterly Pro Forma GAAP Statements of Operations Footnotes

Notes to the Unaudited Pro Forma Condensed Consolidated Statement of Operations and Other Data

1) This adjustment relates to Excluded Assets and is made up of the following components:

Impact of changes in economics of certain TPG general partner interests in TPG Funds:

The TPG Operating Group transferred to Remain Co certain performance allocation economic entitlements from certain of the TPG general partner entities that are defined as Excluded

Assets, as well as certain cash and amounts due to affiliates at the TPG Operating Group that relate to these TPG general partner entities' economic entitlements. We continue to

consolidate these TPG general partner entities because we maintain control and have an implicit variable interest. This adjustment results in a transfer of $4.8 million and $165.3 million

from net income attributable to controlling interests to non-controlling interests for the quarters ended December 31, 2021 and 2020, respectively.

Transfer of other investments:

The TPG Operating Group also transferred the economic entitlements associated with certain other investments, including our investment in our former affiliate. For the quarter ended

December 31, 2021, the impact results in the exclusion of total revenues of $7.4 million and investment loss of $17.4 million with an increase to net income attributable to controlling

interests of $8.4 million and non-controlling interest of $1.6 million. For the quarter ended December 31, 2020, the impact results in the exclusion of total revenues of $17.8 million and

investment income of $26.1 million with a reduction to net income attributable to controlling interests of $37.0 million and non-controlling interest of $6.9 million. This does not include

certain of our strategic equity method investments, including Harlem Capital Partners, Vamos Ventures and LandSpire Group, as the economics of these investments continue to be part

of the TPG Operating Group after the Reorganization.

Deconsolidation of consolidated TPG Funds:

We transferred the TPG Operating Group's co-investment interests in certain TPG Funds to Remain Co. These TPG Funds were historically consolidated and as a result of the transfer to

Remain Co, are deconsolidated because we no longer hold a more than insignificant economic interest. For the quarter ended December 31, 2021, this results in a reduction of $0.6

million of expenses and $15.5 million of investment income, and associated impacts to income attributable to controlling interests, non-controlling interest in consolidated TPG Funds, and

non-controlling interests. For the quarter ended December 31, 2020, this results in an increase in net expenses of $1.0 million, a reduction of $0.8 million of investment income, and

associated impacts to income attributable to controlling, non-controlling interest in consolidated TPG Funds and non-controlling interests.

2)

This adjustment relates to the changes in economic entitlements that the holders of TPG Operating Group Common Units will retain, and the associated reallocation of interests after the

Reorganization. Specified Company Assets include certain TPG general partner entities to which the TPG Operating Group retained an economic entitlement and that are consolidated

both before and after the Reorganization. As part of the Reorganization, the sharing percentage of the associated performance allocation income was reallocated between controlling and

non-controlling interests. Subject to certain exceptions, we expect RemainCo to be entitled to between 10% and 15% of these Specified Company Assets' related performance

allocations, which we will treat as non-controlling interests, and to allocate generally between 65% and 70% indirectly to our partners and professionals through performance allocation

vehicles and Promote Units, with the remaining 20% available for distribution to the TPG Operating Group Common Unit holders. RemainCo's entitlement to performance allocations

associated with future funds will step down over time. In conjunction with allocating between 65% and 70% of performance allocations associated with the Specified Company Assets to

our partners and professionals, we will reduce the amount of cash-based bonuses historically paid to these individuals as further described in Note 5 below. The primary impact of this is

a reallocation from income attributable to controlling interests to income attributable to non-controlling interests. Specifically, this adjustment reflects reclassifications of $173.3 million and

$297.1 million, for the quarters ended December 31, 2021 and 2020, respectively, from net income attributable to controlling interests to net income attributable to other non-controlling

interests.

TPG | 41View entire presentation