Paycor Investor Presentation Deck

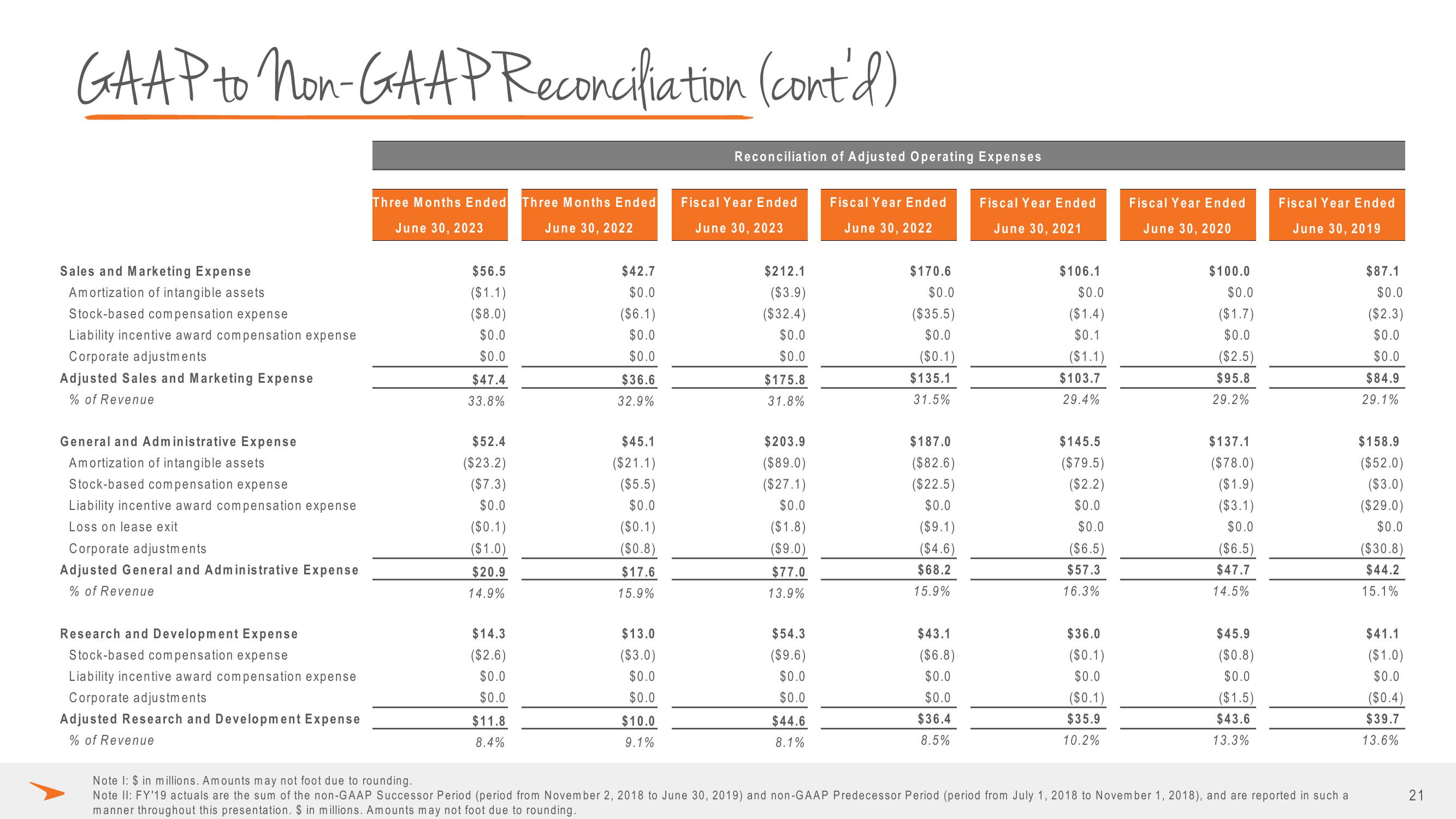

GAAP to Non-GAAP Reconciliation (cont'd)

Sales and Marketing Expense

Amortization of intangible assets

Stock-based compensation expense

Liability incentive award compensation expense

Corporate adjustments

Adjusted Sales and Marketing Expense

% of Revenue

General and Administrative Expense

Amortization of intangible assets

Stock-based compensation expense

Liability incentive award compensation expense

Loss on lease exit

Corporate adjustments

Adjusted General and Administrative Expense

% of Revenue

Research and Development Expense

Stock-based compensation expense

Liability incentive award compensation expense

Corporate adjustments

Adjusted Research and Development Expense

% of Revenue

Three Months Ended Three Months Ended

June 30, 2023

June 30, 2022

$56.5

($1.1)

($8.0)

$0.0

$0.0

$47.4

33.8%

$52.4

($23.2)

($7.3)

$0.0

($0.1)

($1.0)

$20.9

14.9%

$14.3

($2.6)

$0.0

$0.0

$11.8

8.4%

$42.7

$0.0

($6.1)

$0.0

$0.0

$36.6

32.9%

$45.1

($21.1)

($5.5)

$0.0

($0.1)

($0.8)

$17.6

15.9%

$13.0

($3.0)

$0.0

$0.0

$10.0

9.1%

Reconciliation of Adjusted Operating Expenses

Fiscal Year Ended

June 30, 2023

$212.1

($3.9)

($32.4)

$0.0

$0.0

$175.8

31.8%

$203.9

($89.0)

($27.1)

$0.0

($1.8)

($9.0)

$77.0

13.9%

$54.3

($9.6)

$0.0

$0.0

$44.6

8.1%

Fiscal Year Ended

June 30, 2022

$170.6

$0.0

($35.5)

$0.0

($0.1)

$135.1

31.5%

$187.0

($82.6)

($22.5)

$0.0

($9.1)

($4.6)

$68.2

15.9%

$43.1

($6.8)

$0.0

$0.0

$36.4

8.5%

Fiscal Year Ended

June 30, 2021

$106.1

$0.0

($1.4)

$0.1

($1.1)

$103.7

29.4%

$145.5

($79.5)

($2.2)

$0.0

$0.0

($6.5)

$57.3

16.3%

$36.0

($0.1)

$0.0

($0.1)

$35.9

10.2%

Fiscal Year Ended

June 30, 2020

$100.0

$0.0

($1.7)

$0.0

($2.5)

$95.8

29.2%

$137.1

($78.0)

($1.9)

($3.1)

$0.0

($6.5)

$47.7

14.5%

$45.9

($0.8)

$0.0

($1.5)

$43.6

13.3%

Fiscal Year Ended

June 30, 2019

Note 1: $ in millions. Amounts may not foot due to rounding.

Note II: FY'19 actuals are the sum of the non-GAAP Successor Period (period from November 2, 2018 to June 30, 2019) and non-GAAP Predecessor Period (period from July 1, 2018 to November 1, 2018), and are reported in such a

manner throughout this presentation. $ in millions. Amounts may not foot due to rounding.

$87.1

$0.0

($2.3)

$0.0

$0.0

$84.9

29.1%

$158.9

($52.0)

($3.0)

($29.0)

$0.0

($30.8)

$44.2

15.1%

$41.1

($1.0)

$0.0

($0.4)

$39.7

13.6%

21View entire presentation