WeWork Investor Presentation Deck

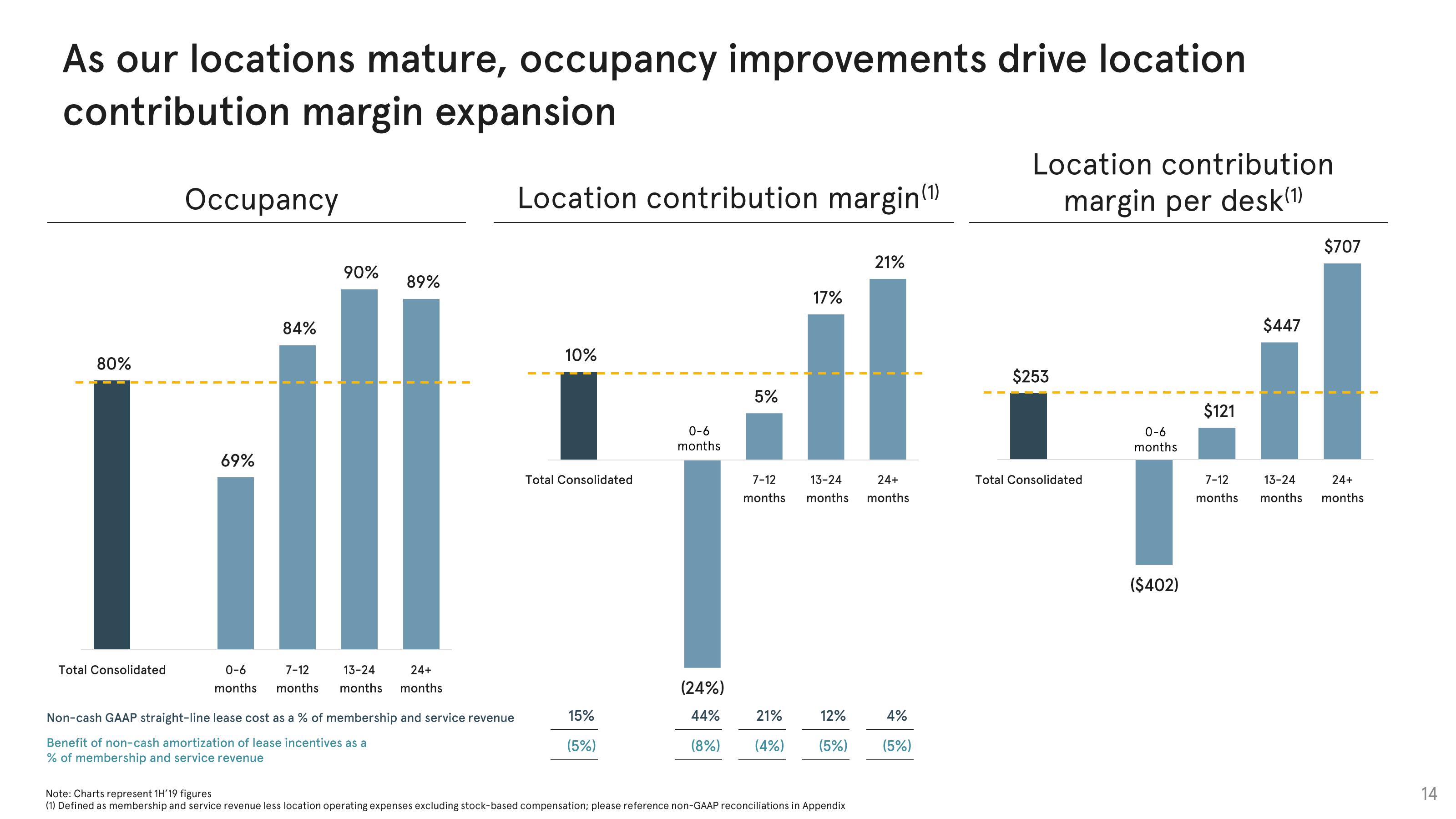

As our locations mature, occupancy improvements drive location

contribution margin expansion

80%

Total Consolidated

Occupancy

69%

84%

90%

89%

0-6

7-12 13-24

24+

months months months months

Non-cash GAAP straight-line lease cost as a % of membership and service revenue

Benefit of non-cash amortization of lease incentives as a

% of membership and service revenue

Location contribution margin(1)

10%

Total Consolidated

15%

(5%)

0-6

months

5%

17%

7-12 13-24

24+

months months months

(24%)

12%

44% 21%

(8%) (4%) (5%)

21%

Note: Charts represent 1H'19 figures

(1) Defined as membership and service revenue less location operating expenses excluding stock-based compensation; please reference non-GAAP reconciliations in Appendix

4%

(5%)

Location contribution

margin per desk(1)

$253

Total Consolidated

0-6

months

($402)

$121

$447

7-12

13-24

months months

$707

24+

months

14View entire presentation