AT&T Results Presentation Deck

Notes

1. The company expects adjustments to 2021 reported diluted EPS to include merger-related amortization in the range of $4.3 billion and other adjustments, a non-cash mark-to-market benefit plan

gain/loss, and other items. The company expects the mark-to-market adjustment, which is driven by interest rates and investment returns that are not reasonably estimable at this time, to be a significant

item. AT&T's 2021 EPS depends on future levels of revenues and expenses which are not reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between these projected non-

GAAP metrics and the reported GAAP metrics without unreasonable effort.

2. Gross capital investment includes capital expenditures and cash payments for vendor financing and excludes FirstNet reimbursements. In 1Q21, gross capital investment included $1.7 billion in vendor

financing payments. In 2021, vendor financing payments are expected to be in the $4 billion range and FirstNet reimbursements are expected to be about $1 billion.

3. Free cash flow is a non-GAAP financial measure that is frequently used by investors and credit rating agencies to provide relevant and useful information. Free cash flow is cash from operating activities

minus capital expenditures. Free cash flow total dividend payout ratio is total dividends paid divided by free cash flow. In 1Q21, dividends paid totaled $3.741 billion. Due to high variability and difficulty in

predicting items that impact cash from operating activities and capital expenditures, the company is not able to provide a reconciliation between projected free cash flow and the most comparable GAAP

metric without unreasonable effort.

4. Domestic HBO Max and HBO subscribers consist of accounts with access to HBO Max (including wholesale subscribers that may not have signed in) and HBO accounts, and exclude free trials and Cinemax

subscribers. Domestic ARPU is defined as domestic HBO Max and HBO subscriber revenues during the period divided by domestic HBO Max and HBO subscribers during the period, excluding HBO

commercial revenues and subscribers. Global HBO Max and HBO subscribers consist of domestic HBO Max subscribers and domestic and international HBO subscribers and exclude free trials, and basic and

Cinemax subscribers.

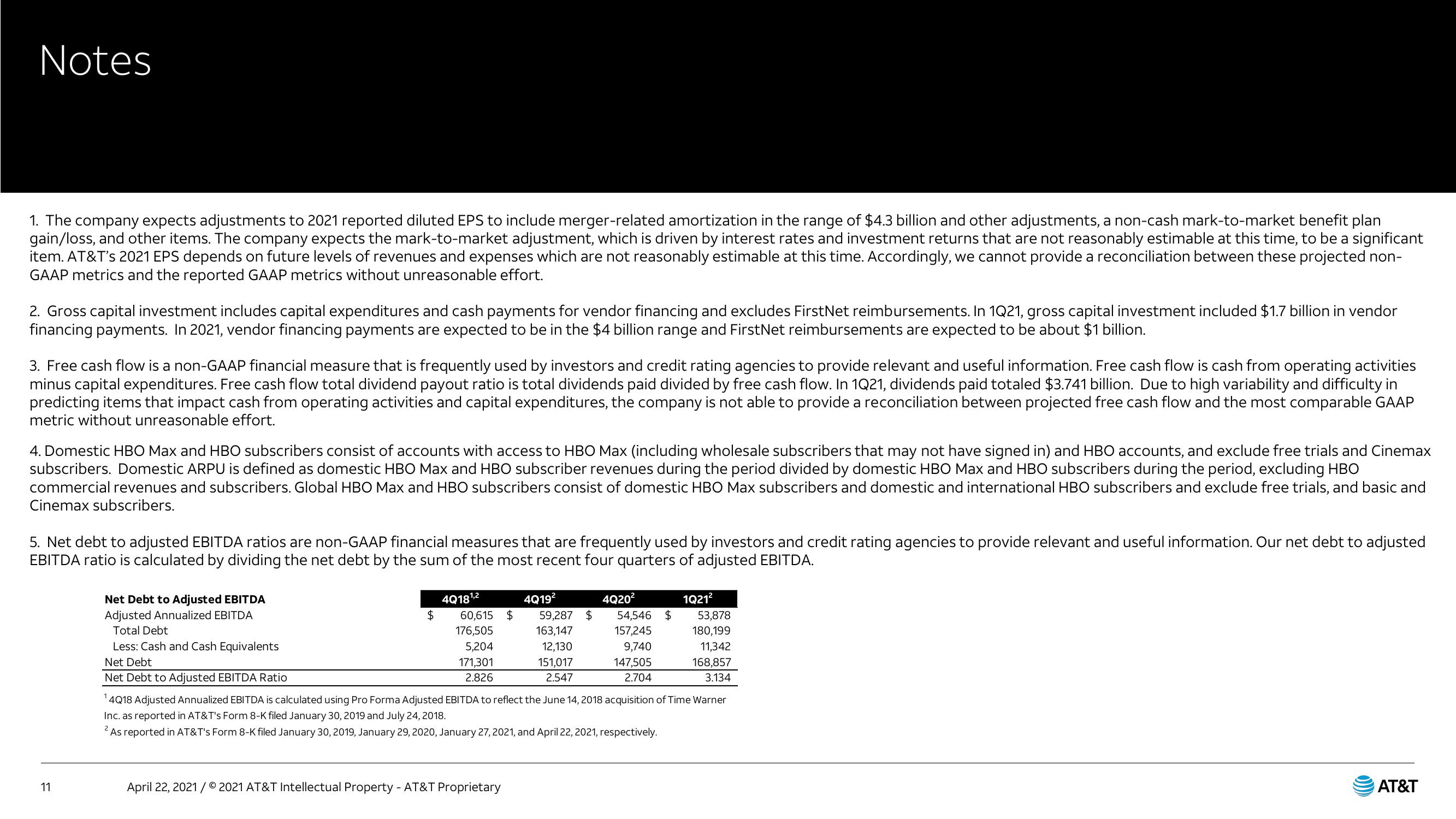

5. Net debt to adjusted EBITDA ratios are non-GAAP financial measures that are frequently used by investors and credit rating agencies to provide relevant and useful information. Our net debt to adjusted

EBITDA ratio is calculated by dividing the net debt by the sum of the most recent four quarters of adjusted EBITDA.

11

Net Debt to Adjusted EBITDA

Adjusted Annualized EBITDA

Total Debt

Less: Cash and Cash Equivalents

Net Debt

Net Debt to Adjusted EBITDA Ratio

$

4018¹

81,2

60,615 $

176,505

5,204

171,301

2.826

4Q19²

April 22, 2021/ © 2021 AT&T Intellectual Property - AT&T Proprietary

59,287 $

163,147

12,130

151,017

2.547

4Q20²

54,546 $

157,245

9,740

147,505

2.704

1Q21²

53,878

180,199

11,342

168,857

3.134

¹4Q18 Adjusted Annualized EBITDA is calculated using Pro Forma Adjusted EBITDA to reflect the June 14, 2018 acquisition of Time Warner

Inc. as reported in AT&T's Form 8-K filed January 30, 2019 and July 24, 2018.

2As reported in AT&T's Form 8-K filed January 30, 2019, January 29, 2020, January 27, 2021, and April 22, 2021, respectively.

AT&TView entire presentation