Vivid Seats SPAC Presentation Deck

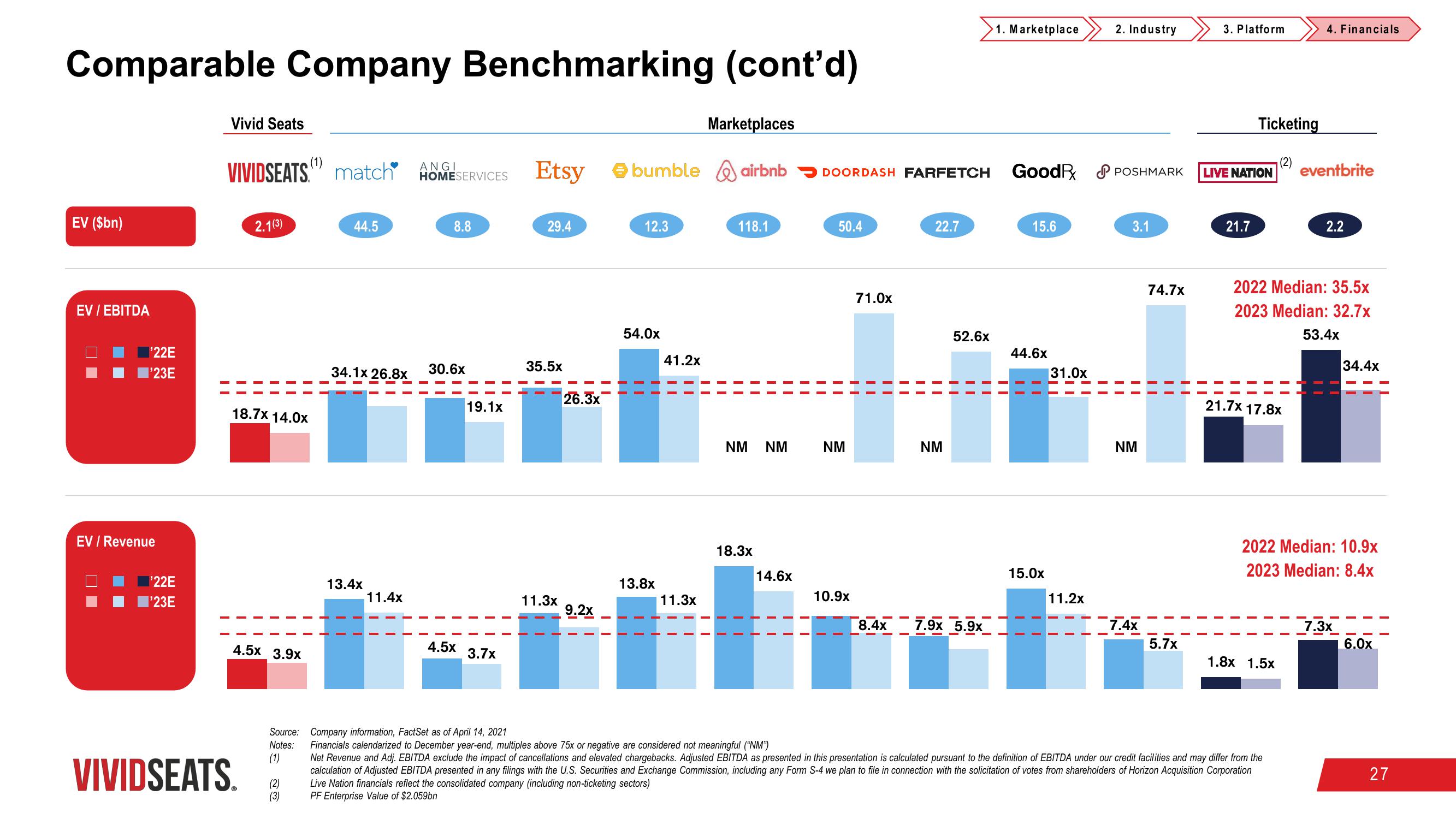

Comparable Company Benchmarking (cont'd)

EV ($bn)

EV / EBITDA

¹22E

I'23E

EV / Revenue

'22E

l'23E

Vivid Seats

VIVIDSEATS match

2.1(3)

18.7x 14.0x

4.5x 3.9x

VIVIDSEATS.

(1)

(2)

(3)

44.5

34.1x 26.8x

13.4x

11.4x

ANGI

HOMESERVICES

8.8

30.6x

4.5x

19.1x

3.7x

Etsy

29.4

35.5x

11.3x

26.3x

9.2x

-

bumble airbnb

12.3

54.0x

13.8x

41.2x

Marketplaces

11.3x

118.1

NM NM

18.3x

14.6x

50.4

NM

10.9x

DOORDASH FARFETCH Good POSHMARK LIVE NATION

71.0x

8.4x

-

-

22.7

NM

52.6x

1. Marketplace

7.9x 5.9x

15.6

44.6x

15.0x

31.0x

2. Industry

11.2x

3.1

NM

7.4x

74.7x

3. Platform

5.7x

Ticketing

21.7

21.7x 17.8x

4. Financials

2022 Median: 35.5x

2023 Median: 32.7x

53.4x

1.8x 1.5x

Source: Company information, FactSet as of April 14, 2021

Notes:

Financials calendarized to December year-end, multiples above 75x or negative are considered not meaningful ("NM")

(1)

Net Revenue and Adj. EBITDA exclude the impact of cancellations and elevated chargebacks. Adjusted EBITDA as presented in this presentation is calculated pursuant to the definition of EBITDA under our credit facilities and may differ from the

calculation of Adjusted EBITDA presented in any filings with the U.S. Securities and Exchange Commission, including any Form S-4 we plan to file in connection with the solicitation of votes from shareholders of Horizon Acquisition Corporation

Live Nation financials reflect the consolidated company (including non-ticketing sectors)

PF Enterprise Value of $2.059bn

eventbrite

2.2

2022 Median: 10.9x

2023 Median: 8.4x

34.4x

7.3x

6.0x

27View entire presentation