Tudor, Pickering, Holt & Co Investment Banking

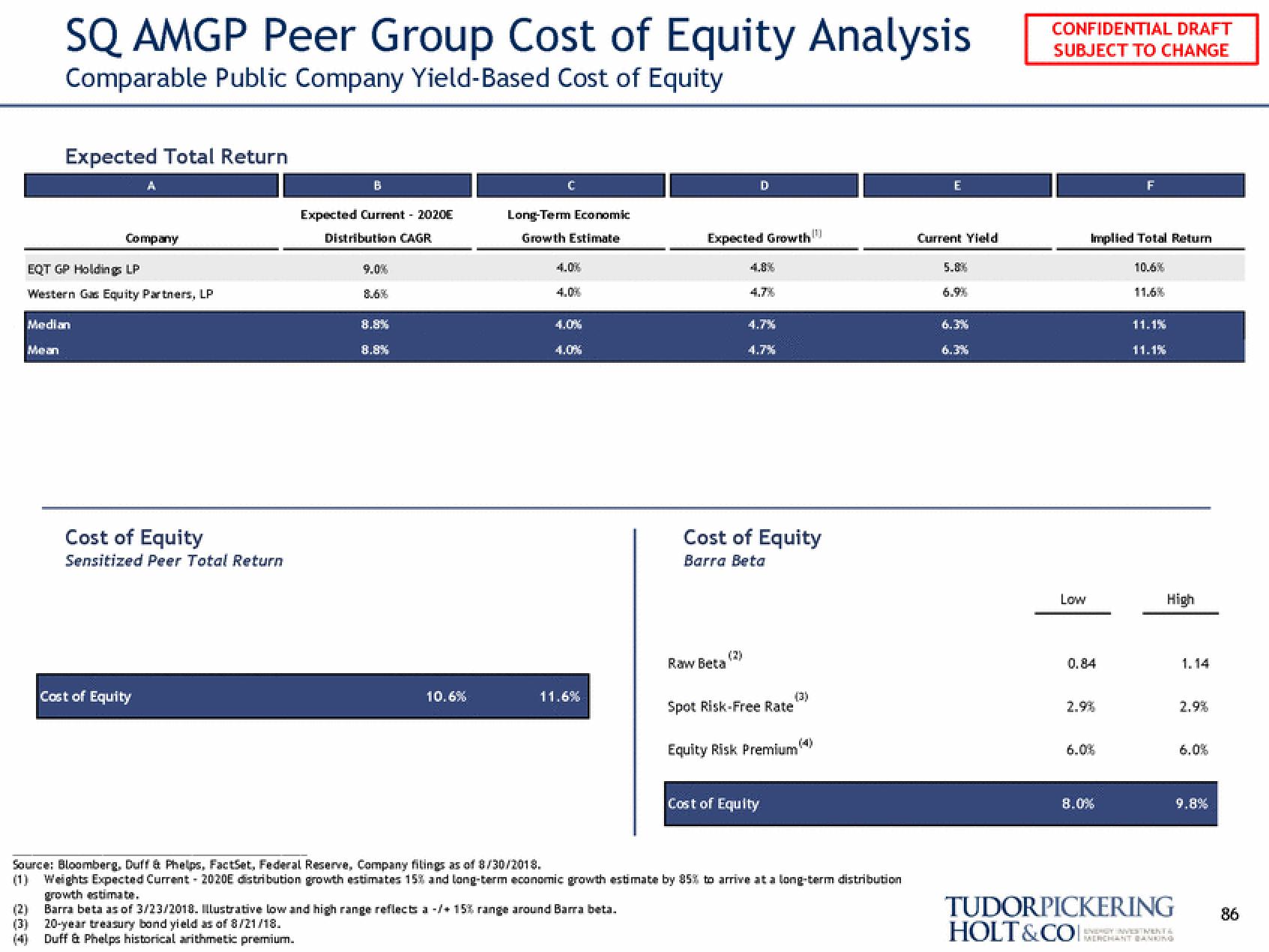

SQ AMGP Peer Group Cost of Equity Analysis

Comparable Public Company Yield-Based Cost of Equity

Expected Total Return

Mean

Median

EQT GP Holdings LP

Western Gas Equity Partners, LP

A

Company

Cost of Equity

Sensitized Peer Total Return

Cost of Equity

B

Expected Current - 2020E

Distribution CAGR

8.6%

8.8%

8.8%

10.6%

Long-Term Economic

Growth Estimate

4.00

4.0%

4.0%

11.6%

D

Expected Growth

Raw Beta

4.7%

4.7%

4.7%

Cost of Equity

Barra Beta

(3)

Spot Risk-Free Rate

Equity Risk Premium

Cost of Equity

Source: Bloomberg, Duff & Phelps, FactSet, Federal Reserve, Company filings as of 8/30/2018.

(1) Weights Expected Current - 2020E distribution growth estimates 15% and long-term economic growth estimate by 85% to arrive at a long-term distribution

growth estimate.

Barra beta as of 3/23/2018. Illustrative low and high range reflects a -/+ 15% range around Barra beta.

(3) 20-year treasury bond yield as of 8/21/18.

Duff & Phelps historical arithmetic premium.

E

Current Yield

5.8%

6.3%

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

Low

Implied Total Return

0.84

2.9%

6.0%

F

8.0%

10.6%

11.1%

11.1%

High

1.14

2.9%

6.0%

9.8%

TUDORPICKERING 86

HOLT&COCHANT BANKINGView entire presentation