Ocado Investor Day Presentation Deck

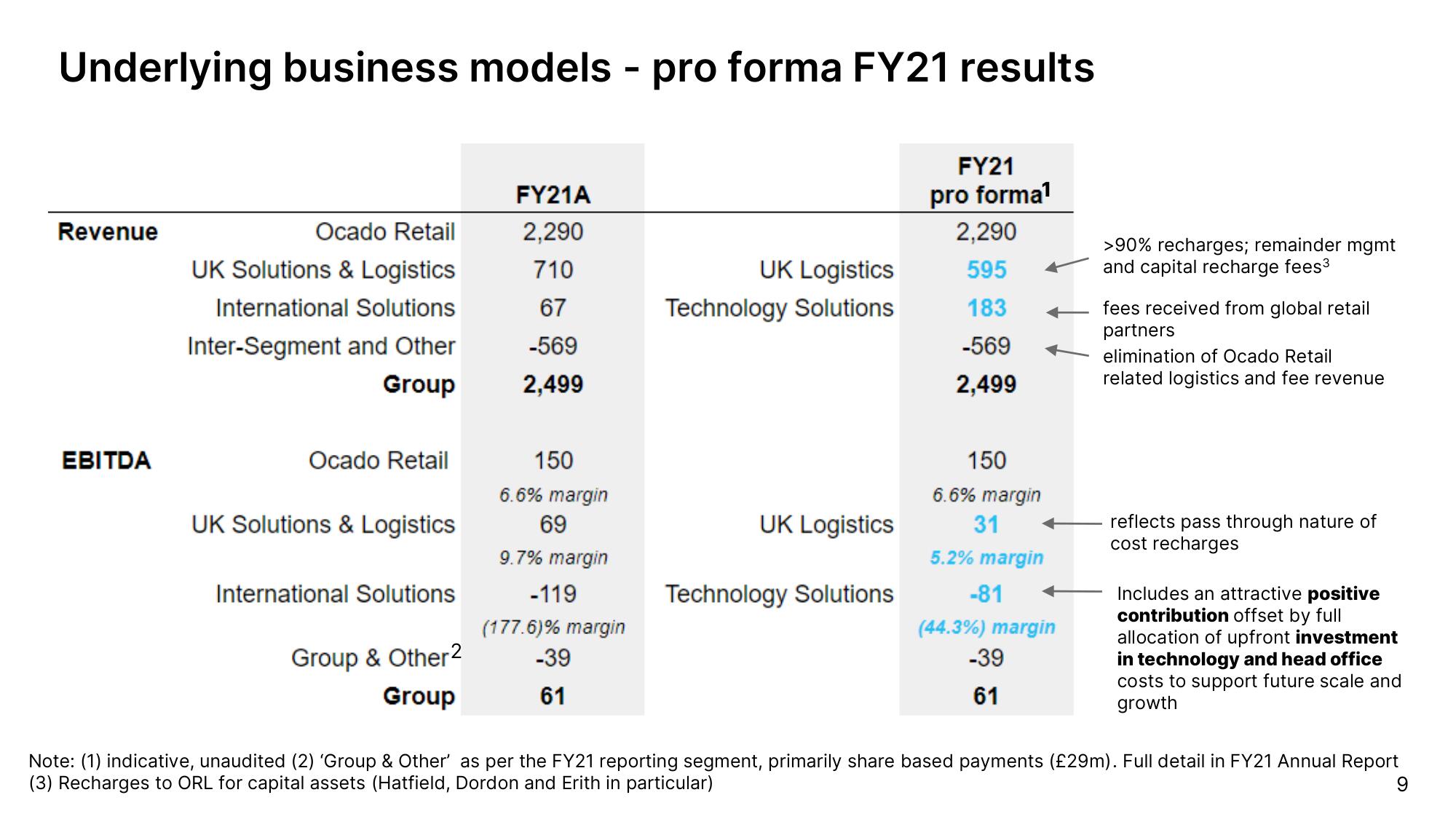

Underlying business models - pro forma FY21 results

Revenue

EBITDA

Ocado Retail

UK Solutions & Logistics

International Solutions

Inter-Segment and Other

Group

Ocado Retail

UK Solutions & Logistics

International Solutions

Group & Other²

Group

FY21A

2,290

710

67

-569

2,499

150

6.6% margin

69

9.7% margin

-119

(177.6)% margin

-39

61

UK Logistics

Technology Solutions

UK Logistics

Technology Solutions

FY21

pro forma¹

2,290

595

183

-569

2,499

150

6.6% margin

31

5.2% margin

-81

(44.3%) margin

-39

61

>90% recharges; remainder mgmt

and capital recharge fees³

fees received from global retail

partners

elimination of Ocado Retail

related logistics and fee revenue

reflects pass through nature of

cost recharges

Includes an attractive positive

contribution offset by full

allocation of upfront in

ment

in technology and head office

costs to support future scale and

growth

Note: (1) indicative, unaudited (2) 'Group & Other' as per the FY21 reporting segment, primarily share based payments (£29m). Full detail in FY21 Annual Report

(3) Recharges to ORL for capital assets (Hatfield, Dordon and Erith in particular)

9View entire presentation