Experienced Senior Team Overview

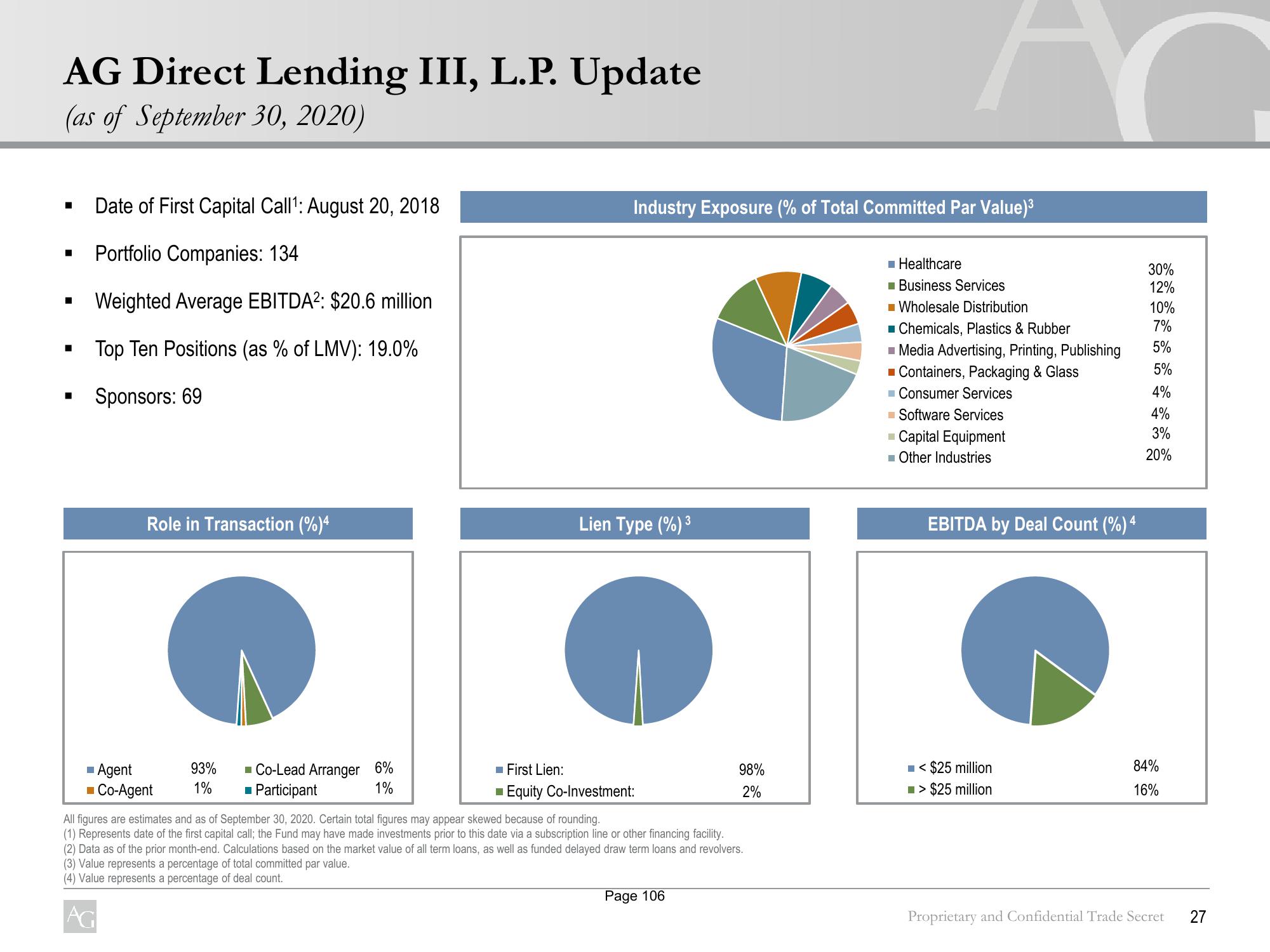

AG Direct Lending III, L.P. Update

(as of September 30, 2020)

■

■

■

■

■

Date of First Capital Call¹: August 20, 2018

Portfolio Companies: 134

Weighted Average EBITDA²: $20.6 million

Top Ten Positions (as % of LMV): 19.0%

Sponsors: 69

Role in Transaction (%)4

■ Agent

■Co-Agent

93%

1%

Co-Lead Arranger 6%

■ Participant

1%

Industry Exposure (% of Total Committed Par Value)³

Lien Type (%) ³

■ First Lien:

■ Equity Co-Investment:

98%

2%

All figures are estimates and as of September 30, 2020. Certain total figures may appear skewed because of rounding.

(1) Represents date of the first capital call; the Fund may have made investments prior to this date via a subscription line or other financing facility.

(2) Data as of the prior month-end. Calculations based on the market value of all term loans, as well as funded delayed draw term loans and revolvers.

(3) Value represents a percentage of total committed par value.

(4) Value represents a percentage of deal count.

AG

Page 106

■Healthcare

■ Business Services

■ Wholesale Distribution

Chemicals, Plastics & Rubber

■ Media Advertising, Printing, Publishing

■ Containers, Packaging & Glass

Consumer Services

■ Software Services

Capital Equipment

■ Other Industries

EBITDA by Deal Count (%) 4

■< $25 million

■>$25 million

30%

12%

10%

7%

5%

5%

4%

4%

3%

20%

84%

16%

Proprietary and Confidential Trade Secret

27View entire presentation