Apollo Global Management Investor Presentation Deck

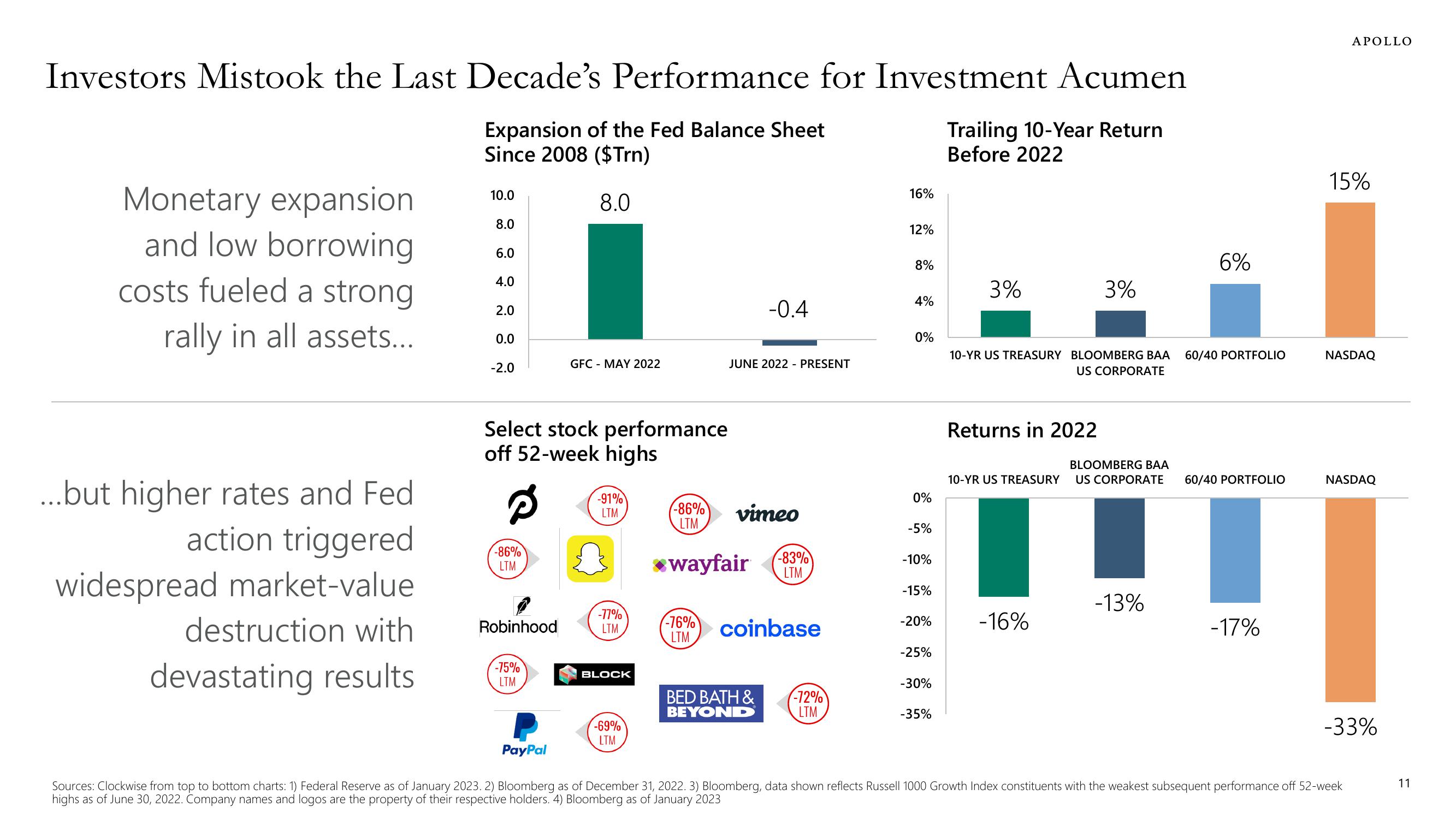

Investors Mistook the Last Decade's Performance for Investment Acumen

Expansion of the Fed Balance Sheet

Since 2008 ($Trn)

Trailing 10-Year Return

Before 2022

8.0

Monetary expansion

and low borrowing

costs fueled a strong

rally in all assets...

...but higher rates and Fed

action triggered

widespread market-value

destruction with

devastating results

10.0

8.0

6.0

4.0

2.0

0.0

-2.0

Select stock performance

off 52-week highs

8

-86%

LTM

Robinhood

-75%

LTM

GFC - MAY 2022

PayPal

-91%

LTM

-77%

LTM

BLOCK

-69%

LTM

-86%

LTM

*wayfair

-76%

LTM

JUNE 2022 - PRESENT

-0.4

vimeo

BED BATH &

BEYOND

-83%

LTM

coinbase

-72%

LTM

16%

12%

8%

4%

0%

0%

-5%

-10%

-15%

-20%

-25%

-30%

-35%

3%

10-YR US TREASURY BLOOMBERG BAA

US CORPORATE

Returns in 2022

3%

BLOOMBERG BAA

10-YR US TREASURY US CORPORATE

-16%

-13%

6%

60/40 PORTFOLIO

60/40 PORTFOLIO

-17%

APOLLO

15%

NASDAQ

NASDAQ

-33%

Sources: Clockwise from top to bottom charts: 1) Federal Reserve as of January 2023. 2) Bloomberg as of December 31, 2022. 3) Bloomberg, data shown reflects Russell 1000 Growth Index constituents with the weakest subsequent performance off 52-week

highs as of June 30, 2022. Company names and logos are the property of their respective holders. 4) Bloomberg as of January 2023

11View entire presentation