Axalta Coating Systems (axta) First Quarter 2021 Financial Results

Q1 Consolidated Results

($ in millions, except

per share data)

Performance Coatings

Mobility Coatings

Net Sales

Income from ops

Adjusted EBIT

% margin

Diluted EPS

Adjusted EPS

$984

Financial Performance

Q1 2020

4.6%

2021

707

356

1,064

Volume

Sensitivity: Business Internal

Q1

53

183

17.2%

0.06

0.50

0.22

0.31

Net Sales Variance

2020

0.3%

648

336

984

65

133

13.5%

Price/Mix

Incl. F/X

3.2%

% Change

FX

9.2 %

6.1 %

8.1 %

(19.2)%

37.8%

(72.7)%

61.3%

Excl. F/X

8.1%

5.0 %

4.6%

4.9%

$1,064

|·

Slide 4: Q1 Consolidated Results

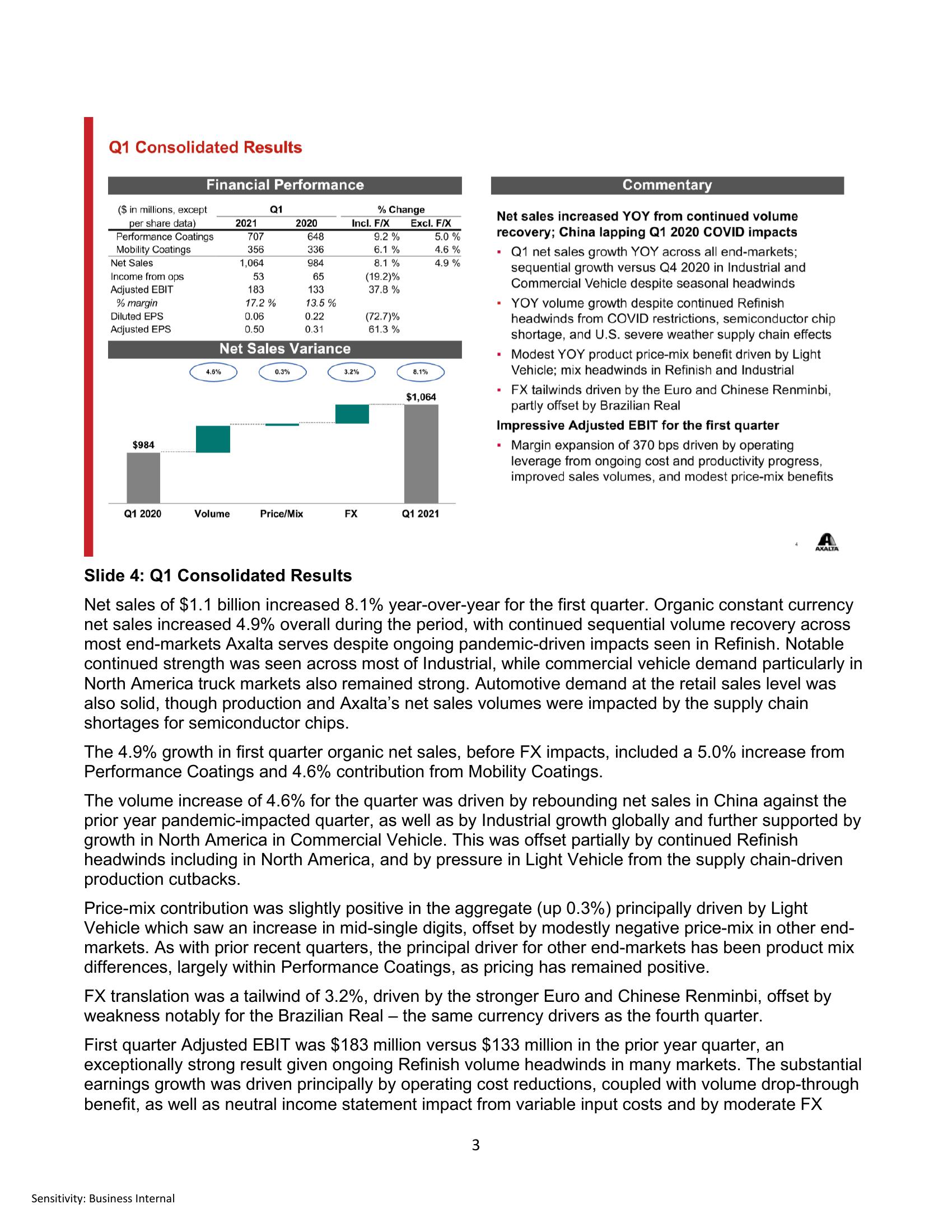

Net sales of $1.1 billion increased 8.1% year-over-year for the first quarter. Organic constant currency

net sales increased 4.9% overall during the period, with continued sequential volume recovery across

most end-markets Axalta serves despite ongoing pandemic-driven impacts seen in Refinish. Notable

continued strength was seen across most of Industrial, while commercial vehicle demand particularly in

North America truck markets also remained strong. Automotive demand at the retail sales level was

also solid, though production and Axalta's net sales volumes were impacted by the supply chain

shortages for semiconductor chips.

Q1 2021

Commentary

Net sales increased YOY from continued volume

recovery; China lapping Q1 2020 COVID impacts

• Q1 net sales growth YOY across all end-markets;

sequential growth versus Q4 2020 in Industrial and

Commercial Vehicle despite seasonal headwinds

YOY volume growth despite continued Refinish

headwinds from COVID restrictions, semiconductor chip

shortage, and U.S. severe weather supply chain effects

.

.

FX tailwinds driven by the Euro and Chinese Renminbi,

partly offset by Brazilian Real

Impressive Adjusted EBIT for the first quarter

Margin expansion of 370 bps driven by operating

leverage from ongoing cost and productivity progress,

improved sales volumes, and modest price-mix benefits

Modest YOY product price-mix benefit driven by Light

Vehicle; mix headwinds in Refinish and Industrial

.

3

The 4.9% growth in first quarter organic net sales, before FX impacts, included a 5.0% increase from

Performance Coatings and 4.6% contribution from Mobility Coatings.

AXALTA

The volume increase of 4.6% for the quarter was driven by rebounding net sales in China against the

prior year pandemic-impacted quarter, as well as by Industrial growth globally and further supported by

growth in North America in Commercial Vehicle. This was offset partially by continued Refinish

headwinds including in North America, and by pressure in Light Vehicle from the supply chain-driven

production cutbacks.

Price-mix contribution was slightly positive in the aggregate (up 0.3%) principally driven by Light

Vehicle which saw an increase in mid-single digits, offset by modestly negative price-mix in other end-

markets. As with prior recent quarters, the principal driver for other end-markets has been product mix

differences, largely within Performance Coatings, as pricing has remained positive.

FX translation was a tailwind of 3.2%, driven by the stronger Euro and Chinese Renminbi, offset by

weakness notably for the Brazilian Real - the same currency drivers as the fourth quarter.

First quarter Adjusted EBIT was $183 million versus $133 million in the prior year quarter, an

exceptionally strong result given ongoing Refinish volume headwinds in many markets. The substantial

earnings growth was driven principally by operating cost reductions, coupled with volume drop-through

benefit, as well as neutral income statement impact from variable input costs and by moderate FXView entire presentation