Q2 2018 Fixed Income Investor Conference Call

External funding profile

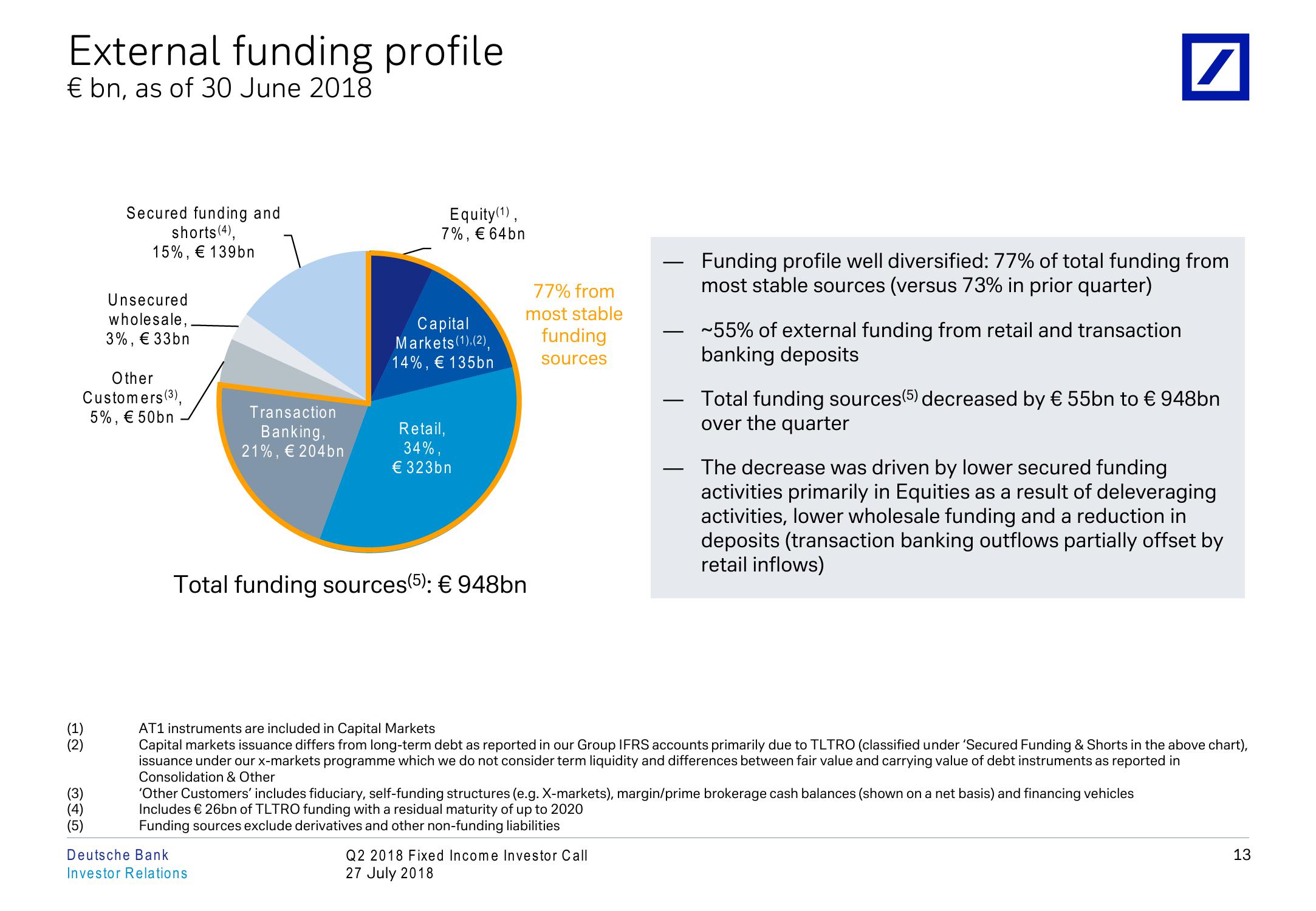

€ bn, as of 30 June 2018

Secured funding and

shorts(4),

15%, € 139bn

Unsecured

wholesale,.

3%, € 33bn

Other

Customers (3),

5%, € 50bn

Equity (1),

7%, € 64bn

Capital

Markets (1),(2),

14%, € 135bn

Transaction

Banking,

21%, € 204bn

Retail,

34%,

€ 323bn

Total funding sources (5): € 948bn

77% from

most stable

funding

sources

-

―

Funding profile well diversified: 77% of total funding from

most stable sources (versus 73% in prior quarter)

~55% of external funding from retail and transaction

banking deposits

Total funding sources (5) decreased by € 55bn to € 948bn

over the quarter

The decrease was driven by lower secured funding

activities primarily in Equities as a result of deleveraging

activities, lower wholesale funding and a reduction in

deposits (transaction banking outflows partially offset by

retail inflows)

(3) (4) (5)

AT1 instruments are included in Capital Markets

Capital markets issuance differs from long-term debt as reported in our Group IFRS accounts primarily due to TLTRO (classified under 'Secured Funding & Shorts in the above chart),

issuance under our x-markets programme which we do not consider term liquidity and differences between fair value and carrying value of debt instruments as reported in

Consolidation & Other

'Other Customers' includes fiduciary, self-funding structures (e.g. X-markets), margin/prime brokerage cash balances (shown on a net basis) and financing vehicles

Includes € 26bn of TLTRO funding with a residual maturity of up to 2020

Funding sources exclude derivatives and other non-funding liabilities

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

13View entire presentation