Goldman Sachs Results Presentation Deck

Asset & Wealth Management

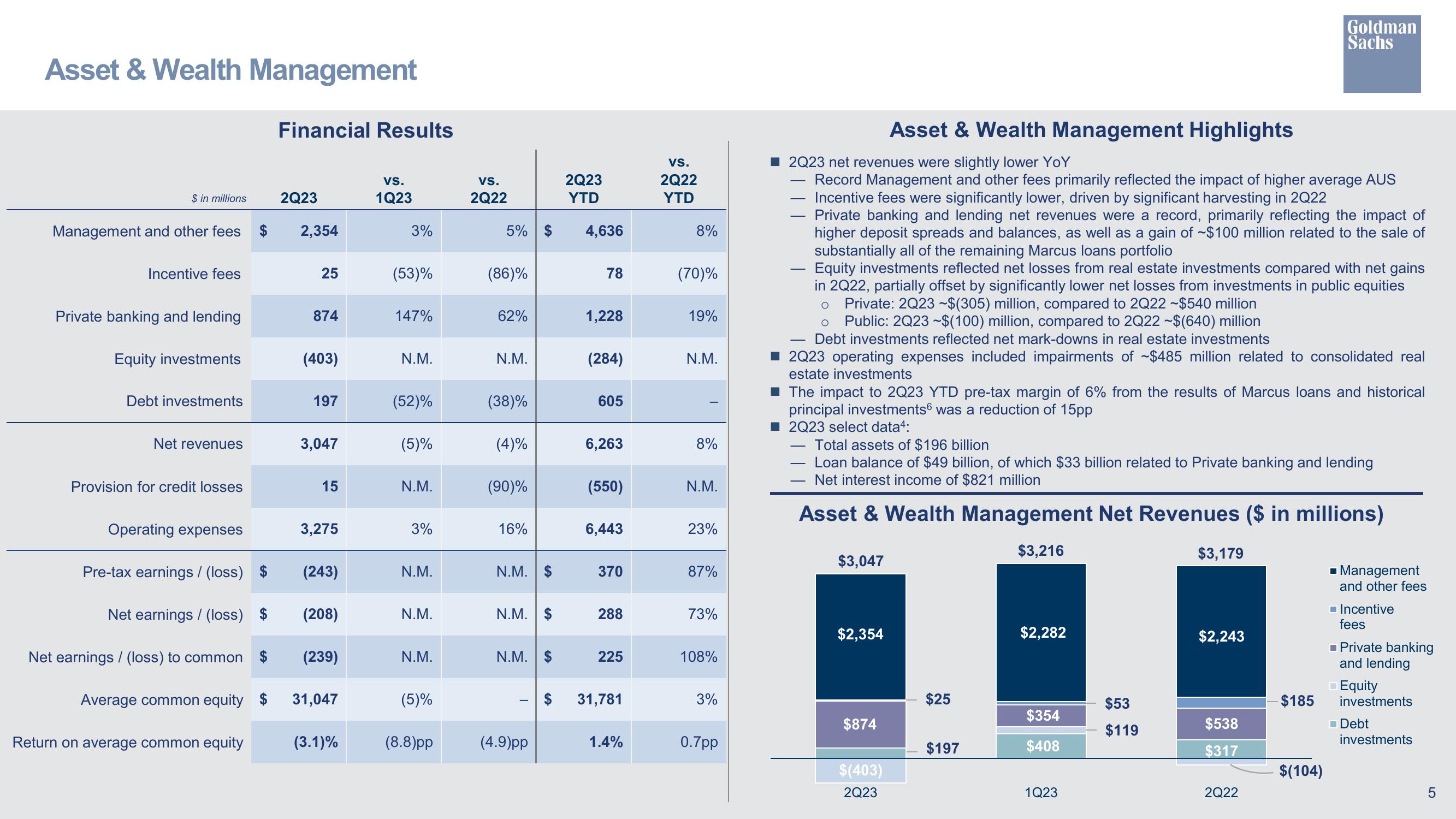

$ in millions

Management and other fees

Incentive fees

Private banking and lending

Equity investments

Debt investments

Net revenues

Provision for credit losses

Operating expenses

Pre-tax earnings / (loss)

Net earnings / (loss)

Net earnings / (loss) to common

Financial Results

Return on average common equity

2Q23

2,354

25

874

(403)

197

3,047

15

3,275

(243)

(208)

(239)

Average common equity $ 31,047

(3.1)%

VS.

1Q23

3%

(53)%

147%

N.M.

(52)%

(5)%

N.M.

3%

N.M.

N.M.

N.M.

(5)%

(8.8)pp

VS.

2Q22

5% $

(86)%

62%

N.M.

(38)%

(4)%

(90)%

16%

N.M. $

N.M. $

N.M. $

(4.9)pp

2Q23

YTD

4,636

78

1,228

(284)

605

6,263

(550)

6,443

370

288

225

31,781

1.4%

VS.

2Q22

YTD

8%

(70)%

19%

N.M.

8%

N.M.

23%

87%

73%

108%

3%

0.7pp

-

■2Q23 net revenues were slightly lower YoY

Record Management and other fees primarily reflected the impact of higher average AUS

Incentive fees were significantly lower, driven by significant harvesting in 2Q22

Private banking and lending net revenues were a record, primarily reflecting the impact of

higher deposit spreads and balances, as well as a gain of ~$100 million related to the sale of

substantially all of the remaining Marcus loans portfolio

Equity investments reflected net losses from real estate investments compared with net gains

in 2Q22, partially offset by significantly lower net losses from investments in public equities

O Private: 2Q23 ~$(305) million, compared to 2Q22 ~$540 million

O Public: 2Q23 -$(100) million, compared to 2Q22 ~$(640) million

Debt investments reflected net mark-downs in real estate investments

2Q23 operating expenses included impairments of ~$485 million related to consolidated real

estate investments

Asset & Wealth Management Highlights

■ The impact to 2Q23 YTD pre-tax margin of 6% from the results of Marcus loans and historical

principal investments was a reduction of 15pp

■2Q23 select data4:

$3,047

Total assets of $196 billion

Loan balance of $49 billion, of which $33 billion related to Private banking and lending

Net interest income of $821 million

Asset & Wealth Management Net Revenues ($ in millions)

$3,216

$2,354

$874

$(403)

2Q23

$25

$197

$2,282

$354

$408

1Q23

$53

$119

$3,179

$2,243

Goldman

Sachs

$538

$317

2Q22

$185

$(104)

■Management

and other fees

Incentive

fees

■ Private banking

and lending

Equity

investments

Debt

investments

5View entire presentation