First Citizens BancShares Results Presentation Deck

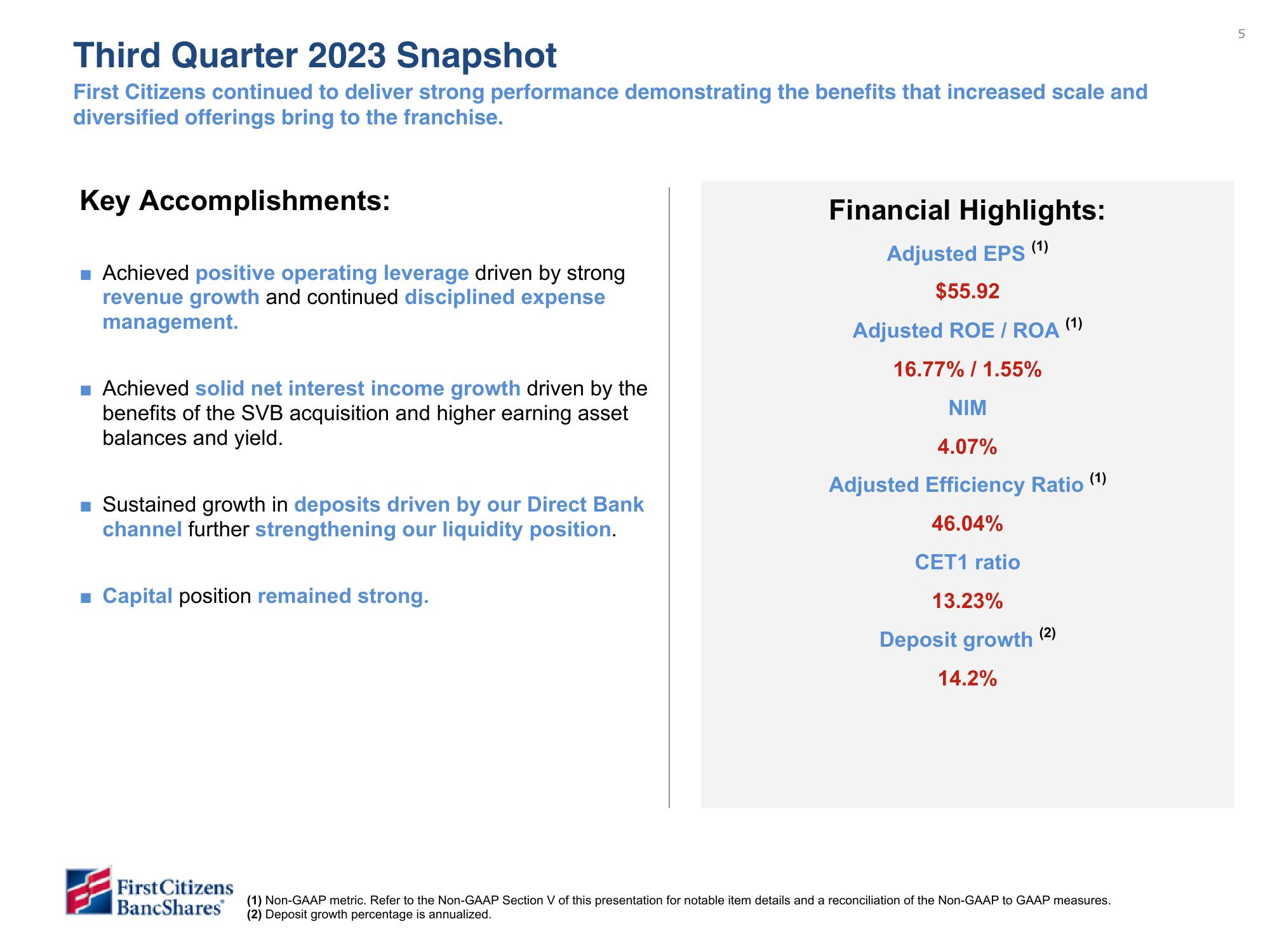

Third Quarter 2023 Snapshot

First Citizens continued to deliver strong performance demonstrating the benefits that increased scale and

diversified offerings bring to the franchise.

Key Accomplishments:

Achieved positive operating leverage driven by strong

revenue growth and continued disciplined expense

management.

Achieved solid net interest income growth driven by the

benefits of the SVB acquisition and higher earning asset

balances and yield.

Sustained growth in deposits driven by our Direct Bank

channel further strengthening our liquidity position.

■ Capital position remained strong.

First Citizens

BancShares

Financial Highlights:

Adjusted EPS (1)

$55.92

Adjusted ROE/ROA (¹)

16.77% / 1.55%

NIM

4.07%

Adjusted Efficiency Ratio (¹)

46.04%

CET1 ratio

13.23%

Deposit growth

14.2%

(2)

(1) Non-GAAP metric. Refer to the Non-GAAP Section V of this presentation for notable item details and a reconciliation of the Non-GAAP to GAAP measures.

(2) Deposit growth percentage is annualized.

5View entire presentation