Baird Investment Banking Pitch Book

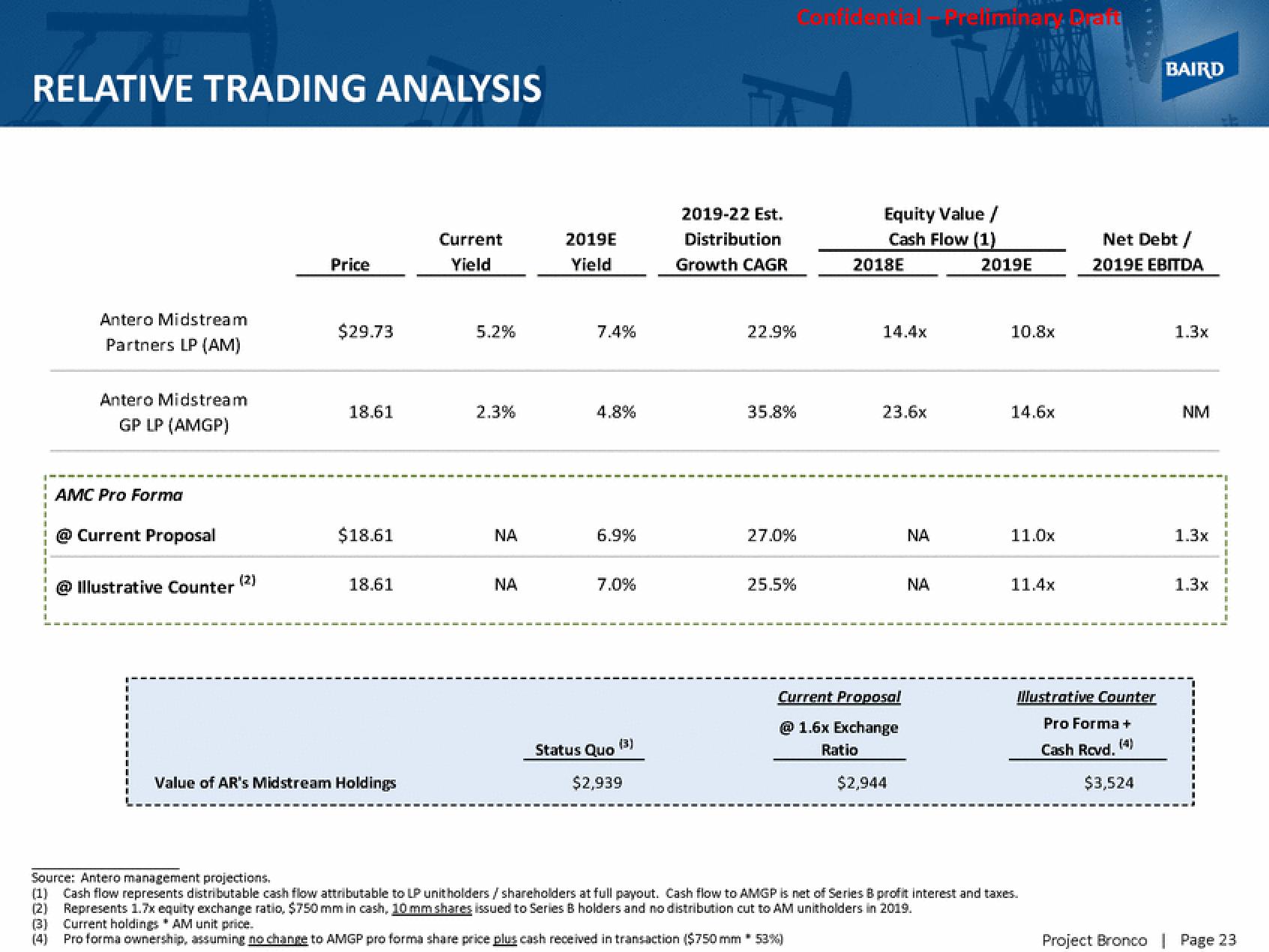

RELATIVE TRADING ANALYSIS

Antero Midstream

Partners LP (AM)

Antero Midstream

GP LP (AMGP)

AMC Pro Forma

@ Current Proposal

@ Illustrative Counter

(2)

Price

$29.73

18.61

$18.61

18.61

Value of AR's Midstream Holdings

Current

Yield

5.2%

2.3%

ΝΑ

NA

2019E

Yield

7.4%

4.8%

6.9%

7.0%

(3)

Status Quo

$2,939

2019-22 Est.

Distribution

Growth CAGR

22.9%

35.8%

27.0%

25.5%

Equity Value /

Cash Flow (1)

2018E

(3) Current holdings * AM unit price.

(4)

Proforma ownership, assuming no change to AMGP pro forma share price plus cash received in transaction ($750 mm * 53%)

14.4x

23.6x

Current Proposal

@1.6x Exchange

Ratio

$2,944

NA

Treliminary Draft

NA

2019E

10.8x

14.6x

11.0x

11.4x

Source: Antero management projections.

(1) Cash flow represents distributable cash flow attributable to LP unitholders / shareholders at full payout. Cash flow to AMGP is net of Series B profit interest and taxes.

(2) Represents 1.7x equity exchange ratio, $750 mm in cash, 10 mm shares issued to Series B holders and no distribution cut to AM unitholders in 2019.

Illustrative Counter

Pro Forma +

Cash Rovd.

Net Debt /

2019E EBITDA

BAIRD

$3,524

1.3x

NM

1.3x

1.3x

Project Bronco | Page 23View entire presentation